5 Powerful Strategies to Conquer the Unforgiving Psychology of Forex Trading

Related Articles: 5 Powerful Strategies to Conquer the Unforgiving Psychology of Forex Trading

- The 5 Essential Steps To Master Forex Trading For Beginners

- 5 Powerful Forex Trading Indicators: Unlocking Profitable Opportunities

- FOREX : Make Money with Currency Trading

- The Ultimate Guide To 5 Powerful Forex Scalping Techniques

- Booming Bullish: 5 Key Factors Driving The Forex Market’s Explosive Growth

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Powerful Strategies to Conquer the Unforgiving Psychology of Forex Trading. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Powerful Strategies to Conquer the Unforgiving Psychology of Forex Trading

The allure of the Forex market, with its immense liquidity and potential for substantial profits, attracts traders from all walks of life. However, beneath the surface of this financial playground lies a hidden adversary – the unforgiving psychology of trading.

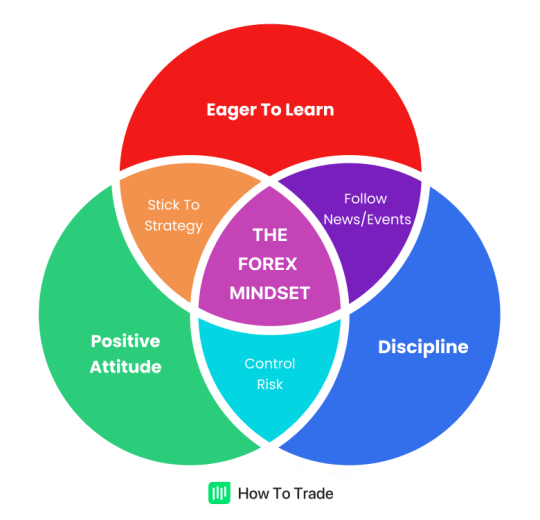

For many, the journey to successful Forex trading is not about mastering technical analysis or economic indicators. Instead, it’s about conquering the internal battles that sabotage even the most meticulously crafted strategies. This article delves into the powerful psychological factors that influence trading decisions and outlines five strategies to help you overcome these internal obstacles.

1. The Enemy Within: Understanding the Psychological Traps

The human mind, with its inherent biases and emotional responses, is a double-edged sword in the Forex market. Here are some of the most common psychological pitfalls that traders face:

- Confirmation Bias: This tendency to favor information that confirms pre-existing beliefs can lead to ignoring vital market signals, clinging to losing trades, and missing out on profitable opportunities.

- Overconfidence: After a string of successful trades, a sense of invincibility can creep in, leading to reckless risk-taking and ignoring risk management principles.

- Fear of Missing Out (FOMO): This anxiety-driven impulse to jump into a trade simply because others are doing so can lead to impulsive decisions and hasty entries into potentially risky positions.

- Revenge Trading: After experiencing a loss, the urge to recoup the lost funds quickly can lead to irrational trading decisions and further losses.

- Loss Aversion: This tendency to feel the pain of a loss more intensely than the pleasure of an equal gain can cause traders to hold onto losing trades for too long, hoping for a rebound that may never come.

- Cognitive Dissonance: This mental discomfort arises when beliefs and actions clash. Traders may cling to a losing trade, despite evidence to the contrary, because admitting a mistake is psychologically painful.

2. The Power of Self-Awareness: Recognizing Your Trading Personality

Understanding your own psychological tendencies is the first step towards mastering them. Take time to introspect and identify your trading personality. Are you:

- The Impulsive Trader: Do you jump into trades based on gut feeling, often without proper analysis?

- The Fearful Trader: Do you hesitate to enter trades due to fear of loss, even when the signals are favorable?

- The Overconfident Trader: Do you believe you have a winning formula and disregard market risks?

- The Perfectionist Trader: Do you only enter trades when all indicators perfectly align, missing out on profitable opportunities?

- The Emotional Trader: Do you let emotions like fear, greed, and anger dictate your trading decisions?

Once you identify your trading personality, you can begin to develop strategies to address your specific vulnerabilities.

3. Building a Fortress of Discipline: Strategies for Psychological Control

a) Develop a Trading Plan: A well-defined plan outlines your entry and exit points, risk management rules, and trading goals. Stick to your plan, even when emotions tempt you to deviate.

b) Practice Risk Management: Never risk more than you can afford to lose. Use stop-loss orders to limit potential losses and protect your capital.

c) Embrace Emotional Intelligence: Learn to recognize and manage your emotions. Take breaks when you feel overwhelmed or emotional, and avoid trading when you’re not in a clear mental state.

d) Maintain a Trading Journal: Track your trades, analyze your wins and losses, and identify patterns in your decision-making. This helps you understand your strengths and weaknesses.

e) Focus on the Process, Not the Outcome: Shift your attention from the immediate profit to the long-term success of your trading strategy. Don’t get caught up in the daily fluctuations of the market.

f) Seek Mentorship and Support: Connect with experienced traders or join trading communities to gain insights and receive support.

4. Harnessing the Power of Mindfulness and Visualization

a) Practice Mindfulness: Regular mindfulness meditation can help you develop emotional awareness and control. By observing your thoughts and feelings without judgment, you can learn to detach from emotional impulses.

b) Visualize Success: Imagine yourself calmly executing your trading plan, making sound decisions, and achieving your financial goals. Visualization can help you build confidence and reduce anxiety.

c) Develop a Positive Mindset: Focus on your strengths and past successes. Avoid negativity and self-doubt. Remember, every trader experiences setbacks, and it’s how you learn from them that matters.

5. The Importance of Patience and Persistence

Forex trading is a marathon, not a sprint. Be patient, persistent, and consistent in your efforts. Don’t expect to become a millionaire overnight. Focus on continuous improvement, learning from your mistakes, and adapting your strategies over time.

Conclusion:

Conquering the psychology of Forex trading is an ongoing journey. It requires self-awareness, discipline, and a willingness to learn and adapt. By understanding the psychological pitfalls, developing strategies to mitigate them, and cultivating a positive mindset, you can transform yourself from an emotional trader to a disciplined and successful Forex investor. Remember, the greatest victories are often won not on the battlefield of technical analysis, but within the depths of your own mind.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Strategies to Conquer the Unforgiving Psychology of Forex Trading. We thank you for taking the time to read this article. See you in our next article!

google.com