The 5 Reasons Why Strategic Mergers Are a Game-Changer for Businesses

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The 5 Reasons Why Strategic Mergers Are a Game-Changer for Businesses. Let’s weave interesting information and offer fresh perspectives to the readers.

The 5 Reasons Why Strategic Mergers Are a Game-Changer for Businesses

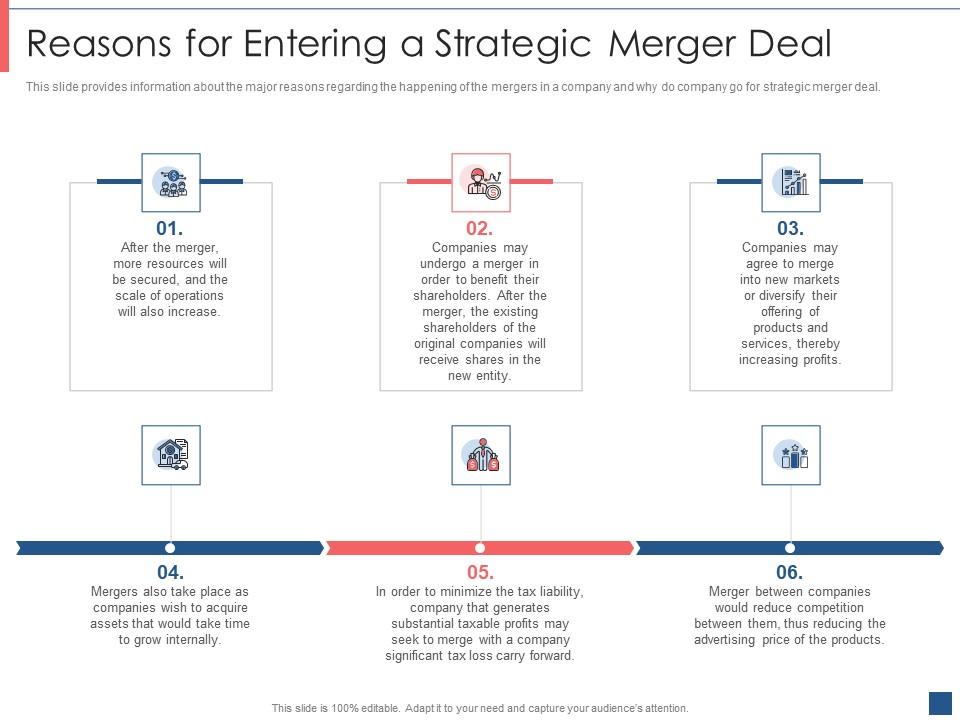

In the ever-evolving landscape of global business, mergers and acquisitions (M&A) have become a powerful tool for companies seeking to achieve growth, enhance market share, and gain a competitive edge. While the idea of combining two separate entities may seem daunting, strategic mergers can unlock immense potential for both businesses involved. However, navigating the complexities of a successful merger requires careful planning, effective execution, and a clear understanding of the potential benefits and challenges.

This article delves into the 5 compelling reasons why strategic mergers can be a game-changer for businesses, highlighting the opportunities and challenges that come with this dynamic business strategy.

1. Enhanced Market Share and Reach:

One of the most prominent benefits of a strategic merger is the potential for significant market share expansion. By combining forces with a complementary company, businesses can tap into new customer segments, expand their geographical reach, and gain access to a wider range of products and services. This can lead to increased revenue, improved brand recognition, and a stronger competitive position within the industry.

For example, the 2016 merger of Kraft Foods and Heinz, creating the Kraft Heinz Company, resulted in a massive global food and beverage conglomerate with a significantly expanded product portfolio and a wider reach across various markets. This move allowed the combined entity to leverage its collective brand power and distribution channels to achieve greater market penetration and sales growth.

2. Access to New Resources and Capabilities:

Mergers can provide businesses with access to new resources, technologies, and expertise that might be difficult or expensive to develop internally. By integrating with a company possessing complementary strengths, businesses can acquire valuable assets, such as intellectual property, research and development capabilities, skilled personnel, or specialized equipment. This can lead to innovation, improved efficiency, and a competitive advantage in the marketplace.

For instance, the 2018 merger of pharmaceutical giants Bristol-Myers Squibb and Celgene brought together a vast portfolio of innovative drug candidates and cutting-edge research capabilities. This merger enabled the combined entity to accelerate the development and launch of new therapies, ultimately expanding its product offerings and strengthening its position in the pharmaceutical industry.

