7 Unbreakable Forex Trading Tips for Astounding Success

Related Articles: 7 Unbreakable Forex Trading Tips for Astounding Success

- Unleashing Profitable Forex Strategies: 5 Essential Market Analysis Techniques

- 5 Revolutionary Forex Brokers You Must Consider In 2024

- Benefit With Forex

- 5 Powerful Forex Trading Strategies To Dominate The Market

- The Ultimate Guide To Forex Signals: 10 Key Insights For Profitable Trading

Introduction

With great pleasure, we will explore the intriguing topic related to 7 Unbreakable Forex Trading Tips for Astounding Success. Let’s weave interesting information and offer fresh perspectives to the readers.

7 Unbreakable Forex Trading Tips for Astounding Success

The allure of forex trading is undeniable. The potential for substantial profits, the global market accessibility, and the constant ebb and flow of currencies can be captivating. But behind the glitter of potential riches lies a demanding world of risk, volatility, and constant learning. Many aspiring traders fall victim to the pitfalls of the market, succumbing to emotional trading, poor risk management, and a lack of understanding of the fundamentals.

This article aims to equip you with 7 unbreakable Forex trading tips that can transform your approach to the market, paving the way for astounding success. These principles are not just theoretical concepts; they are battle-tested strategies honed through years of experience and backed by solid financial theory.

1. Master the Fundamentals: A Foundation for Success

Before you even think about entering a trade, you must understand the fundamental factors that drive currency movements. This is not about simply memorizing economic indicators; it’s about grasping the intricate interplay of economic forces, geopolitical events, and market sentiment.

Key Fundamental Concepts to Master:

- Economic Indicators: Familiarize yourself with key economic indicators like GDP, inflation, interest rates, unemployment, and trade balances. Understanding how these indicators impact a country’s economic health and currency value is crucial.

- Monetary Policy: Central banks play a pivotal role in influencing currency values through their monetary policies. Learn about interest rate adjustments, quantitative easing, and other tools used by central banks to manage inflation and economic growth.

- Geopolitical Events: Global events, such as wars, elections, trade disputes, and political instability, can significantly impact currency values. Staying informed about these events and their potential impact on the forex market is essential.

- Market Sentiment: The overall market mood can influence currency movements. Positive sentiment often leads to currency appreciation, while negative sentiment can drive depreciation. Learn to read the market’s emotions through news headlines, social media trends, and expert analysis.

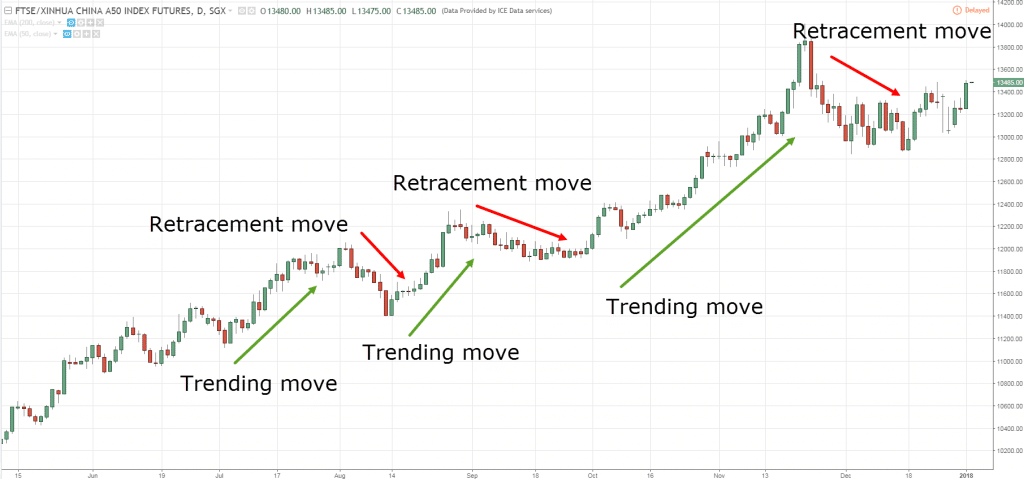

2. Embrace Technical Analysis: Finding Patterns in the Chaos

Technical analysis provides a framework for identifying trends and patterns in price movements. By studying charts and using technical indicators, traders can anticipate potential future price movements.

Essential Technical Analysis Tools:

- Chart Patterns: Learn to recognize common chart patterns like head and shoulders, double tops/bottoms, and triangles. These patterns can provide valuable insights into potential price reversals or continuations.

