5 Crucial Steps to Unleash Your Credit Card Fraud Protection

Related Articles: 5 Crucial Steps to Unleash Your Credit Card Fraud Protection

- 5 Powerful Strategies To Unlock A Stellar Credit Score

- Tricks of Credit Card Company

- “Bad Credit” Credit Cards: How You Can Avoid High Fees

- Shockingly High! 15% Interest Rates: Are Credit Cards Crushing Your Finances?

- The Ultimate Guide To Navigating The 5 Biggest Student Credit Card Myths

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 5 Crucial Steps to Unleash Your Credit Card Fraud Protection. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Crucial Steps to Unleash Your Credit Card Fraud Protection

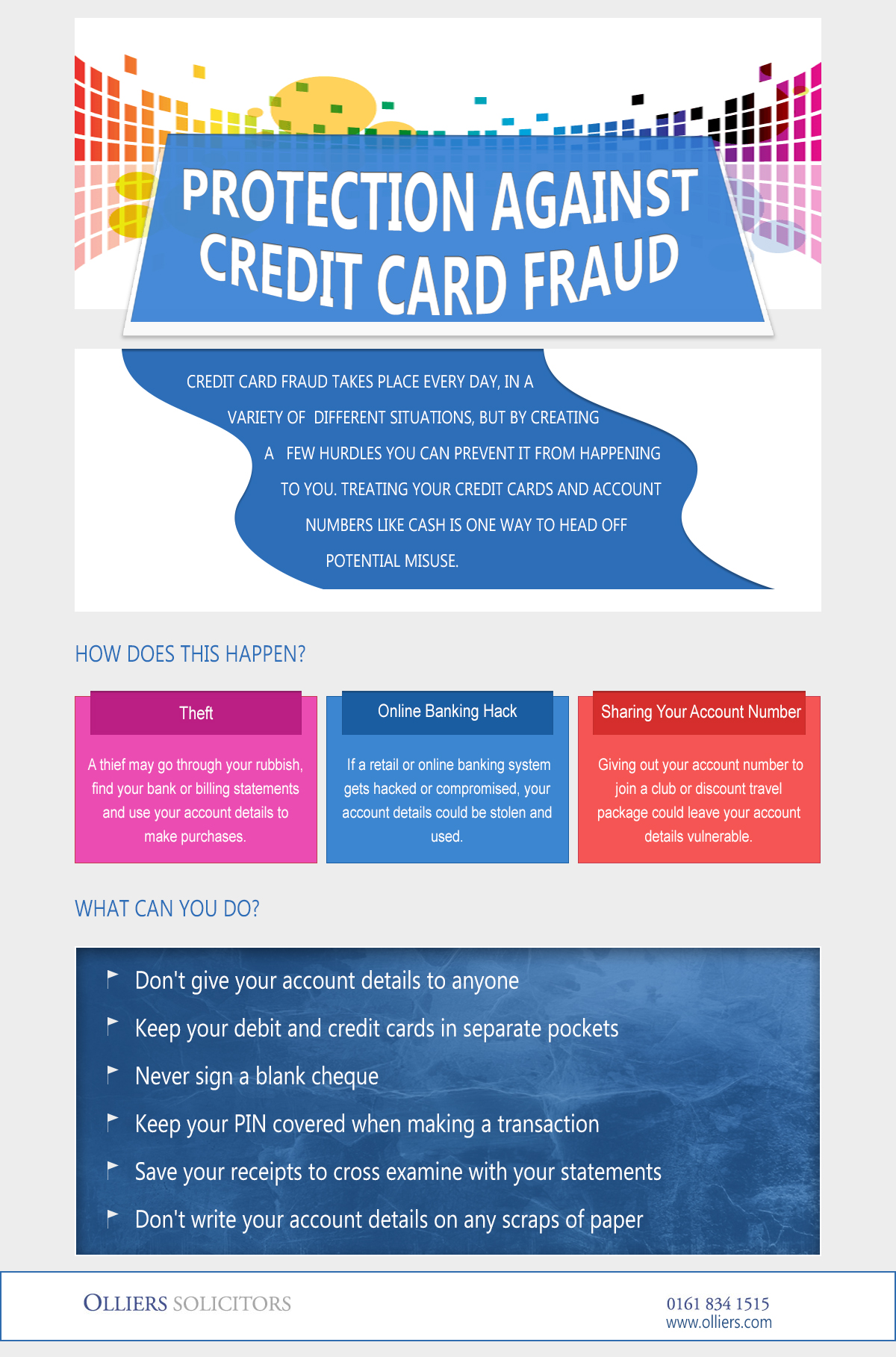

Credit card fraud is a growing concern, with criminals constantly evolving their tactics to steal your hard-earned money. However, you don’t have to be a victim. By taking proactive steps to protect yourself, you can significantly reduce your risk and empower yourself against these financial predators. This article will guide you through five crucial steps to unleash your credit card fraud protection and safeguard your financial well-being.

