5 Unstoppable Forex Trading Tools To Dominate The Market

Related Articles: 5 Unstoppable Forex Trading Tools To Dominate The Market

- Unleash The Power Of 5: Mastering Forex Risk Management For Explosive Growth

- 7 Unbreakable Forex Trading Tips For Astounding Success

- 5 Unforgettable Forex Trading Platforms: Unlock Your Trading Potential

- Benefit With Forex

- FOREX : Make Money with Currency Trading

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Unstoppable Forex Trading Tools To Dominate The Market. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Unstoppable Forex Trading Tools To Dominate The Market

The foreign exchange (forex) market is a dynamic and complex arena where traders from around the globe engage in buying and selling currencies. Navigating this vast market requires a strategic approach, encompassing a deep understanding of market dynamics, effective risk management, and the utilization of powerful trading tools. While technical expertise is crucial, the right tools can significantly empower traders, transforming their trading journey from daunting to potentially profitable.

This article delves into five essential forex trading tools that can elevate your trading game and help you gain a competitive edge. These tools are designed to empower traders with valuable insights, enhance their decision-making, and streamline their trading workflow, ultimately contributing to a more efficient and potentially successful trading experience.

1. Trading Platforms: The Foundation of Your Trading Journey

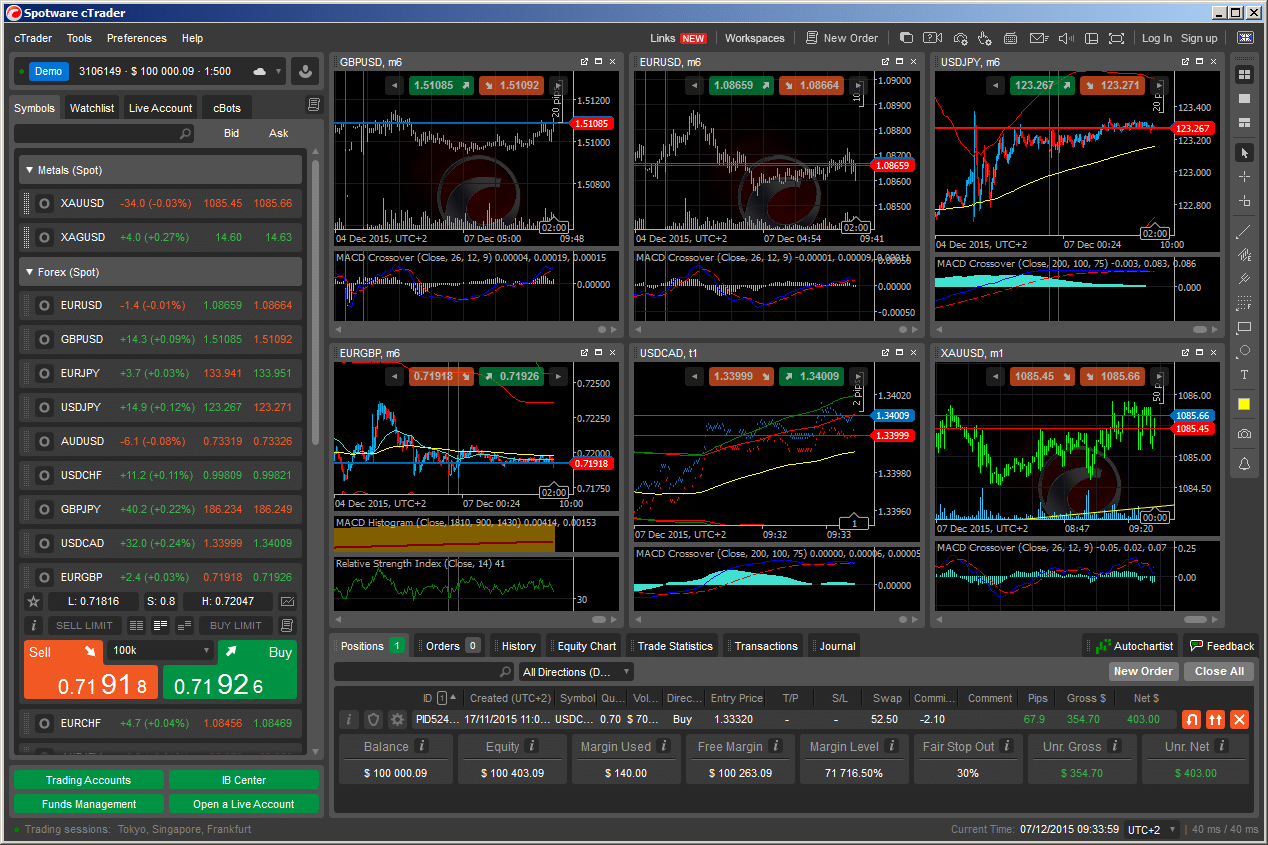

Trading platforms are the digital gateways to the forex market, providing traders with the necessary tools to execute trades, analyze market data, and manage their positions. Choosing the right platform is a crucial step in setting up your trading strategy, as it will be your primary interface for interacting with the market.

