The 5 Key Metrics That Can Transform Your Business Financial Analysis

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The 5 Key Metrics That Can Transform Your Business Financial Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

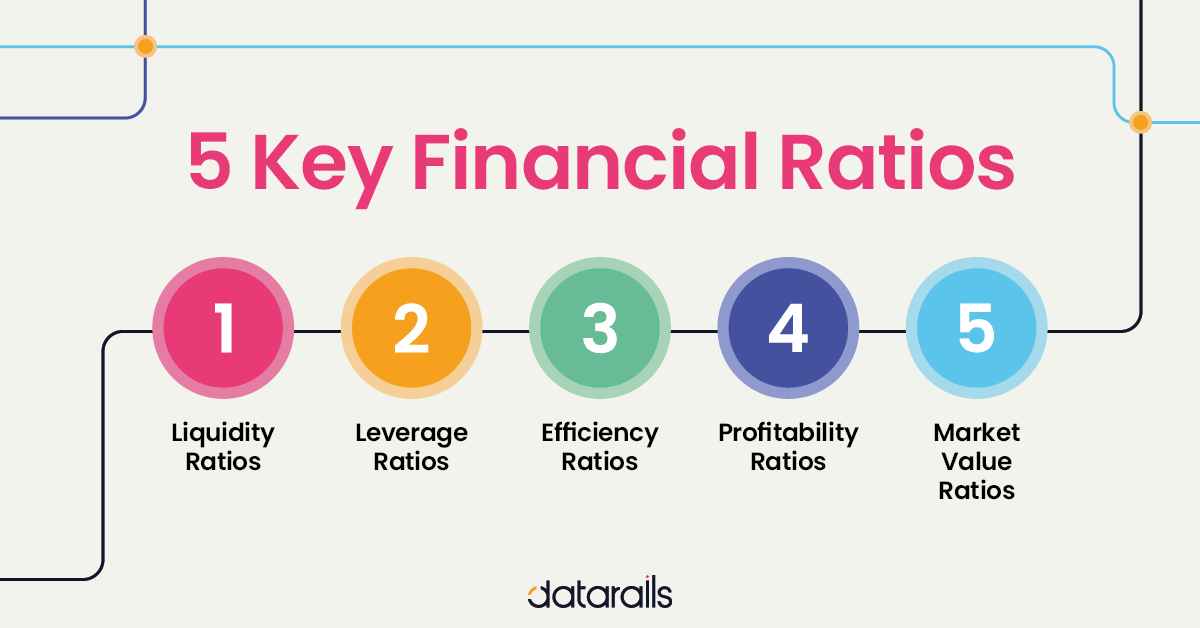

The 5 Key Metrics That Can Transform Your Business Financial Analysis

In the ever-evolving landscape of business, understanding your financial health is not just crucial, it’s essential. A solid grasp of your financial performance can be the difference between success and failure, growth and stagnation. While the world of financial analysis can seem complex and daunting, it doesn’t have to be. By focusing on the right metrics, you can gain valuable insights into your business’s strengths, weaknesses, and opportunities.

This article will delve into five key metrics that can transform your business financial analysis, providing you with a clear and actionable roadmap to understanding your financial performance.

1. Profitability: The Heartbeat of Your Business

Profitability is the lifeblood of any business. It represents the difference between your revenue and expenses, indicating whether your business is generating a profit or incurring a loss. Understanding your profitability is fundamental to determining your overall financial health.

Key Profitability Metrics:

- Gross Profit Margin: This metric measures the percentage of revenue remaining after deducting the cost of goods sold (COGS). A higher gross profit margin indicates greater efficiency in production and cost control.

- Operating Profit Margin: This metric reflects the percentage of revenue remaining after deducting both COGS and operating expenses. A higher operating profit margin signifies strong operational efficiency and cost management.

- Net Profit Margin: This metric represents the percentage of revenue remaining after deducting all expenses, including taxes and interest. A higher net profit margin indicates a more profitable business overall.

Analyzing Profitability:

- Benchmarking: Compare your profitability metrics against industry averages or competitors to gauge your performance relative to others.

- Trend Analysis: Track your profitability metrics over time to identify any trends, such as increasing or decreasing profitability.

- Cost Analysis: Break down your expenses to identify areas where you can reduce costs and improve profitability.

2. Liquidity: The Ability to Meet Short-Term Obligations

Liquidity refers to your business’s ability to meet its short-term financial obligations, such as paying suppliers, employees, and other creditors. A healthy level of liquidity is essential for ensuring the smooth operation of your business.

