Unlocking the Secrets of a Powerful 3-Part Business Balance Sheet: A Guide to Financial Success

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unlocking the Secrets of a Powerful 3-Part Business Balance Sheet: A Guide to Financial Success. Let’s weave interesting information and offer fresh perspectives to the readers.

Unlocking the Secrets of a Powerful 3-Part Business Balance Sheet: A Guide to Financial Success

The balance sheet, a cornerstone of financial reporting, often gets overshadowed by its more dynamic counterpart, the income statement. However, this seemingly static document holds the key to understanding a company’s financial health, revealing its assets, liabilities, and equity in a clear and concise manner. By mastering the art of reading and analyzing a balance sheet, business owners, investors, and even employees can gain invaluable insights into a company’s true financial standing, uncovering hidden opportunities and potential risks.

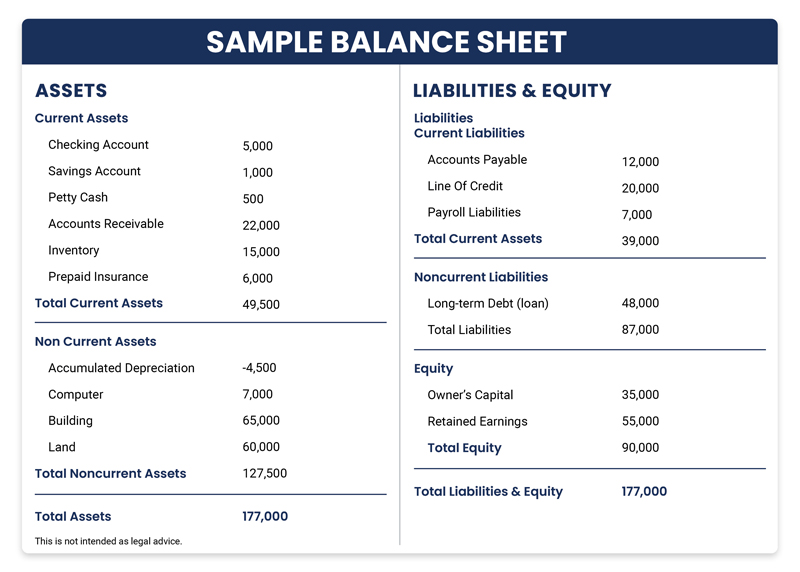

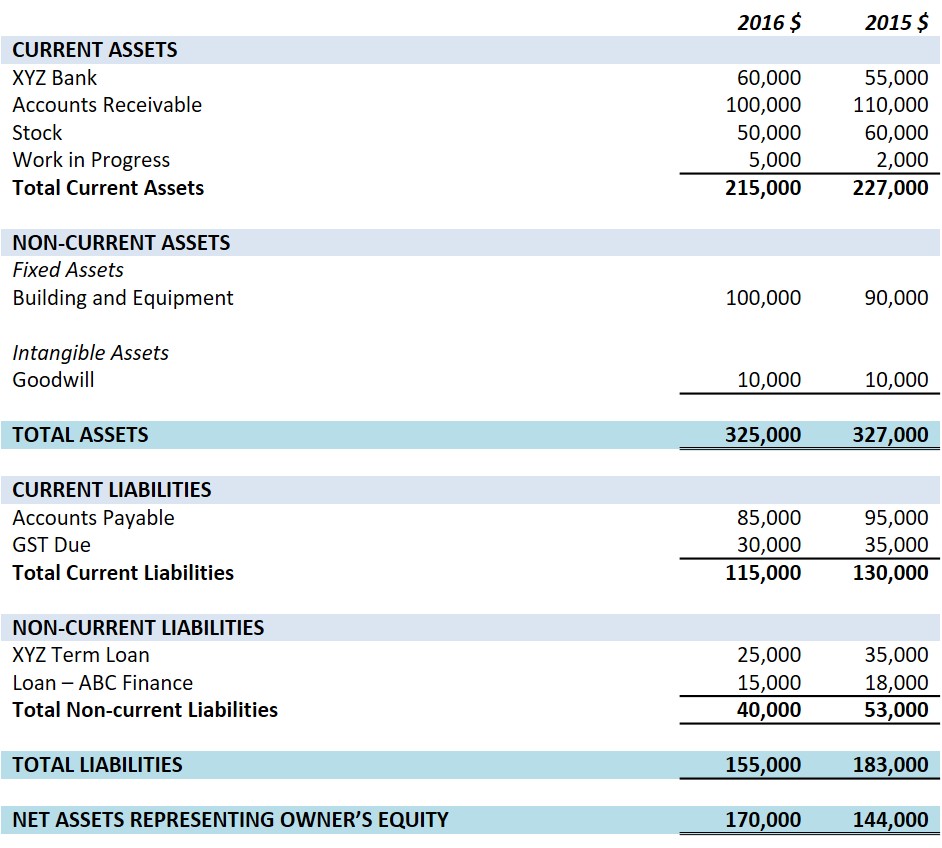

This article will delve into the anatomy of a balance sheet, breaking down its three key components: assets, liabilities, and equity. We’ll explore the different types of accounts within each category, providing practical examples and insights to help you decipher the information presented. Finally, we’ll discuss how to use this knowledge to make informed decisions about your business or investment strategy.

