Essential 7 Business Legal Models: A Powerful Guide to Choosing the Right Structure

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Essential 7 Business Legal Models: A Powerful Guide to Choosing the Right Structure. Let’s weave interesting information and offer fresh perspectives to the readers.

Essential 7 Business Legal Models: A Powerful Guide to Choosing the Right Structure

Choosing the right legal structure for your business is a crucial, often overwhelming, decision. The implications extend far beyond paperwork; the legal model you select directly impacts your liability, taxation, fundraising capabilities, and overall operational efficiency. This guide explores seven essential business legal models, empowering you to make an informed choice that aligns with your business goals and risk tolerance. Understanding these models is vital for building a sustainable and successful enterprise.

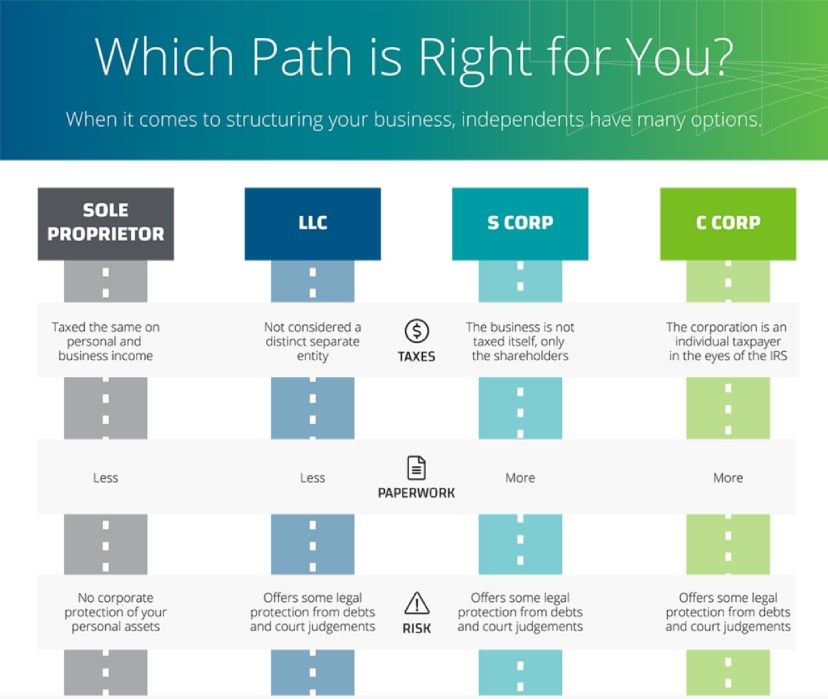

1. Sole Proprietorship: This is the simplest structure, where the business and the owner are legally indistinguishable. It’s easy to set up, requiring minimal paperwork and administrative burden. The owner directly receives all profits but also bears unlimited personal liability for business debts and obligations. This means personal assets, such as a house or car, are at risk if the business incurs debt or faces lawsuits. Sole proprietorships are typically best suited for very small, low-risk businesses with limited financial needs. Taxation is straightforward, with profits and losses reported on the owner’s personal income tax return.

2. Partnership: A partnership involves two or more individuals who agree to share in the profits or losses of a business. There are several types of partnerships, including general partnerships (where all partners share in the business’s operational management and liability) and limited partnerships (where some partners have limited liability and limited input into management). Partnerships offer the advantage of pooled resources and expertise, but like sole proprietorships, general partners face unlimited personal liability. The partnership agreement, a legally binding contract, outlines the responsibilities, profit-sharing arrangements, and dispute resolution mechanisms among partners. Taxation is similar to sole proprietorships, with profits and losses passed through to the partners’ individual tax returns.

3. Limited Liability Company (LLC): The LLC structure combines the pass-through taxation benefits of a partnership or sole proprietorship with the limited liability protection of a corporation. Members of an LLC (the equivalent of shareholders in a corporation) are not personally liable for the business’s debts or obligations. This separation of personal and business assets is a significant advantage, shielding personal wealth from business risks. LLCs offer flexibility in management structure, allowing for member-managed or manager-managed operations. The formation process typically involves filing articles of organization with the relevant state authority. The taxation of an LLC can vary depending on the election made by the members (e.g., single-member LLCs are often taxed as sole proprietorships, while multi-member LLCs can be taxed as partnerships).

4. S Corporation (S Corp): An S Corp is a type of corporation that elects to pass its income and losses through to its shareholders, avoiding double taxation (corporate tax and individual income tax). This structure is particularly attractive to businesses that anticipate generating significant profits, as it can lead to lower overall tax burdens. However, S Corps have stricter requirements than other structures, including limitations on the number of shareholders and restrictions on the types of shareholders allowed. Shareholders must also be US citizens or resident aliens. The formation of an S Corp involves incorporating the business and then filing Form 2553 with the IRS to elect S Corp status. Maintaining compliance with S Corp regulations is crucial to avoid penalties.

5. C Corporation (C Corp): A C Corp is a traditional corporate structure characterized by its separate legal entity status. This means the corporation is distinct from its shareholders, offering significant liability protection. However, C Corps are subject to double taxation: the corporation pays taxes on its profits, and shareholders pay taxes on dividends received. This can be a significant disadvantage, especially for profitable businesses. C Corps are often preferred by larger companies seeking to raise capital through the issuance of stock, as they offer greater flexibility in attracting investors and managing ownership. The formation of a C Corp involves incorporating the business and complying with state and federal regulations.

6. Cooperative: A cooperative is a business owned and operated by its members, who share in the profits or benefits. Cooperatives often focus on social or environmental goals in addition to profit generation. They are commonly found in agricultural, retail, and credit union sectors. Management is typically democratic, with members having voting rights proportional to their participation. Cooperatives offer a unique structure for businesses that prioritize member involvement and shared responsibility. The legal requirements for forming a cooperative vary depending on the type and location of the business.

7. Non-profit Organization: A non-profit organization is a tax-exempt entity that operates for a charitable, educational, religious, or other public benefit purpose. It does not distribute profits to its members or owners. Non-profits rely on donations, grants, and fundraising activities to support their operations. They are subject to strict regulations and reporting requirements to maintain their tax-exempt status. Forming a non-profit typically involves obtaining 501(c)(3) status from the IRS, which confers tax-exempt status under US federal law.

Choosing the Right Model:

Selecting the appropriate legal structure requires careful consideration of several factors:

- Liability Protection: How much protection do you need from personal liability for business debts?

- Tax Implications: What is the most tax-efficient structure for your business?

- Fundraising Needs: Do you plan to seek external investment or funding?

- Management Structure: How do you want to manage and control the business?

- Administrative Burden: How much paperwork and administrative overhead are you willing to handle?

This guide provides a foundational understanding of the various legal models available. However, consulting with legal and financial professionals is highly recommended to determine the optimal structure for your specific circumstances. The right legal model can significantly impact your business’s long-term success, making informed decision-making paramount. Don’t underestimate the power of choosing wisely.

Closure

Thus, we hope this article has provided valuable insights into Essential 7 Business Legal Models: A Powerful Guide to Choosing the Right Structure. We thank you for taking the time to read this article. See you in our next article!

google.com