Essential 7-Step Guide to Transformative Business Accounting

Introduction

With great pleasure, we will explore the intriguing topic related to Essential 7-Step Guide to Transformative Business Accounting. Let’s weave interesting information and offer fresh perspectives to the readers.

Essential 7-Step Guide to Transformative Business Accounting

The heart of any successful business beats with the rhythm of accurate and insightful financial data. Business accounting, often perceived as a dry and complex realm, is actually a transformative force capable of driving growth, profitability, and strategic decision-making. This guide outlines seven essential steps to master business accounting and unlock its full potential.

1. Establish a Robust Chart of Accounts:

The foundation of any accounting system lies in a well-defined Chart of Accounts (COA). This hierarchical structure categorizes all financial transactions, ensuring consistent and accurate recording. A robust COA should be tailored to your specific industry, business model, and reporting needs.

- Key Considerations:

- Industry Standards: Adhere to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS) relevant to your industry.

- Business Model: Categorize accounts based on your unique revenue streams, expenses, and assets.

- Reporting Requirements: Ensure the COA facilitates the creation of reports necessary for internal analysis, tax filings, and external stakeholders.

2. Embrace Automated Accounting Software:

Gone are the days of manual spreadsheets and tedious calculations. Modern accounting software empowers businesses with automation, real-time data, and seamless integration with other business tools.

- Benefits:

- Efficiency: Automated data entry, reconciliation, and reporting save valuable time and resources.

- Accuracy: Software minimizes human error, ensuring reliable financial data.

- Real-Time Insights: Access up-to-date financial information anytime, anywhere.

- Scalability: Software can adapt to your business’s growth and changing needs.

