The 5-Step Credit Card Approval Process: A Demystifying Guide for Your Financial Journey

Related Articles: The 5-Step Credit Card Approval Process: A Demystifying Guide for Your Financial Journey

- Unlocking 5 Powerful Perks: The Ultimate Guide To Business Credit Cards

- Unleashing 5 Powerful Ways Credit Cards Can Transform Your Finances

- Conquer Credit Card Debt: A 5-Step Strategy For Financial Freedom

- Unlocking Financial Freedom: 5 Strategies For Finding A Credit Card With Bad Credit

- Credit card Examinations – Picking The Best Arrangement

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The 5-Step Credit Card Approval Process: A Demystifying Guide for Your Financial Journey. Let’s weave interesting information and offer fresh perspectives to the readers.

The 5-Step Credit Card Approval Process: A Demystifying Guide for Your Financial Journey

Obtaining a credit card can be a daunting experience, particularly for those new to the financial world. The application process, with its intricate web of criteria and requirements, can feel like navigating a labyrinth. However, understanding the mechanics of credit card approval is the first step towards unlocking the potential of this powerful financial tool. This comprehensive guide will demystify the process, providing you with the knowledge to navigate it confidently and increase your chances of securing approval.

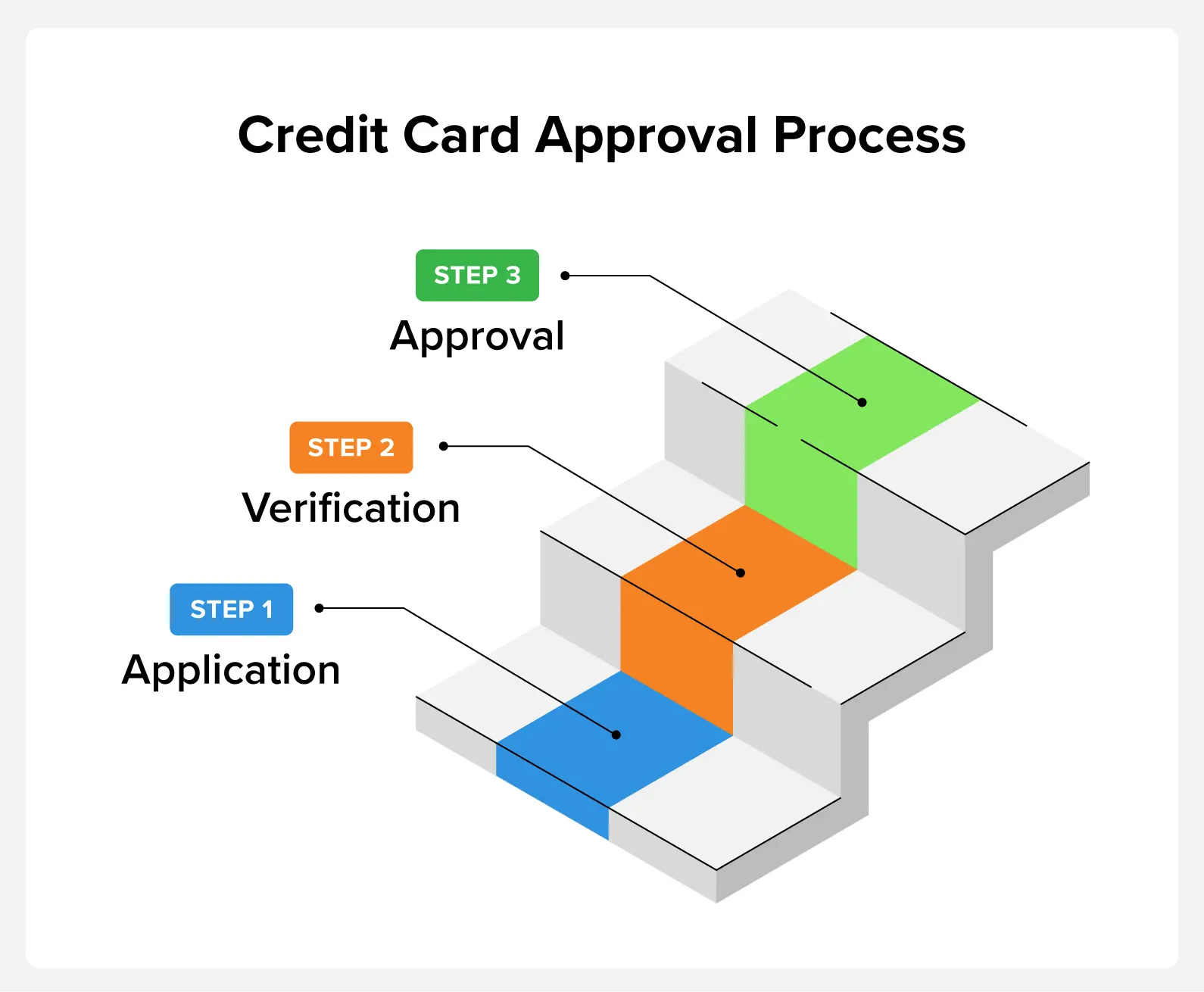

Step 1: The Application – Your First Impression

The journey begins with your application, the first step in the credit card approval process. This seemingly simple act of filling out a form is where you present your financial profile to the lender. The application form will request personal information, including your name, address, Social Security number, and employment details. Most importantly, it will ask for your income and credit history.

The Importance of Accuracy and Completeness

Accuracy is paramount in this stage. Any inaccuracies or inconsistencies can raise red flags and lead to delays or even denial. Furthermore, ensure that you provide complete information, as incomplete forms may also trigger scrutiny.

Beyond the Basics – Understanding the Application’s Impact

The information you provide in your application serves as the foundation for the lender’s initial assessment. It allows them to gauge your creditworthiness and determine whether you meet the minimum eligibility requirements.