- Technical Indicators: Explore popular indicators like moving averages, MACD, RSI, and Bollinger Bands. These indicators help identify overbought/oversold conditions, trend strength, and potential support and resistance levels.

- Support and Resistance Levels: Identify price levels where buying or selling pressure tends to be strong. These levels can act as potential turning points for price movements.

3. Discipline and Risk Management: The Cornerstones of Success

The forex market is a battlefield of emotions. Fear, greed, and impulsiveness can lead to disastrous trading decisions. Discipline and risk management are crucial for staying calm, rational, and in control.

Essential Risk Management Practices:

- Stop-Loss Orders: Set automatic orders to exit trades when your predefined loss limit is reached. This protects your capital from substantial losses during adverse market movements.

- Position Sizing: Never risk more than a predetermined percentage of your trading capital on a single trade. This minimizes potential losses and allows you to stay in the game even after experiencing setbacks.

- Trading Journal: Document your trades, including entry and exit points, rationale, and outcomes. This journal helps you analyze your performance, identify areas for improvement, and learn from your mistakes.

4. Backtesting and Paper Trading: Learning Without Losing

Before risking real money, test your trading strategies and refine your skills through backtesting and paper trading.

Backtesting: Analyze historical market data to see how your trading strategies would have performed in the past. This helps identify potential flaws in your strategies and adjust them for future success.

Paper Trading: Practice trading in a simulated environment with virtual money. This allows you to get a feel for the market dynamics, test your strategies, and build confidence before risking real capital.

5. Embrace Continuous Learning: A Lifelong Pursuit

The forex market is constantly evolving. New trends emerge, trading strategies become outdated, and geopolitical landscapes shift. Staying ahead of the curve requires a commitment to continuous learning.

Ways to Continuously Improve Your Forex Trading Skills:

- Read Forex Books and Articles: Explore the vast resources available on forex trading, including books, articles, and online courses.

- Attend Webinars and Workshops: Participate in webinars and workshops hosted by experienced traders and industry experts. These events provide valuable insights and networking opportunities.

- Join Forex Forums and Communities: Engage in online forums and communities dedicated to forex trading. Share your experiences, learn from others, and stay updated on market trends.

6. Choose the Right Broker: Finding the Perfect Partner

Choosing the right forex broker is crucial for your success. A reliable broker provides access to a wide range of trading instruments, competitive trading conditions, and excellent customer support.

Key Factors to Consider When Selecting a Forex Broker:

- Regulation and Security: Ensure your broker is regulated by a reputable financial authority to ensure the safety of your funds.

- Trading Platform: Choose a platform that offers user-friendly interfaces, advanced charting tools, and a wide range of order types.

- Spreads and Commissions: Compare spreads and commissions offered by different brokers to find the most cost-effective option.

- Customer Support: Ensure the broker provides responsive and helpful customer support through multiple channels.

7. Develop a Trading Plan: A Roadmap for Success

A trading plan is your roadmap to success. It outlines your trading goals, risk management strategies, and entry and exit criteria. A well-defined plan helps you stay focused, disciplined, and avoid impulsive decisions.

Essential Components of a Forex Trading Plan:

- Trading Goals: Define your short-term and long-term financial objectives.

- Risk Management: Establish clear risk parameters, including stop-loss orders, position sizing, and maximum allowable losses.

- Entry and Exit Criteria: Define specific conditions for entering and exiting trades based on technical and fundamental analysis.

- Time Management: Allocate specific time slots for market analysis, trading, and reviewing your performance.

- Emotional Control: Develop strategies for managing emotional impulses and staying calm under pressure.

The Power of Consistency and Patience

The path to forex trading success is not a sprint; it’s a marathon. It requires consistent effort, patience, and a willingness to learn from both successes and failures. Don’t get discouraged by initial setbacks. Embrace the learning process, refine your strategies, and remain committed to your trading plan.

Conclusion: Unlocking the Potential of the Forex Market

By mastering the fundamentals, embracing technical analysis, practicing discipline and risk management, engaging in continuous learning, choosing the right broker, and developing a comprehensive trading plan, you can unlock the potential of the forex market. Remember, success in forex trading is not about luck or shortcuts; it’s about mastering the fundamentals, honing your skills, and applying a disciplined and strategic approach. With dedication and perseverance, you can transform your trading journey from a pursuit of quick riches to a path of consistent and rewarding success.

Closure

Thus, we hope this article has provided valuable insights into 7 Unbreakable Forex Trading Tips for Astounding Success. We appreciate your attention to our article. See you in our next article!

google.com