Key Liquidity Metrics:

- Current Ratio: This ratio measures your company’s ability to pay current liabilities with current assets. A current ratio of 2:1 or higher is generally considered healthy.

- Quick Ratio: This ratio is similar to the current ratio but excludes inventory from current assets, providing a more conservative measure of liquidity. A quick ratio of 1:1 or higher is generally considered healthy.

- Cash Flow from Operations: This metric reflects the cash generated from your business’s core operations. A positive cash flow from operations indicates that your business is generating enough cash to cover its operating expenses.

Analyzing Liquidity:

- Seasonal Fluctuations: Consider seasonal variations in your business’s cash flow and adjust your liquidity strategies accordingly.

- Inventory Management: Optimize your inventory levels to avoid tying up too much cash in unsold goods.

- Credit Management: Manage your receivables effectively to ensure timely payments from customers.

3. Solvency: The Ability to Meet Long-Term Obligations

Solvency refers to your business’s ability to meet its long-term financial obligations, such as debt payments and lease obligations. A strong solvency position is crucial for ensuring the long-term sustainability of your business.

Key Solvency Metrics:

- Debt-to-Equity Ratio: This ratio measures the proportion of debt financing to equity financing. A lower debt-to-equity ratio indicates a lower level of financial risk.

- Times Interest Earned (TIE) Ratio: This ratio measures your business’s ability to cover its interest expense with its earnings before interest and taxes (EBIT). A higher TIE ratio indicates a stronger ability to meet interest obligations.

- Debt-to-Asset Ratio: This ratio measures the proportion of debt financing to total assets. A lower debt-to-asset ratio indicates a lower level of financial risk.

Analyzing Solvency:

- Debt Structure: Analyze the maturity dates and interest rates of your debt to understand your future debt obligations.

- Cash Flow Projections: Project your future cash flows to ensure you have sufficient cash to meet your long-term debt obligations.

- Debt Management: Develop a strategy for managing your debt, including refinancing or restructuring options.

4. Efficiency: Maximizing Resource Utilization

Efficiency refers to how effectively your business uses its resources, such as assets, labor, and capital. Improving efficiency can lead to increased profitability and a stronger financial position.

Key Efficiency Metrics:

- Inventory Turnover Ratio: This ratio measures how quickly your business sells its inventory. A higher inventory turnover ratio indicates efficient inventory management.

- Days Sales Outstanding (DSO): This metric measures the average number of days it takes your business to collect payment from customers. A lower DSO indicates efficient receivables management.

- Asset Turnover Ratio: This ratio measures how efficiently your business uses its assets to generate revenue. A higher asset turnover ratio indicates efficient asset utilization.

Analyzing Efficiency:

- Process Optimization: Identify areas where you can streamline your operations and reduce waste.

- Technology Investment: Explore how technology can improve your efficiency, such as automating tasks or improving communication.

- Employee Training: Invest in training and development to enhance employee skills and productivity.

5. Growth: Expanding Your Business Horizons

Growth is essential for any business seeking to thrive in the long term. By tracking key growth metrics, you can assess your business’s progress and identify opportunities for future expansion.

Key Growth Metrics:

- Revenue Growth Rate: This metric measures the percentage increase in revenue over a specific period. A higher revenue growth rate indicates strong business growth.

- Customer Acquisition Cost (CAC): This metric measures the cost of acquiring a new customer. A lower CAC indicates efficient customer acquisition strategies.

- Customer Lifetime Value (CLTV): This metric measures the total revenue generated from a customer over their relationship with your business. A higher CLTV indicates strong customer loyalty and retention.

Analyzing Growth:

- Market Research: Stay informed about industry trends and potential growth opportunities.

- Product Development: Invest in research and development to create new products or services that meet evolving customer needs.

- Marketing Strategies: Develop effective marketing campaigns to reach new customers and expand your market reach.

The Power of Financial Analysis: A Catalyst for Success

By mastering these five key metrics, you can transform your business financial analysis, gaining valuable insights into your business’s performance and potential. These metrics provide a powerful tool for identifying areas for improvement, making informed decisions, and driving your business towards success.

Remember: Financial analysis is not a static process. It requires ongoing monitoring, analysis, and adaptation. By embracing a proactive approach to financial analysis, you can ensure that your business is on a path towards sustainable growth and profitability.

Closure

Thus, we hope this article has provided valuable insights into The 5 Key Metrics That Can Transform Your Business Financial Analysis. We thank you for taking the time to read this article. See you in our next article!

google.com