Key Factors Considered:

- Credit Score: This numerical representation of your creditworthiness is a crucial factor. Higher scores typically indicate responsible financial behavior and increase your chances of approval.

- Credit History: Lenders delve into your credit history, reviewing your past borrowing and repayment patterns. A history of on-time payments and responsible credit utilization is favorable.

- Income: Lenders assess your income to determine your ability to repay the credit card debt. Higher income generally leads to better approval odds.

- Debt-to-Income Ratio (DTI): This ratio compares your monthly debt payments to your gross monthly income. A lower DTI is preferred, as it signifies that you have more financial flexibility to manage additional debt.

- Employment History: Stability in employment history is often viewed positively. Lenders seek assurance that you have a reliable source of income.

Step 2: The Pre-Approval – A Glimpse into Your Potential

After submitting your application, you may receive a pre-approval notification. This is not a guarantee of approval but rather an indication that you meet the lender’s preliminary criteria.

The Value of Pre-Approval:

- Provides Insight: Pre-approval gives you an idea of the credit card offers you might be eligible for, including interest rates and credit limits.

- Enhances Confidence: It can boost your confidence by suggesting that you have a good chance of getting approved.

- Simplifies the Process: If you’re pre-approved, the final approval process might be streamlined.

Understanding the Limitations:

- Not a Guarantee: Pre-approval is not a final approval. The lender may still conduct a more thorough review of your financial information.

- Conditional Offer: Pre-approval may be subject to certain conditions, such as verifying your income or credit history.

- Offer May Change: The terms of the pre-approved offer, including interest rates and credit limits, may change after a full review.

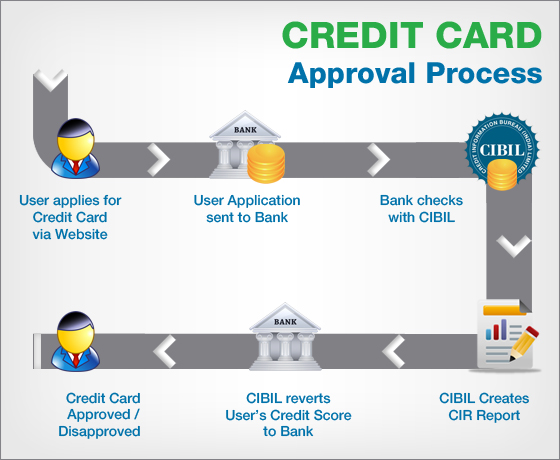

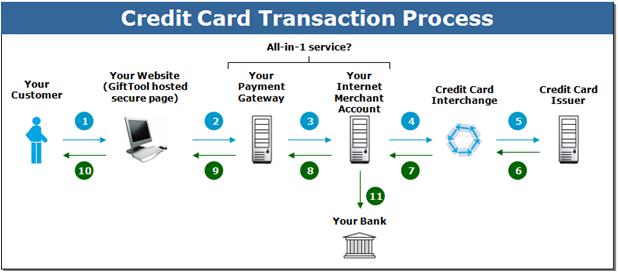

Step 3: The Credit Check – A Deeper Dive into Your Financial Profile

Once you submit your application, the lender will conduct a hard inquiry on your credit report. This is a comprehensive review of your credit history, providing a detailed picture of your financial behavior.

