Booming Bullish: 5 Key Factors Driving the Forex Market’s Explosive Growth

Related Articles: Booming Bullish: 5 Key Factors Driving the Forex Market’s Explosive Growth

- Unleash The Power Of 5: Mastering Forex Risk Management For Explosive Growth

- The Ultimate Guide To Forex Signals: 10 Key Insights For Profitable Trading

- 5 Unforgettable Forex Trading Platforms: Unlock Your Trading Potential

- The 5 Essential Steps To Master Forex Trading For Beginners

- 7 Unbreakable Forex Trading Tips For Astounding Success

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Booming Bullish: 5 Key Factors Driving the Forex Market’s Explosive Growth. Let’s weave interesting information and offer fresh perspectives to the readers.

Booming Bullish: 5 Key Factors Driving the Forex Market’s Explosive Growth

The Forex market, the world’s largest and most liquid financial market, has been on a tear in recent months, with trading volumes surging to unprecedented levels. This surge in activity can be attributed to a confluence of factors, each contributing to the market’s bullish momentum. While some analysts caution against complacency, the overall sentiment remains overwhelmingly optimistic, prompting investors to dive headfirst into the exhilarating world of currency trading.

1. Global Economic Recovery Fuels Forex Demand: The global economy, battered by the COVID-19 pandemic, is finally showing signs of a robust recovery. This recovery is fueled by several factors, including massive government stimulus packages, easing lockdowns, and a gradual return to normalcy in many parts of the world. The International Monetary Fund (IMF) projects global growth to reach 5.9% in 2021, a significant rebound from the 3.3% contraction in 2020. This positive outlook is boosting investor confidence and driving demand for Forex trading, as traders seek to capitalize on the opportunities presented by a recovering global economy.

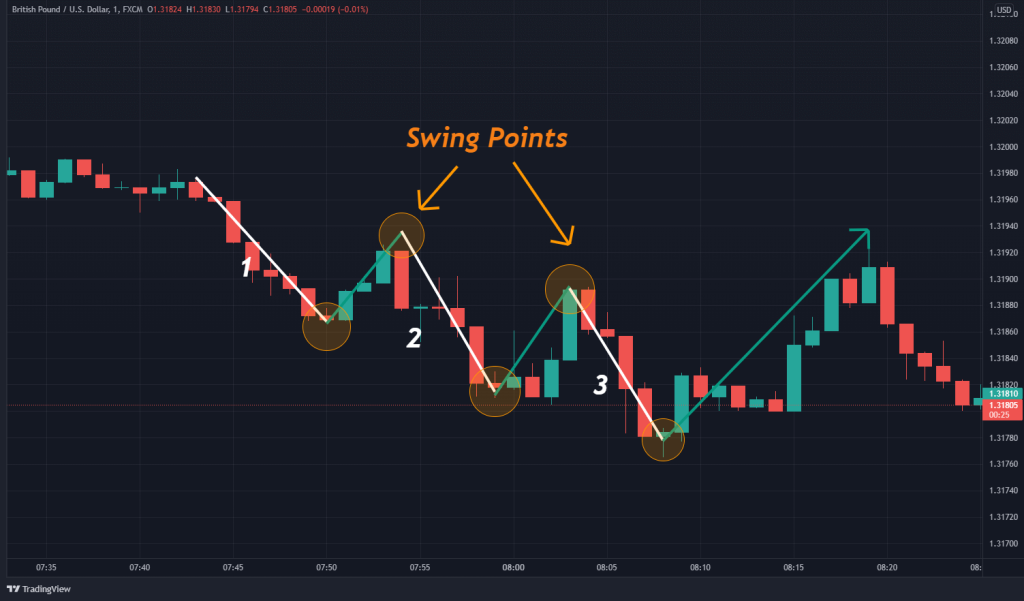

2. Interest Rate Differentials Drive Currency Appreciation: Central banks worldwide are employing various monetary policies to stimulate economic growth. This includes adjusting interest rates, a key factor influencing currency valuations. When a central bank raises interest rates, it makes its currency more attractive to foreign investors, as they can earn higher returns on their investments. This can lead to currency appreciation, making the currency more expensive to buy. The recent divergence in interest rate policies between major economies has created significant opportunities for Forex traders to profit from the resulting currency fluctuations. For instance, the US Federal Reserve has maintained a loose monetary policy, keeping interest rates low, while the Bank of England has begun to raise rates, leading to a surge in the value of the British Pound against the US Dollar.

3. Geopolitical Tensions Fuel Forex Volatility: The geopolitical landscape remains volatile, with ongoing conflicts, trade wars, and political uncertainty adding to the unpredictability of the Forex market. These geopolitical events can trigger significant currency fluctuations, creating both risks and opportunities for Forex traders. For example, the ongoing tensions between the US and China have led to increased volatility in the Chinese Yuan, attracting traders seeking to capitalize on these fluctuations. The recent withdrawal of US troops from Afghanistan also contributed to increased volatility in the Afghan Afghani.

4. Technological Advancements Democratize Forex Trading: Technological advancements have revolutionized the Forex market, making it more accessible to a wider range of investors. Online trading platforms, mobile apps, and sophisticated trading tools have lowered barriers to entry, allowing even novice traders to participate in the market with ease. This increased accessibility has contributed to the surge in Forex trading volume, as more individuals and institutions join the market, eager to tap into its vast potential.

5. Increased Investor Appetite for Risk: The global economic recovery and the availability of low-interest rates have emboldened investors to take on more risk. This increased risk appetite has spilled over into the Forex market, with traders seeking higher returns by engaging in more speculative trading strategies. This has led to increased volatility and liquidity in the market, further driving the growth of Forex trading.

Challenges and Cautions: While the current bullish sentiment in the Forex market is undeniable, it is important to acknowledge the challenges and potential risks associated with this market. The recent surge in volatility, driven by geopolitical tensions and economic uncertainties, can create significant losses for traders who are not adequately prepared. Additionally, the increasing complexity of the market, fueled by technological advancements, necessitates a high level of expertise and risk management skills to navigate the complexities of Forex trading.

Conclusion: The Forex market is experiencing a period of explosive growth, driven by a confluence of factors, including a recovering global economy, interest rate differentials, geopolitical tensions, technological advancements, and increased investor appetite for risk. While the current bullish sentiment is encouraging, it is crucial for traders to remain vigilant and adopt a disciplined approach to risk management. By carefully analyzing market trends, understanding the underlying drivers of currency fluctuations, and employing appropriate trading strategies, traders can navigate the dynamic and unpredictable world of Forex trading and potentially reap significant rewards. However, it is important to remember that Forex trading involves inherent risks and should be approached with caution and a thorough understanding of the market dynamics.

Closure

Thus, we hope this article has provided valuable insights into Booming Bullish: 5 Key Factors Driving the Forex Market’s Explosive Growth. We appreciate your attention to our article. See you in our next article!

google.com