The 5 Unforgettable Forex Trading Software Tools That Will Transform Your Game

Related Articles: The 5 Unforgettable Forex Trading Software Tools That Will Transform Your Game

- FOREX : Make Money with Currency Trading

- 5 Unstoppable Forex Trading Tools To Dominate The Market

- Booming Bullish: 5 Key Factors Driving The Forex Market’s Explosive Growth

- 5 Revolutionary Forex Brokers You Must Consider In 2024

- The 5 Essential Steps To Master Forex Trading For Beginners

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The 5 Unforgettable Forex Trading Software Tools That Will Transform Your Game. Let’s weave interesting information and offer fresh perspectives to the readers.

The 5 Unforgettable Forex Trading Software Tools That Will Transform Your Game

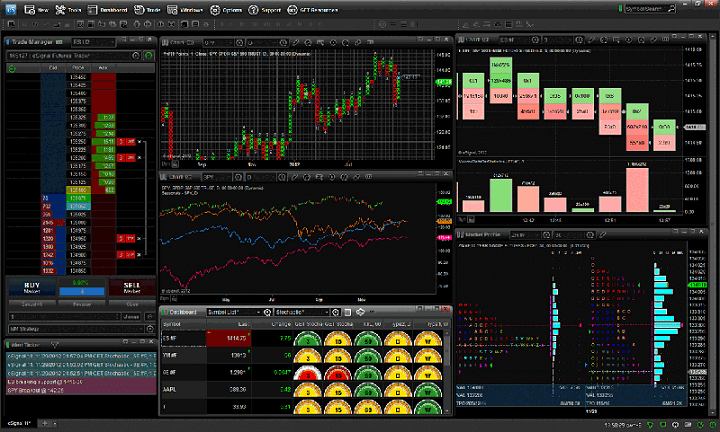

The world of forex trading is a dynamic and often overwhelming landscape. Navigating the intricacies of currency exchange rates, market trends, and technical analysis requires a sophisticated arsenal of tools. This is where forex trading software comes in, offering traders the power to gain an edge, streamline their workflows, and ultimately, achieve greater success.

However, the sheer volume of software options available can be daunting. How do you discern the truly transformative tools from the mediocre? This article delves into the world of forex trading software, showcasing five exceptional options that have the potential to revolutionize your trading journey.

Understanding the Landscape of Forex Trading Software

Before exploring specific software, let’s understand the diverse landscape of options available. Forex trading software falls into several broad categories:

- Trading Platforms: These are the core platforms where you execute trades, analyze charts, and manage your positions. Popular examples include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

- Technical Analysis Software: These tools help identify patterns and trends in price movements using indicators, oscillators, and other technical analysis techniques.

- Fundamental Analysis Software: These tools provide insights into economic indicators, news events, and other fundamental factors that influence currency values.

- Automated Trading Software (Expert Advisors): These programs allow traders to automate their trading strategies, based on predefined rules and parameters.

- Backtesting Software: This software allows traders to test their strategies on historical data, providing insights into their potential performance.

Choosing the Right Software: Considerations and Criteria

The best forex trading software for you will depend on your individual trading style, experience level, and specific needs. Here are some crucial factors to consider:

- User Interface and Usability: A user-friendly interface is paramount, especially for beginners. Look for software with intuitive navigation, clear visuals, and customizable layouts.

- Trading Features: Ensure the software offers the trading tools and features you need, including order types, charting capabilities, and real-time data feeds.

- Technical Analysis Tools: Assess the breadth and depth of technical analysis indicators, drawing tools, and other features that support your trading strategies.

- Fundamental Analysis Capabilities: If you rely heavily on fundamental analysis, consider software that provides access to economic data, news feeds, and sentiment indicators.

- Automated Trading Options: If you’re interested in automated trading, ensure the software supports Expert Advisors (EAs) and offers robust backtesting capabilities.

- Security and Reliability: Choose a reputable software provider with a strong track record of security and reliability. Look for features like two-factor authentication and encrypted data transmission.

- Customer Support: Reliable customer support is essential, especially when you encounter technical issues or have questions. Check for readily available support channels like live chat, email, and phone.

- Cost and Fees: Consider the software’s pricing structure, including subscription fees, transaction fees, and any additional costs associated with specific features.

5 Unforgettable Forex Trading Software Tools

Now, let’s explore five exceptional forex trading software tools that can elevate your trading experience:

1. MetaTrader 4 (MT4)

MetaTrader 4 (MT4) is a veteran in the forex trading world, widely considered the industry standard. Its popularity stems from its user-friendly interface, extensive charting capabilities, and vast library of technical indicators.

Key Features:

- Intuitive Interface: MT4 boasts a straightforward interface that is easy to navigate, even for novice traders.

- Comprehensive Charting: The platform offers a wide array of chart types, including candlestick, line, and bar charts, with customizable timeframes and drawing tools.

- Abundant Indicators: MT4 provides a rich library of technical indicators, including moving averages, MACD, RSI, and Bollinger Bands.

