5 Steps to Unleash the Power of Strategic Business Budgeting

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Steps to Unleash the Power of Strategic Business Budgeting. Let’s weave interesting information and offer fresh perspectives to the readers.

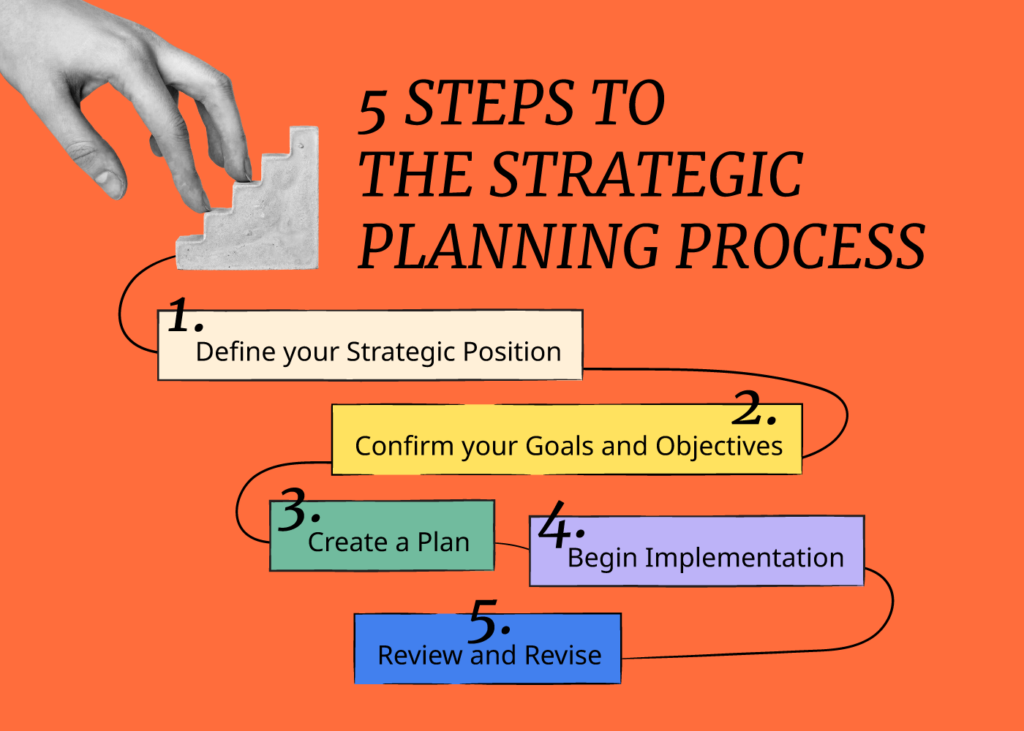

5 Steps to Unleash the Power of Strategic Business Budgeting

In the dynamic world of business, success hinges on making informed decisions, and one of the most critical tools for achieving this is strategic budgeting. It’s not just about crunching numbers; it’s about aligning resources with your company’s vision, goals, and strategic objectives. A well-crafted budget acts as a roadmap, guiding your business towards profitability and sustainable growth.

However, many businesses struggle with budgeting. They either lack a clear understanding of its importance or struggle to implement effective strategies. This can lead to wasted resources, missed opportunities, and ultimately, financial instability.

This article will guide you through a 5-step framework for creating a strategic business budget that unleashes the power of your resources and propels your business forward.

Step 1: Define Your Business Goals and Objectives

The foundation of any effective budget lies in a clear understanding of your business goals and objectives. What are you trying to achieve? What are your priorities? Are you aiming for increased market share, product development, expansion, or simply maintaining profitability?

Here are some questions to consider:

- What are your short-term and long-term goals?

- What are the key performance indicators (KPIs) that will measure your progress towards these goals?

- What are the specific initiatives or projects that will help you achieve these goals?

Once you have a clear picture of your goals and objectives, you can begin to allocate resources accordingly.