3. Cost Synergies and Operational Efficiency:

Mergers can create significant cost savings through economies of scale and operational efficiencies. By combining operations, businesses can streamline processes, eliminate redundancies, negotiate better prices for raw materials and supplies, and reduce overhead costs. These cost savings can be reinvested in research and development, marketing, or other strategic initiatives, further boosting profitability and growth.

The 2017 merger of the American Airlines Group and US Airways provided a compelling example of cost synergies. By consolidating their operations, the combined airline was able to reduce operating costs, improve route efficiency, and achieve significant savings through shared resources and personnel. These cost reductions contributed to improved profitability and allowed the airline to invest in fleet upgrades and other strategic initiatives.

4. Diversification and Risk Reduction:

Mergers can help businesses diversify their product portfolio, customer base, and geographic reach, reducing their overall risk exposure. By entering new markets or expanding into different product categories, businesses can mitigate the impact of economic downturns or industry-specific challenges. This diversification strategy can provide greater stability and resilience in the face of market fluctuations.

The 2015 merger of the oil and gas giants Halliburton and Baker Hughes exemplified the benefits of diversification. By combining their operations, the combined entity gained access to a wider range of products and services, allowing them to tap into new markets and reduce their reliance on any single sector or region. This diversification strategy provided greater financial stability and reduced their overall risk exposure.

5. Innovation and Competitive Advantage:

Mergers can foster innovation and drive competitive advantage by combining the best ideas and talent from both organizations. By bringing together diverse perspectives, expertise, and resources, businesses can accelerate product development, enhance research and development capabilities, and create new solutions that meet evolving market demands.

The 2010 merger of the technology giants Google and Motorola Mobility demonstrated the potential for innovation through mergers. This combination allowed Google to leverage Motorola’s expertise in mobile hardware and manufacturing, while Motorola gained access to Google’s powerful software platform and global reach. This merger resulted in the development of innovative mobile devices and a strengthened position in the rapidly evolving smartphone market.

Challenges of Mergers and Acquisitions:

While strategic mergers offer significant potential for growth and success, they also present several challenges that must be carefully considered and addressed.

1. Integration Challenges:

Merging two distinct companies with different cultures, systems, and processes can be a complex and time-consuming process. Integrating employees, aligning corporate cultures, and harmonizing operational procedures require careful planning, effective communication, and a commitment to change management. Failure to address these integration challenges can lead to employee dissatisfaction, operational disruptions, and a decline in productivity.

2. Cultural Clash:

Merging companies with different corporate cultures can create friction and resistance among employees. Differences in values, work styles, communication practices, and decision-making processes can lead to conflicts and hinder the smooth integration of the two entities. It is crucial to identify potential cultural clashes early on and develop strategies to bridge these differences through communication, training, and a shared vision for the future.

3. Regulatory Scrutiny:

Mergers often face scrutiny from regulatory authorities who assess the potential impact on competition and consumer welfare. Antitrust laws may require businesses to divest certain assets or operations to ensure fair competition in the market. Navigating the regulatory landscape can be a complex and time-consuming process, requiring legal expertise and strategic planning.

4. Financial Risks:

Mergers can involve significant financial investments and risks. The cost of acquiring another company, integrating operations, and addressing potential liabilities can strain financial resources. It is crucial to conduct thorough due diligence, assess financial risks, and secure adequate financing to ensure the success of the merger.

5. Employee Morale and Retention:

Mergers can impact employee morale and retention, as employees may face uncertainty about their roles, responsibilities, and career prospects. It is essential to communicate effectively with employees, address their concerns, and provide support and guidance during the transition. Failing to address employee anxieties can lead to increased turnover and a decline in productivity.

Conclusion:

Strategic mergers can be a powerful tool for businesses seeking to achieve growth, enhance market share, and gain a competitive edge. However, navigating the complexities of a successful merger requires careful planning, effective execution, and a clear understanding of the potential benefits and challenges. By addressing the integration challenges, cultural clashes, regulatory scrutiny, financial risks, and employee concerns, businesses can maximize the opportunities and mitigate the risks associated with mergers and acquisitions, ultimately transforming them into game-changers that drive sustainable growth and success.

Closure

Thus, we hope this article has provided valuable insights into The 5 Reasons Why Strategic Mergers Are a Game-Changer for Businesses. We appreciate your attention to our article. See you in our next article!

google.com