The Impact of Hard Inquiries:

- Credit Score Dip: Hard inquiries can temporarily lower your credit score, though this impact is usually minimal.

- Lender’s Evaluation: The information obtained from the credit check helps lenders assess your risk and make a more informed decision.

- Impact on Future Applications: Multiple hard inquiries in a short period can affect your credit score and potentially hinder future credit applications.

The Importance of Understanding Your Credit Report:

- Accuracy: Ensure your credit report is accurate and free of errors, as any discrepancies can negatively affect your approval chances.

- Dispute Errors: If you discover errors, file a dispute with the credit bureaus to correct them.

- Review Regularly: Check your credit report at least annually to monitor for any issues or suspicious activity.

Step 4: The Decision – The Moment of Truth

After reviewing your application, credit report, and other relevant information, the lender will make a decision regarding your credit card approval.

Factors Influencing the Decision:

- Credit Score: A higher credit score generally increases your chances of approval and may lead to more favorable terms.

- Credit History: A history of responsible credit management is crucial, demonstrating your ability to handle debt responsibly.

- Income and Debt-to-Income Ratio: Your income and DTI play a significant role in determining your ability to repay the credit card debt.

- Application Information: The accuracy and completeness of your application information are important considerations.

- Lender’s Policies: Each lender has its own set of criteria and policies for credit card approval.

The Importance of Understanding the Terms:

- Interest Rates: Pay close attention to the interest rate, as it will impact the cost of borrowing.

- Credit Limit: Your credit limit determines the maximum amount you can borrow on the card.

- Fees: Be aware of any associated fees, such as annual fees, late payment fees, or over-limit fees.

Step 5: The Activation – Unlocking Your Credit Card Benefits

If your application is approved, you will receive a credit card and instructions on how to activate it.

Activation Process:

- Online Activation: Many cards can be activated online through the issuer’s website.

- Phone Activation: You may also be able to activate your card by calling the issuer’s customer service line.

- Mail Activation: Some cards require you to activate them by mail.

Getting Started:

- Set a Budget: Establish a budget and stick to it to avoid overspending and accumulating debt.

- Use Your Card Responsibly: Pay your balance in full each month to avoid accruing interest charges.

- Monitor Your Account: Track your spending and monitor your account regularly to ensure there are no unauthorized charges.

Building Your Credit Through Responsible Use:

- On-Time Payments: Make all payments on time to maintain a positive credit history.

- Low Credit Utilization: Keep your credit utilization ratio low by using a small percentage of your available credit.

- Diversify Your Credit: Consider applying for different types of credit, such as personal loans or auto loans, to demonstrate your ability to manage various credit accounts.

Challenges and Solutions:

1. Credit Score:

Challenge: A low credit score can significantly hinder your chances of approval.

Solution: Focus on improving your credit score by paying bills on time, reducing debt, and avoiding excessive credit applications.

2. Income:

Challenge: Limited income can make it difficult to qualify for a credit card.

Solution: Consider applying for a secured credit card, which requires a security deposit. This can help you build credit and potentially qualify for an unsecured card in the future.

3. Debt-to-Income Ratio:

Challenge: A high DTI can indicate that you are already stretched financially and may not be able to handle additional debt.

Solution: Work on reducing your existing debt by creating a debt repayment plan and prioritizing higher-interest debt.

4. Employment History:

Challenge: A lack of stable employment history can raise concerns about your ability to repay debt.

Solution: Consider looking for a stable job or providing additional documentation, such as pay stubs or tax returns, to demonstrate your income.

5. Application Errors:

Challenge: Errors or omissions on your application can lead to delays or denial.

Solution: Carefully review your application before submitting it and ensure all information is accurate and complete.

Final Thoughts

The credit card approval process can be a complex journey, but by understanding the steps and factors involved, you can increase your chances of success. Remember to be patient, thorough, and accurate throughout the process. With careful planning and responsible use, a credit card can become a valuable tool in your financial journey, offering benefits such as building credit, earning rewards, and accessing convenient financing options.

Closure

Thus, we hope this article has provided valuable insights into The 5-Step Credit Card Approval Process: A Demystifying Guide for Your Financial Journey. We appreciate your attention to our article. See you in our next article!

google.com