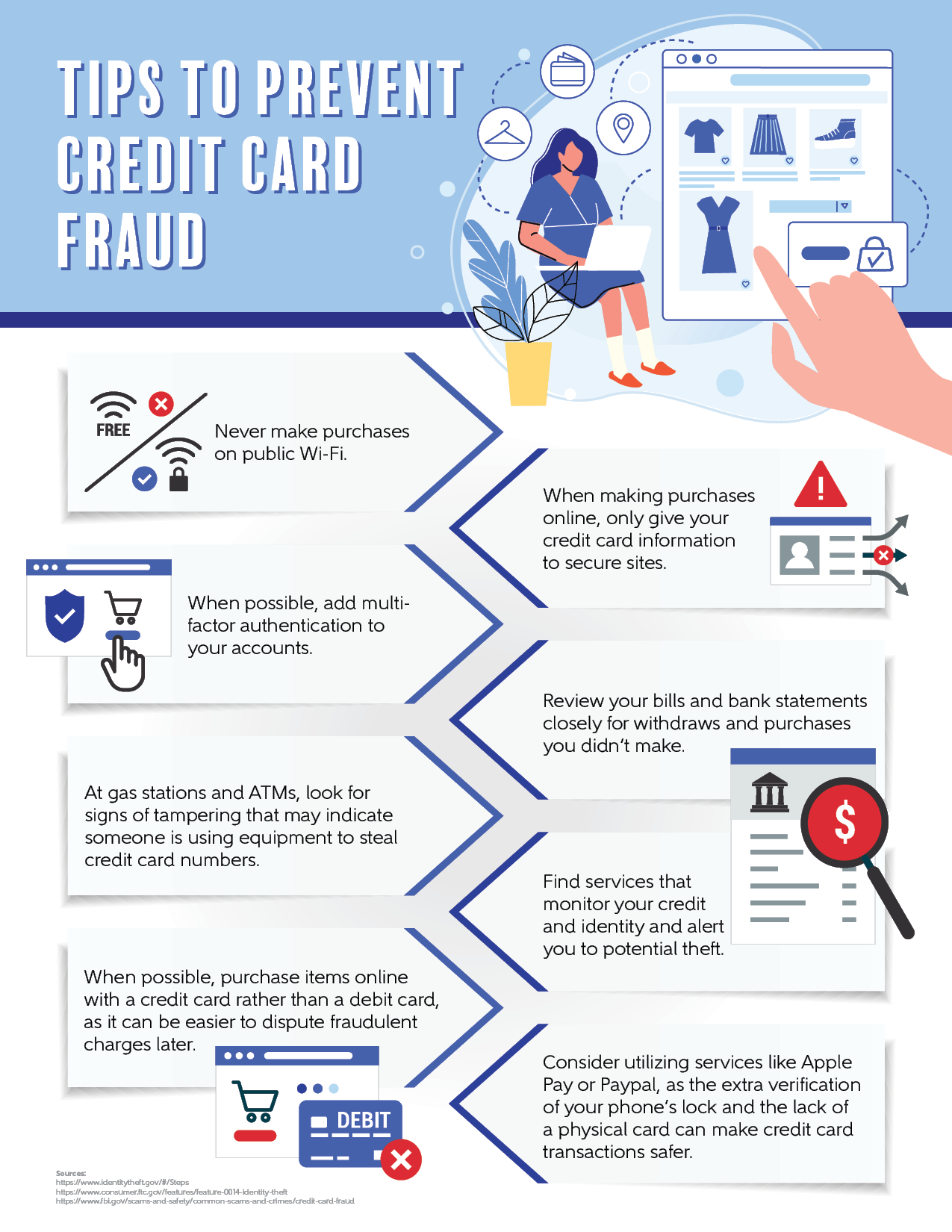

1. Mastering the Basics: The Foundation of Security

The first line of defense against credit card fraud lies in understanding and implementing basic security measures. These seemingly simple steps form the foundation of your financial protection strategy:

- Safeguard Your Cards: Treat your credit cards like precious valuables. Store them securely, away from prying eyes, and never leave them unattended. Be cautious when carrying multiple cards, ensuring they are well-protected in your wallet or purse.

- Be Vigilant with PINs and Passwords: Your PIN and passwords are the keys to your financial kingdom. Never share them with anyone, and avoid writing them down where they could be easily found. Utilize strong, unique passwords for online accounts, and consider using a password manager to streamline this process.

- Protect Your Online Transactions: When shopping online, ensure the website is secure by looking for the “https” prefix in the URL and a padlock icon in the address bar. Be wary of suspicious websites or emails asking for personal information, and never click on links from unknown sources.

- Regularly Review Statements: Scrutinize your credit card statements for any unauthorized transactions. Report any discrepancies immediately to your credit card issuer, as prompt action can minimize potential losses.

