Unleashing the Power of 5: A Definitive Guide to Transformative Business Valuation

Introduction

With great pleasure, we will explore the intriguing topic related to Unleashing the Power of 5: A Definitive Guide to Transformative Business Valuation. Let’s weave interesting information and offer fresh perspectives to the readers.

Unleashing the Power of 5: A Definitive Guide to Transformative Business Valuation

In the ever-evolving landscape of business, understanding the true worth of an enterprise is paramount. Whether you’re seeking investment, planning a merger, or simply aiming to gain a clear picture of your company’s financial health, a comprehensive business valuation is an indispensable tool. This article delves into the intricacies of this crucial process, providing a detailed roadmap to unlock the power of five key valuation methods.

Why Valuation Matters: A Foundation for Success

Business valuation goes beyond simply assigning a dollar figure to a company. It’s a strategic process that unveils a company’s intrinsic value, revealing its potential and future prospects. This information is invaluable for:

- Investment Decisions: Investors rely on valuations to assess the risk and return potential of a company before committing capital.

- Mergers and Acquisitions: Valuation helps determine the fair price for a company being acquired or the price a company should offer for another.

- Financing: Banks and other lenders use valuations to determine the loan amount and terms they are willing to offer.

- Estate Planning: Valuations are crucial for determining the value of a business for estate tax purposes.

- Legal Disputes: In cases of shareholder disputes, divorce proceedings, or bankruptcy, valuations can provide objective evidence of a company’s worth.

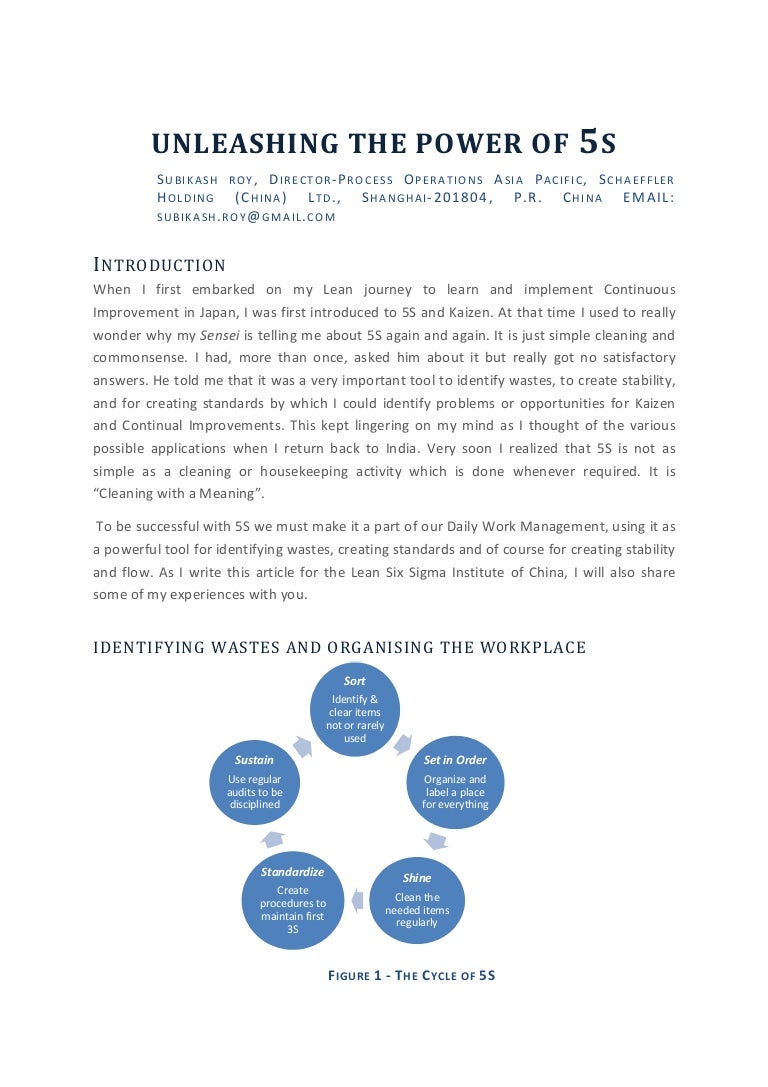

5 Pillars of Valuation: A Comprehensive Approach

No single valuation method is universally applicable. The best approach often involves a combination of methods, tailored to the specific characteristics of the business being assessed. Here’s a breakdown of five commonly used techniques:

1. Income Approach:

This method focuses on the future earnings potential of the business. It involves projecting future income streams and discounting them back to present value using a chosen discount rate. The discount rate reflects the risk associated with the business and the expected rate of return.