Essential Features of a Powerful Forex Trading Platform:

- Order Execution: A robust trading platform should offer seamless order execution capabilities, enabling traders to place and manage orders efficiently. Features like one-click trading, stop-loss and take-profit orders, and advanced order types (like market, limit, and stop orders) are essential for executing trades effectively.

Real-Time Market Data: Access to real-time market data is paramount for informed decision-making. Look for platforms that provide live price feeds, charts, and indicators, allowing you to track market movements and identify potential trading opportunities.

Real-Time Market Data: Access to real-time market data is paramount for informed decision-making. Look for platforms that provide live price feeds, charts, and indicators, allowing you to track market movements and identify potential trading opportunities.- Charting and Technical Analysis Tools: Comprehensive charting and technical analysis tools are critical for analyzing market trends and identifying trading patterns. Features like candlestick charts, line charts, moving averages, and various technical indicators (RSI, MACD, Bollinger Bands, etc.) can help you interpret market sentiment and predict potential price movements.

- Fundamental Analysis Tools: While technical analysis focuses on price action, fundamental analysis examines economic news, events, and data that can influence currency values. Look for platforms that offer economic calendars, news feeds, and access to fundamental data, enabling you to stay informed about factors that could impact your trades.

- Risk Management Features: Effective risk management is vital for protecting your capital. Choose platforms that offer features like stop-loss orders, position limits, and margin monitoring, allowing you to control your risk exposure and prevent significant losses.

- Mobile Accessibility: The ability to trade on the go is increasingly important. Look for platforms that offer dedicated mobile apps, providing you with access to your accounts and trading tools from your smartphone or tablet.

Popular Forex Trading Platforms:

- MetaTrader 4 (MT4): A widely popular and versatile platform, MT4 offers robust charting tools, a vast library of technical indicators, and a customizable interface.

- MetaTrader 5 (MT5): An advanced platform building upon MT4, MT5 offers enhanced features like more advanced order types, deeper market analysis tools, and improved backtesting capabilities.

- cTrader: Known for its speed and advanced order execution capabilities, cTrader is favored by professional traders and those seeking a high-performance trading experience.

- TradingView: While not strictly a trading platform, TradingView is a powerful charting and analysis platform used by many traders. It offers an extensive range of technical indicators, drawing tools, and social features, making it a valuable resource for market research and analysis.

2. Technical Indicators: Decoding Market Trends and Patterns

Technical indicators are mathematical calculations that analyze historical price data, helping traders identify trends, patterns, and potential trading opportunities. They provide valuable insights into market sentiment, momentum, and volatility, aiding in decision-making and risk management.

Types of Technical Indicators:

- Trend Indicators: These indicators aim to identify the overall direction of price movement, helping traders determine whether a market is trending up, down, or sideways. Examples include moving averages, MACD, and ADX.

- Momentum Indicators: These indicators measure the speed and strength of price changes, providing insights into the strength of a trend and potential reversals. Examples include RSI, Stochastic Oscillator, and Rate of Change (ROC).

- Volatility Indicators: These indicators measure the degree of price fluctuations, providing insights into market risk and potential trading opportunities. Examples include Average True Range (ATR), Bollinger Bands, and volatility index.

- Volume Indicators: These indicators analyze trading volume, providing insights into market participation and potential price movements. Examples include On-Balance Volume (OBV), Chaikin Money Flow, and Accumulation/Distribution Index.

Using Technical Indicators Effectively:

- Understand the Underlying Logic: Before using any technical indicator, it’s essential to grasp its underlying logic and how it is calculated.

- Combine Multiple Indicators: Using multiple indicators in conjunction can provide a more comprehensive picture of market dynamics and confirm trading signals.

- Consider Market Context: Indicators should be used within the context of broader market conditions and economic factors.

- Backtest and Optimize: Backtesting indicators using historical data can help you assess their effectiveness and identify optimal settings.

3. Economic Calendars: Staying Ahead of Market-Moving Events

Economic calendars are essential tools for forex traders, providing a schedule of upcoming economic releases and events that could significantly impact currency values. These events can range from interest rate decisions and employment data to inflation reports and political announcements.