Understanding the Fundamental Equation

The balance sheet adheres to a simple yet powerful equation:

Assets = Liabilities + Equity

This equation represents the core principle of accounting: everything a company owns (assets) is either financed by borrowing (liabilities) or by the owners’ investment (equity).

1. Assets: What the Company Owns

Assets are the resources controlled by a company that are expected to provide future economic benefits. They are categorized into two primary groups:

Current Assets: These are assets expected to be converted into cash or used up within one year. Examples include:

- Cash and Cash Equivalents: The most liquid asset, readily available for immediate use. This category also includes short-term investments, such as treasury bills and money market funds.

- Accounts Receivable: Money owed to the company by its customers for goods or services already delivered.

- Inventory: Raw materials, work-in-progress, and finished goods held for sale.

- Prepaid Expenses: Expenses paid in advance, such as rent, insurance, or advertising.

Non-Current Assets: These assets are expected to provide benefits for more than one year. They include:

- Property, Plant, and Equipment (PP&E): Tangible assets such as land, buildings, machinery, and vehicles used in the business.

- Intangible Assets: Assets that lack physical form but have value. Examples include patents, trademarks, copyrights, and goodwill.

- Long-Term Investments: Investments in other companies or securities that are held for more than a year.

2. Liabilities: What the Company Owes

Liabilities represent the company’s obligations to external parties. They are also categorized into two main groups:

Current Liabilities: These are obligations due within one year. Examples include:

- Accounts Payable: Money owed to suppliers for goods or services received.

- Salaries Payable: Wages owed to employees.

- Short-Term Loans: Loans with a maturity of less than one year.

- Deferred Revenue: Payments received for goods or services not yet delivered.

Non-Current Liabilities: These are obligations due in more than one year. They include:

- Long-Term Loans: Loans with a maturity of more than one year.

- Bonds Payable: Debt securities issued by the company to raise capital.

- Deferred Tax Liabilities: Taxes that are expected to be paid in the future.

3. Equity: The Owners’ Stake

Equity represents the owners’ stake in the company. It reflects the amount of capital invested by the owners, along with any accumulated profits or losses. Equity is further divided into:

Shareholders’ Equity: This represents the owners’ investment in the company through shares or stock. It includes:

- Common Stock: The basic ownership unit in a company.

- Preferred Stock: A type of stock that pays a fixed dividend and has priority over common stock in the event of liquidation.

- Additional Paid-in Capital: The amount received from investors above the par value of the stock.

Retained Earnings: Accumulated profits that have not been distributed to shareholders as dividends.

Analyzing the Balance Sheet: Unveiling the Financial Story

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. By carefully analyzing the different components, you can gain valuable insights into:

- Liquidity: The ability of a company to meet its short-term obligations. A high ratio of current assets to current liabilities indicates strong liquidity.

- Solvency: The ability of a company to meet its long-term obligations. A high ratio of assets to liabilities suggests good solvency.

- Financial Leverage: The extent to which a company uses debt financing. A high level of debt can increase financial risk but also potentially enhance returns.

- Profitability: While not directly reflected in the balance sheet, it can be inferred by analyzing changes in retained earnings over time.

Key Ratios for Balance Sheet Analysis

Several key ratios can help you analyze a company’s financial position based on its balance sheet:

- Current Ratio: (Current Assets / Current Liabilities) – Measures a company’s ability to meet its short-term obligations.

- Quick Ratio: (Current Assets – Inventory) / Current Liabilities) – A more conservative measure of liquidity, excluding inventory which may be difficult to sell quickly.

- Debt-to-Equity Ratio: (Total Debt / Total Equity) – Measures the extent to which a company uses debt financing.

- Return on Equity (ROE): (Net Income / Total Equity) – Measures the profitability of the company’s investment.

Practical Applications: Making Informed Decisions

The insights gleaned from balance sheet analysis can be used to make informed decisions in various contexts:

- Business Owners: By understanding their company’s financial position, owners can make informed decisions about investment, financing, and operational strategies.

- Investors: Investors can use balance sheet analysis to evaluate the financial health of potential investment opportunities.

- Creditors: Creditors use balance sheet analysis to assess the creditworthiness of borrowers.

- Employees: Understanding a company’s financial position can help employees make informed decisions about their career paths and investments.

Conclusion: A Powerful Tool for Financial Success

The balance sheet, often overlooked, is a powerful tool for understanding a company’s financial health. By mastering the art of reading and analyzing this essential document, you can gain invaluable insights into a company’s assets, liabilities, and equity, enabling you to make informed decisions about your business or investment strategy. Remember, the balance sheet is not just a static document; it’s a dynamic representation of a company’s financial story, waiting to be deciphered and understood. By embracing its power, you can unlock the secrets to financial success.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Secrets of a Powerful 3-Part Business Balance Sheet: A Guide to Financial Success. We thank you for taking the time to read this article. See you in our next article!

google.com