Unleashing the 5 Pillars of Unstoppable Business Capital: A Guide to Financial Freedom

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unleashing the 5 Pillars of Unstoppable Business Capital: A Guide to Financial Freedom. Let’s weave interesting information and offer fresh perspectives to the readers.

Unleashing the 5 Pillars of Unstoppable Business Capital: A Guide to Financial Freedom

The quest for financial freedom is a universal one, driving entrepreneurs and businesses alike to seek out the lifeblood of success: capital. But the path to acquiring and managing capital isn’t always clear. It’s often shrouded in complex jargon, intimidating regulations, and a constant pressure to perform. This article aims to cut through the noise, providing a practical roadmap to understanding and harnessing the power of business capital, empowering you to build a strong, sustainable financial foundation.

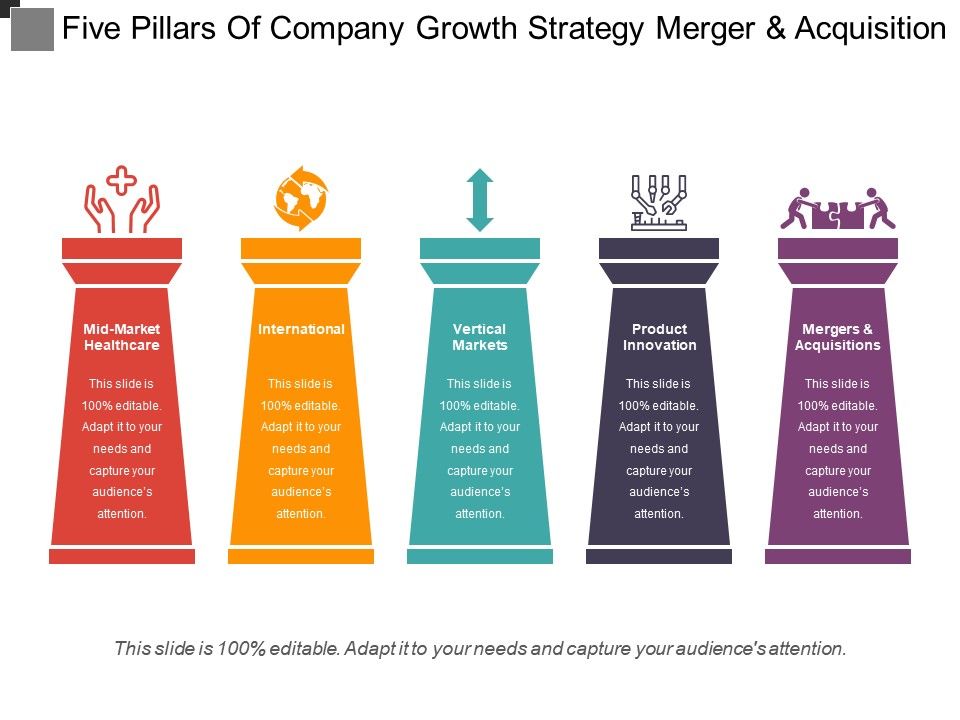

Understanding the 5 Pillars of Business Capital:

Business capital isn’t just about money. It’s a multifaceted concept encompassing various resources that fuel growth and drive profitability. We’ll explore five key pillars:

1. Financial Capital: This is the most obvious form of capital, representing the actual money a business possesses. It can be obtained through various sources, including:

- Equity Financing: Raising funds by selling ownership shares of the business.

- Debt Financing: Borrowing money from banks, investors, or other lenders, which needs to be repaid with interest.

- Venture Capital: Investment from specialized firms that focus on high-growth companies with the potential for significant returns.

- Angel Investors: Individuals who provide funding in exchange for equity, often in early-stage businesses.

- Crowdfunding: Raising funds from a large number of individuals, often through online platforms.

2. Human Capital: This refers to the skills, knowledge, experience, and creativity of your workforce. A strong human capital base is essential for driving innovation, productivity, and customer satisfaction. Investing in your team through training, development programs, and fostering a positive work environment is crucial for long-term success.

3. Physical Capital: This encompasses the tangible assets a business owns, such as buildings, equipment, machinery, and inventory. Investing in physical capital is essential for expanding operations, improving efficiency, and delivering products or services effectively.

4. Intellectual Capital: This represents the intangible assets that drive your business’s competitive advantage. It includes patents, trademarks, copyrights, brand reputation, customer relationships, and unique processes or technologies. Protecting and leveraging your intellectual capital is critical for maintaining a competitive edge and securing long-term growth.

5. Social Capital: This refers to the network of relationships and connections a business has built. Strong social capital can provide access to valuable resources, including potential investors, partners, customers, and mentors. Building and nurturing these relationships through networking, community engagement, and strategic partnerships is essential for fostering growth and expanding your reach.

Navigating the Capital Landscape:

Understanding the different types of capital is only the first step. The real challenge lies in effectively managing and deploying these resources to achieve your business goals. Here are some key considerations:

- Strategic Planning: Before seeking capital, develop a comprehensive business plan outlining your vision, objectives, target market, financial projections, and how you intend to utilize the funds.

- Financial Management: Implement robust financial management practices, including accurate accounting, budgeting, cash flow analysis, and expense control. This will ensure you’re using capital wisely and making informed decisions.

- Risk Management: Every business faces risks. Develop a strategy to identify, assess, and mitigate potential threats to your financial stability and growth.

- Transparency and Communication: Maintain open and transparent communication with investors, lenders, and stakeholders, keeping them informed about your progress, challenges, and future plans.

- Legal and Regulatory Compliance: Ensure you’re fully compliant with all relevant laws and regulations governing business operations, financing, and reporting.

Unlocking the Power of Business Capital:

Building a strong financial foundation is not a one-time event but an ongoing journey. Here are some practical steps to help you unlock the power of business capital:

- Prioritize Growth: Invest in areas that will drive long-term growth, such as research and development, marketing, talent acquisition, and strategic partnerships.

- Optimize Operations: Continuously seek ways to improve efficiency, reduce costs, and maximize profitability.

- Build a Strong Team: Invest in your human capital by attracting, retaining, and developing talented individuals who share your vision.

- Leverage Technology: Embrace technology to streamline operations, improve customer service, and gain a competitive advantage.

- Stay Informed: Keep abreast of industry trends, market dynamics, and evolving regulations to make informed decisions and adapt to changing circumstances.

The Bottom Line:

Building a successful business requires more than just a good idea. It requires a strategic approach to acquiring, managing, and deploying capital. By understanding the five pillars of business capital and implementing sound financial practices, you can build a strong financial foundation that will fuel growth, drive profitability, and ultimately, achieve your entrepreneurial goals. Remember, business capital is not just about money; it’s about leveraging all your resources to create a sustainable and thriving enterprise. So, embrace the power of capital, and watch your business soar.

Closure

Thus, we hope this article has provided valuable insights into Unleashing the 5 Pillars of Unstoppable Business Capital: A Guide to Financial Freedom. We appreciate your attention to our article. See you in our next article!

google.com