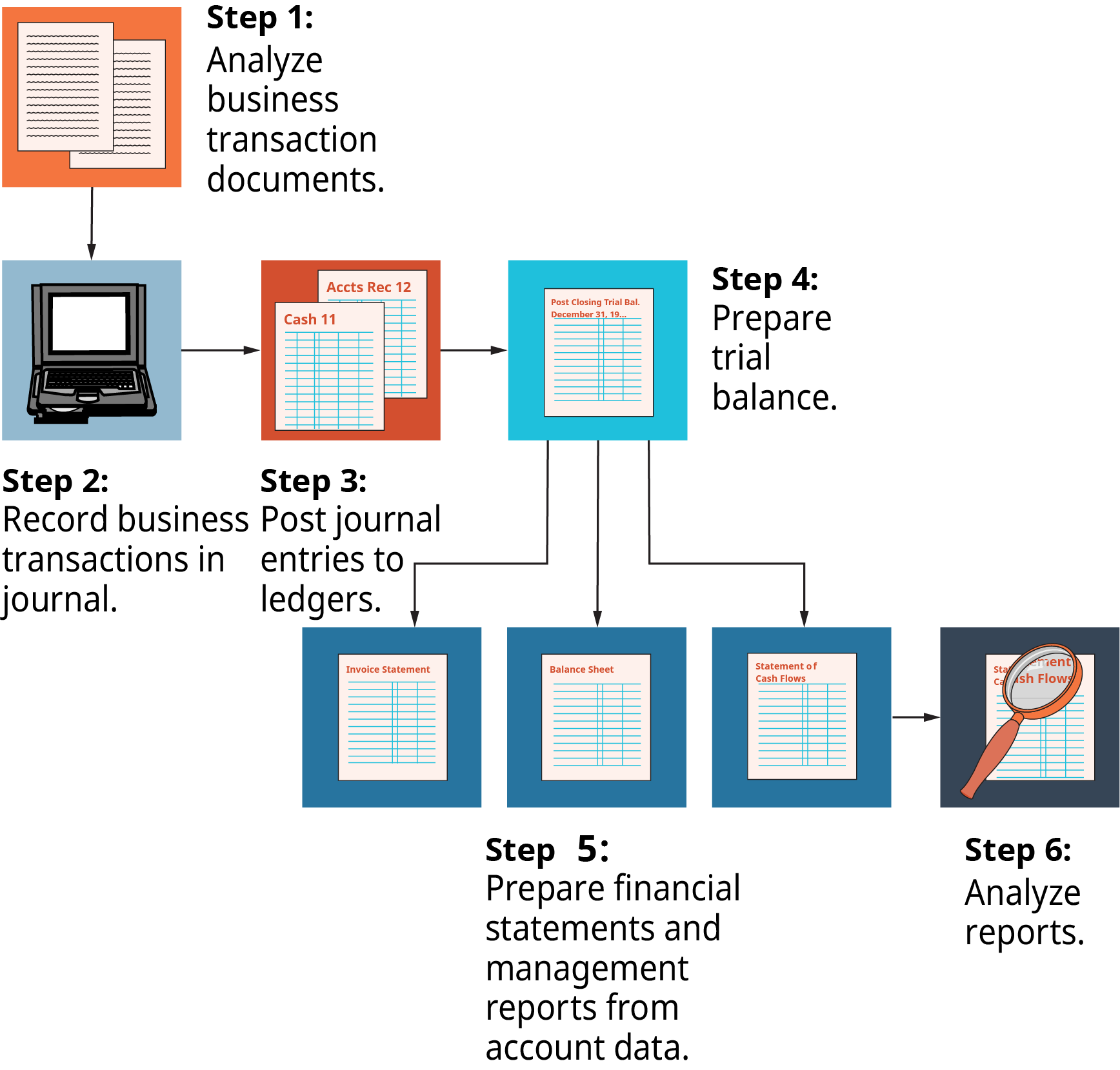

3. Implement a Consistent Transaction Recording System:

Maintaining accurate and consistent financial records is paramount. Develop a standardized system for recording all transactions, including:

- Timely Entry: Record transactions promptly to avoid errors and ensure data accuracy.

- Source Documentation: Retain supporting documents (invoices, receipts, bank statements) for each transaction.

- Double-Entry Bookkeeping: Utilize the double-entry system to ensure all transactions are recorded in at least two accounts, maintaining balance and accuracy.

4. Regularly Reconcile Bank Statements:

Bank reconciliation is a crucial step in ensuring the accuracy of your financial records. Compare your internal records with bank statements to identify discrepancies and rectify errors.

- Benefits:

- Error Detection: Identify and correct mistakes in recording transactions.

- Fraud Prevention: Detect unauthorized transactions or potential fraudulent activity.

- Improved Cash Flow Management: Gain a clearer understanding of your cash balances and identify any discrepancies.

5. Generate and Analyze Financial Statements:

Financial statements are the cornerstone of business decision-making. Regularly generate and analyze key reports, including:

- Income Statement: Reveals your business’s profitability over a specific period.

- Balance Sheet: Provides a snapshot of your assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement: Tracks the movement of cash in and out of your business.

6. Embrace Budgeting and Forecasting:

Budgets and forecasts are essential tools for financial planning and control.

- Benefits:

- Goal Setting: Establish clear financial targets and objectives.

- Resource Allocation: Optimize resource allocation based on projected needs.

- Performance Monitoring: Track progress against budget and make necessary adjustments.

- Risk Management: Identify potential financial risks and develop mitigation strategies.

7. Seek Professional Guidance:

While this guide provides a strong foundation, seeking professional guidance from a qualified accountant or financial advisor is highly recommended.

- Benefits:

- Expertise: Leverage specialized knowledge and experience in accounting and financial management.

- Compliance: Ensure adherence to tax regulations and other legal requirements.

- Strategic Insights: Gain valuable insights and recommendations for business growth and profitability.

Beyond the Basics: Unlocking the Power of Business Accounting

Mastering the fundamentals of business accounting is just the beginning. To truly unlock its transformative power, consider these advanced strategies:

- Cost Accounting: Analyze and control costs to optimize profitability and identify areas for improvement.

- Financial Modeling: Develop sophisticated financial models to simulate various scenarios and inform strategic decision-making.

- Performance Metrics: Establish key performance indicators (KPIs) to track progress and measure the effectiveness of business operations.

- Data Analytics: Leverage data analytics tools to extract insights from financial data and identify trends, patterns, and opportunities.

Conclusion:

Business accounting is not merely a compliance requirement; it is a powerful tool for driving growth, profitability, and strategic decision-making. By embracing the seven steps outlined in this guide, businesses can establish a robust financial foundation, unlock valuable insights, and navigate the complexities of the business world with confidence. Remember, the journey to transformative business accounting begins with a commitment to accuracy, analysis, and strategic thinking.

Closure

Thus, we hope this article has provided valuable insights into Essential 7-Step Guide to Transformative Business Accounting. We thank you for taking the time to read this article. See you in our next article!

google.com