Step 2: Conduct a Comprehensive Financial Analysis

Before you can create a budget, you need to understand your current financial position. This involves conducting a comprehensive analysis of your income, expenses, and cash flow.

Here’s what to consider:

- Income: Analyze your historical revenue data, identify trends, and project future income based on market conditions and your business strategy.

- Expenses: Categorize your expenses, identify areas of potential cost savings, and analyze the impact of inflation and other economic factors.

- Cash flow: Analyze your cash flow patterns, identify potential bottlenecks, and ensure that you have sufficient liquidity to meet your obligations.

Tools to use:

- Spreadsheets: Excel or Google Sheets are excellent for basic financial analysis.

- Accounting software: Software like QuickBooks or Xero can provide more sophisticated financial reporting and analysis.

Step 3: Develop a Realistic Budget

Now that you have a clear understanding of your goals and financial position, you can start developing your budget. This involves allocating resources to each area of your business based on your priorities.

Here are some key considerations:

- Revenue: Project your revenue based on historical data, market trends, and your business strategy.

- Expenses: Allocate funds to different expense categories, such as salaries, marketing, rent, utilities, and supplies. Be realistic about your spending needs and consider opportunities for cost savings.

- Capital expenditures: Plan for any major investments, such as new equipment or facilities.

Budgeting methods:

- Zero-based budgeting: This method starts from scratch each year, requiring you to justify every expense.

- Incremental budgeting: This method uses the previous year’s budget as a starting point and adjusts it for inflation and other changes.

- Activity-based budgeting: This method allocates resources based on the activities required to achieve your goals.

Step 4: Monitor and Adjust Your Budget Regularly

A budget is not a static document; it needs to be constantly monitored and adjusted as needed. This involves tracking your actual income and expenses against your budget and making adjustments as necessary.

Here are some tips for effective budget monitoring:

- Set up regular budget review meetings.

- Use dashboards and reports to track your progress.

- Analyze variances between your actual results and your budget.

- Be prepared to make adjustments to your budget based on changing market conditions or unforeseen circumstances.

Step 5: Communicate Your Budget Effectively

Once you have developed and implemented your budget, it’s important to communicate it effectively to your team. This ensures that everyone is aligned on the financial goals and priorities of the business.

Here are some tips for effective budget communication:

- Provide clear and concise budget summaries.

- Explain the rationale behind your budget decisions.

- Encourage questions and feedback from your team.

- Regularly update your team on your budget performance.

Benefits of Strategic Budgeting

- Improved financial control: A strategic budget helps you track your income and expenses, identify areas of waste, and make informed financial decisions.

- Enhanced decision-making: A well-crafted budget provides a clear framework for allocating resources, prioritizing projects, and making strategic decisions.

- Increased profitability: By controlling costs and maximizing revenue, a strategic budget can help you improve your bottom line.

- Improved communication: A budget serves as a common language for financial discussions, fostering better communication and collaboration among team members.

- Increased accountability: A budget creates a clear framework for accountability, ensuring that everyone is responsible for their financial performance.

Common Budgeting Mistakes to Avoid

- Not setting clear goals and objectives: Without a clear understanding of your goals, your budget will be ineffective.

- Underestimating expenses: It’s important to be realistic about your spending needs and avoid underestimating expenses.

- Not monitoring your budget regularly: A budget is not a set-it-and-forget-it document. You need to monitor it regularly and make adjustments as needed.

- Failing to communicate your budget effectively: If your team doesn’t understand your budget, they won’t be able to support it.

Conclusion

Strategic budgeting is an essential tool for any business that wants to achieve success. By following the five steps outlined in this article, you can create a budget that aligns your resources with your goals, enhances your decision-making, and propels your business forward. Remember, a budget is not just a document; it’s a roadmap for your business’s future. By investing the time and effort to create a strategic budget, you’re investing in the success of your business.

Closure

Thus, we hope this article has provided valuable insights into 5 Steps to Unleash the Power of Strategic Business Budgeting. We thank you for taking the time to read this article. See you in our next article!

google.com