- Be Aware of Skimming: Skimming devices can be attached to ATMs and point-of-sale terminals to steal your card information. Inspect the card reader before swiping, looking for any unusual attachments or tampering. Consider using chip-enabled cards, which offer enhanced security.

2. Embrace Technology: Shield Yourself with Digital Tools

In the digital age, technology can be both a blessing and a curse. While it offers convenience, it also presents new vulnerabilities for fraudsters. However, technology can also be your strongest ally in protecting yourself.

- Utilize Two-Factor Authentication: Two-factor authentication (2FA) adds an extra layer of security to online accounts by requiring a second verification step, usually a code sent to your phone or email. Enabling 2FA on your online banking and credit card accounts significantly reduces the risk of unauthorized access.

- Enable Fraud Alerts: Many credit card companies offer fraud alerts, which notify you via text message or email if suspicious activity is detected on your account. This immediate notification allows you to act swiftly and prevent further damage.

- Monitor Your Credit Report: Regularly checking your credit report for any inaccuracies or suspicious activity is crucial. You can obtain a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually through AnnualCreditReport.com.

- Consider a Credit Monitoring Service: Credit monitoring services provide comprehensive protection by monitoring your credit report for changes, alerting you to potential fraud, and offering identity theft protection. These services can be a valuable investment for peace of mind.

3. Be Proactive: Taking the Offensive Against Fraud

Beyond the defensive measures, proactive steps can significantly strengthen your credit card fraud protection. By actively engaging in these practices, you take control and minimize your vulnerability:

- Limit Your Credit Card Exposure: Carrying only the cards you need for specific transactions reduces the risk of theft or loss. Consider leaving your less-used cards at home, especially when traveling.

- Establish a Spending Limit: Set a realistic spending limit on your credit cards and stick to it. This disciplined approach helps prevent overspending and reduces the potential financial impact of fraud.

- Use a Secure Wallet: Invest in a secure wallet with RFID blocking technology, which protects your credit cards from electronic theft. This is especially important when traveling or using public transportation.

- Be Wary of Phishing Scams: Phishing scams often involve emails or text messages that appear legitimate but aim to trick you into revealing personal information. Be cautious about clicking on links or opening attachments from unknown senders, and never provide your credit card details in response to unsolicited requests.

4. Stay Informed: Knowledge is Power

Staying informed about the latest credit card fraud trends and prevention strategies is crucial for staying ahead of the curve. By keeping up-to-date, you can make informed decisions and protect yourself from evolving threats:

- Subscribe to Security Alerts: Sign up for security alerts from your credit card issuer, bank, and other financial institutions. These alerts often provide valuable information about emerging threats and offer tips for staying safe.

- Follow Financial News: Stay informed about current events related to credit card fraud. News articles, blogs, and financial publications often highlight new scams and provide valuable insights into how to protect yourself.

- Attend Financial Workshops: Participate in workshops or seminars focused on financial security and fraud prevention. These events can offer practical advice and valuable insights from experts.

5. Act Promptly: Swift Action Minimizes Damage

If you suspect credit card fraud, act swiftly to minimize potential losses. Prompt action is key to limiting the damage and restoring your financial security:

- Report Fraud Immediately: If you notice any unauthorized transactions on your credit card statement, report them immediately to your credit card issuer. The sooner you report the fraud, the faster the process of reversing the charges and preventing further damage.

- File a Police Report: In addition to contacting your credit card issuer, file a police report to document the fraud. This documentation can be helpful in the event of disputes or legal proceedings.

- Contact the Credit Bureaus: Contact the three major credit bureaus (Equifax, Experian, and TransUnion) to place a fraud alert on your credit report. This alert will notify potential lenders that you may be a victim of fraud and can help prevent further identity theft.

- Review Your Credit Report: After reporting the fraud, carefully review your credit report for any other suspicious activity. Ensure all the transactions listed are legitimate and dispute any inaccuracies.

Conclusion: Embrace a Culture of Security

Protecting yourself from credit card fraud requires a proactive approach and a commitment to financial security. By mastering the basics, embracing technology, staying informed, and acting swiftly, you can significantly reduce your risk and empower yourself against financial predators. Remember, credit card fraud is a serious issue, but by taking appropriate precautions, you can unleash your own protection and safeguard your financial well-being.

Remember, prevention is always better than cure. By adopting these practices, you take control of your financial security and ensure a brighter future.

Further Resources:

- Federal Trade Commission (FTC): https://www.ftc.gov/

- Consumer Financial Protection Bureau (CFPB): https://www.consumerfinance.gov/

- AnnualCreditReport.com: https://www.annualcreditreport.com/

- Identity Theft Resource Center (ITRC): https://www.idtheftcenter.org/

This article provides general information and should not be considered financial or legal advice. Always consult with a qualified professional for personalized guidance.

Closure

Thus, we hope this article has provided valuable insights into 5 Crucial Steps to Unleash Your Credit Card Fraud Protection. We hope you find this article informative and beneficial. See you in our next article!

google.com