Key Economic Releases to Monitor:

- Interest Rate Decisions: Central bank decisions on interest rates can significantly impact currency values, as they influence borrowing costs and economic growth.

- Employment Data: Employment figures, such as unemployment rates and non-farm payrolls, provide insights into economic health and potential currency fluctuations.

- Inflation Reports: Inflation data reflects the rate of price increases, impacting consumer spending and influencing monetary policy decisions.

- Government Spending and Budget Announcements: Government spending and budget plans can impact economic growth and currency values.

- Political Events and Elections: Political events, elections, and policy announcements can create significant volatility in the forex market.

Using Economic Calendars Strategically:

- Anticipate Market Volatility: Monitoring economic calendars allows you to anticipate potential market volatility surrounding major economic releases.

- Identify Potential Trading Opportunities: Understanding the potential impact of economic events can help you identify potential trading opportunities.

- Manage Risk Effectively: By anticipating market volatility, you can adjust your risk management strategies accordingly.

4. Forex News Sources: Keeping Up with Market-Shaping Events

Staying informed about global events and news is crucial for making informed trading decisions. Forex news sources provide real-time updates on economic data, political developments, and other market-moving events that can impact currency values.

Types of Forex News Sources:

- Financial News Websites: Reputable financial news websites like Bloomberg, Reuters, and MarketWatch provide comprehensive coverage of economic data, market analysis, and global events.

- Forex News Aggregators: Websites and apps like Investing.com, FXStreet, and DailyFX aggregate news from multiple sources, providing a consolidated view of market-moving events.

- Social Media Platforms: While caution is advised, social media platforms like Twitter and Facebook can provide real-time insights and sentiment analysis, though it’s important to verify information and avoid misinformation.

Using Forex News Sources Effectively:

- Prioritize Reliable Sources: Stick to reputable and reliable news sources known for accuracy and objectivity.

- Stay Informed about Key Events: Focus on economic releases, political developments, and other significant events that could impact the forex market.

- Analyze News Impact: Don’t just read the headlines; analyze the potential impact of news events on currency values.

- Avoid Emotional Reactions: Avoid making impulsive trading decisions based solely on news headlines.

5. Risk Management Tools: Protecting Your Capital and Limiting Losses

Risk management is an integral part of forex trading, ensuring that you protect your capital and limit potential losses. Effective risk management strategies are crucial for long-term success in this volatile market.

Key Risk Management Tools:

- Stop-Loss Orders: Stop-loss orders are crucial for automatically exiting a trade when a predetermined price level is reached, limiting potential losses.

- Take-Profit Orders: Take-profit orders allow you to lock in profits when a specific price target is reached, ensuring you don’t miss out on potential gains.

- Position Sizing: Position sizing involves determining the appropriate amount of capital to allocate to each trade, considering your risk tolerance and account balance.

- Margin Monitoring: Margin is the amount of capital required to open and maintain a trade. Monitoring your margin levels is crucial to avoid margin calls, which can force you to close positions.

- Risk/Reward Ratio: This ratio compares the potential profit of a trade to the potential loss, helping you identify trades with favorable risk-reward profiles.

Implementing Effective Risk Management:

- Define Your Risk Tolerance: Determine your maximum acceptable loss per trade and adjust your position sizing accordingly.

- Set Realistic Expectations: Understand that forex trading involves risk, and it’s crucial to set realistic profit goals.

- Avoid Overtrading: Don’t chase every trading opportunity; be selective and only enter trades that align with your strategy.

- Continuously Monitor Your Risk: Regularly review your risk management strategies and make adjustments as needed.

Conclusion: Mastering the Tools for Forex Trading Success

The forex market offers vast opportunities for profit, but it also presents significant risks. Mastering the tools discussed in this article can equip you with the knowledge, insights, and resources to navigate this complex market more effectively. From choosing the right trading platform to utilizing technical indicators, economic calendars, and news sources, and implementing robust risk management strategies, these tools can empower you to make informed trading decisions, protect your capital, and potentially achieve your trading goals. Remember, forex trading is a journey, and continuous learning and refinement of your skills and strategies are essential for long-term success.

Closure

Thus, we hope this article has provided valuable insights into 5 Unstoppable Forex Trading Tools To Dominate The Market. We hope you find this article informative and beneficial. See you in our next article!

google.com

Real-Time Market Data: Access to real-time market data is paramount for informed decision-making. Look for platforms that provide live price feeds, charts, and indicators, allowing you to track market movements and identify potential trading opportunities.

Real-Time Market Data: Access to real-time market data is paramount for informed decision-making. Look for platforms that provide live price feeds, charts, and indicators, allowing you to track market movements and identify potential trading opportunities.