- Discounted Cash Flow (DCF): This is the most widely used income approach. It forecasts the company’s future cash flows and discounts them back to the present value based on a chosen discount rate.

- Capitalized Earnings: This method uses a capitalization rate to convert a company’s current earnings into a present value. The capitalization rate reflects the risk and return associated with the business.

2. Market Approach:

This approach compares the subject company to similar publicly traded companies or recently sold private companies. It leverages market data to arrive at a valuation.

- Public Company Comparables (PCC): This method compares the subject company to publicly traded companies in the same industry with similar characteristics. The valuation is derived by adjusting the market value of the comparable companies based on key differences.

- Precedent Transactions: This approach analyzes recent transactions of similar companies to determine the price paid for them. It relies on the assumption that similar companies in similar market conditions will be valued similarly.

3. Asset Approach:

This method focuses on the value of the company’s tangible and intangible assets. It involves adding up the value of all assets, including land, buildings, equipment, intellectual property, and goodwill.

- Liquidation Value: This approach calculates the value of the company’s assets if they were to be sold off individually. It’s often used in bankruptcy situations.

- Replacement Cost: This method estimates the cost of replacing the company’s assets with new ones. It’s useful for valuing companies with unique assets or those with high replacement costs.

4. Hybrid Approach:

This method combines elements of two or more of the other valuation methods. It provides a more comprehensive picture of the company’s value by considering multiple perspectives.

- Adjusted Present Value (APV): This approach combines the DCF method with adjustments for the value of the company’s debt and equity.

- Weighted Average Cost of Capital (WACC): This method combines the DCF approach with a weighted average cost of capital to determine the present value of the company’s future cash flows.

5. Qualitative Factors:

While quantitative methods provide a numerical basis for valuation, qualitative factors play a crucial role in shaping the final assessment. These factors include:

- Management Team: The quality and experience of the management team can significantly influence a company’s value.

- Competitive Landscape: The strength of the company’s competitors and the industry’s growth potential impact its value.

- Market Share: A company with a dominant market share generally commands a higher valuation.

- Brand Reputation: Strong brands with established customer loyalty are more valuable than those with weak brand recognition.

- Regulatory Environment: The regulatory landscape can significantly affect a company’s value, particularly in industries subject to strict regulations.

Choosing the Right Approach: A Tailored Strategy

The most effective valuation approach depends on a number of factors, including:

- The purpose of the valuation: Whether it’s for investment, financing, or estate planning, the purpose will influence the chosen method.

- The stage of the company’s life cycle: Early-stage companies may be valued differently than mature companies with a proven track record.

- The industry: Different industries have different valuation metrics and approaches.

- The availability of data: Some methods require more data than others.

- The complexity of the business: Companies with complex operations or a large number of assets may require a more sophisticated valuation approach.

The Role of Professionals: Expertise for Accuracy

While some basic valuation techniques can be applied by business owners, a comprehensive and accurate valuation often requires the expertise of a qualified professional. Valuation specialists possess the knowledge, experience, and tools to conduct thorough analyses and arrive at reliable results. They can:

- Identify the most appropriate valuation methods for the specific situation.

- Gather and analyze relevant data.

- Apply industry-specific valuation techniques.

- Develop a comprehensive valuation report.

- Provide expert testimony in legal disputes.

Navigating the Future: Valuation as a Strategic Tool

Business valuation is not a one-time event. It’s an ongoing process that should be revisited periodically to reflect changes in the company’s performance, the market, and the economic environment. By conducting regular valuations, businesses can:

- Monitor their progress and identify areas for improvement.

- Stay ahead of competitors and adapt to changing market conditions.

- Make informed decisions about investment, financing, and growth strategies.

- Ensure they are maximizing their value and creating long-term shareholder value.

Conclusion: Unlocking Value, Empowering Growth

In the competitive world of business, a deep understanding of value is essential for survival and success. By mastering the five key valuation methods and leveraging the expertise of professionals, companies can unlock their true potential and navigate the path to sustainable growth. A well-executed valuation is not just a number; it’s a powerful tool that empowers businesses to make informed decisions, attract investment, and ultimately, achieve their strategic goals.

Closure

Thus, we hope this article has provided valuable insights into Unleashing the Power of 5: A Definitive Guide to Transformative Business Valuation. We appreciate your attention to our article. See you in our next article!

google.com