- Expert Advisors (EAs): MT4 supports automated trading through Expert Advisors, allowing traders to execute pre-programmed strategies.

- Backtesting Capabilities: MT4 allows you to backtest your strategies on historical data, providing valuable insights into their potential performance.

- Community Support: MT4 has a vibrant online community, offering a wealth of resources, tutorials, and support from fellow traders.

2. MetaTrader 5 (MT5)

MetaTrader 5 (MT5) is the successor to MT4, offering enhanced features and functionalities. It caters to both novice and advanced traders, providing a powerful platform for technical and fundamental analysis.

Key Features:

- Advanced Trading Features: MT5 expands upon MT4’s trading features, offering additional order types, including pending orders and market orders.

- Enhanced Charting Capabilities: MT5 offers improved charting capabilities, including advanced drawing tools and the ability to analyze multiple timeframes simultaneously.

- Economic Calendar: MT5 incorporates an integrated economic calendar, providing traders with real-time updates on important economic events.

- Multiple Market Access: MT5 allows traders to access various financial markets, including forex, stocks, and futures.

- Advanced Technical Analysis: MT5 includes a comprehensive suite of technical indicators and analysis tools, enabling traders to conduct in-depth market analysis.

3. TradingView

TradingView stands out as a popular online charting platform that has gained immense popularity among forex traders. Its strengths lie in its intuitive interface, real-time data, and extensive social features.

Key Features:

- User-Friendly Interface: TradingView’s interface is designed for ease of use, making it accessible to traders of all experience levels.

- Real-time Data: The platform provides real-time data feeds from various sources, ensuring accurate and up-to-date market information.

- Advanced Charting Tools: TradingView offers a wide range of charting tools, including candlestick, line, and bar charts, along with customizable indicators and drawing tools.

- Social Trading: TradingView fosters a vibrant community of traders, allowing users to share ideas, strategies, and chart analysis.

- Backtesting and Strategy Testing: TradingView allows you to backtest your trading strategies on historical data, helping you evaluate their effectiveness.

4. NinjaTrader

NinjaTrader is a versatile platform catering to both active traders and those seeking advanced features for automated trading. It offers a robust suite of technical analysis tools, backtesting capabilities, and customization options.

Key Features:

- Powerful Charting Engine: NinjaTrader’s charting engine provides a wide array of chart types, indicators, and drawing tools, empowering traders with in-depth market analysis.

- Advanced Order Types: The platform offers a variety of order types, including market orders, limit orders, stop orders, and trailing stops.

- Automated Trading (NinjaScript): NinjaTrader allows you to develop and implement automated trading strategies using its proprietary NinjaScript programming language.

- Backtesting and Strategy Optimization: NinjaTrader offers advanced backtesting and strategy optimization tools, enabling traders to fine-tune their trading strategies.

- Market Depth and Tick Charts: NinjaTrader provides access to market depth data and tick charts, offering a granular view of market activity.

5. cTrader

cTrader is a cutting-edge platform designed for professional traders, offering advanced features like order book depth, real-time market data, and a powerful trading engine.

Key Features:

- High-Performance Trading Engine: cTrader’s trading engine is renowned for its speed, efficiency, and reliability, enabling traders to execute orders quickly and seamlessly.

- Order Book Depth: The platform provides access to order book depth data, giving traders a deeper understanding of market liquidity and order flow.

- Real-time Market Data: cTrader offers real-time market data feeds from multiple sources, ensuring accurate and timely information.

- Advanced Charting Capabilities: The platform features advanced charting tools, including candlestick, line, and bar charts, with customizable indicators and drawing tools.

- Automated Trading (cAlgo): cTrader allows traders to develop and implement automated trading strategies using its cAlgo programming language.

Beyond the Software: Building Your Trading Arsenal

While these software tools provide a solid foundation for forex trading, they are just one part of the puzzle. To truly succeed in this challenging market, you need to develop a comprehensive trading strategy, manage risk effectively, and continuously educate yourself.

Developing a Trading Strategy:

- Define Your Trading Style: Identify your risk tolerance, time commitment, and trading goals to determine the best trading style for you, whether it’s scalping, day trading, or swing trading.

- Choose Your Market: Select the currency pairs you want to trade based on your understanding of their volatility, liquidity, and correlation with other markets.

- Identify Your Entry and Exit Points: Develop a clear set of rules for entering and exiting trades based on technical and fundamental analysis.

- Manage Your Risk: Establish stop-loss orders to limit your potential losses on each trade and determine your position size based on your risk tolerance.

Managing Risk Effectively:

- Use Stop-Loss Orders: Set stop-loss orders to automatically close your trades when the price reaches a predetermined level, limiting your potential losses.

- Diversify Your Portfolio: Spread your trading capital across multiple currency pairs to reduce the impact of losses on any single trade.

- Control Your Leverage: Leverage amplifies both profits and losses, so use it cautiously and only when necessary.

- Monitor Your Trades: Regularly review your trading performance, identify areas for improvement, and adjust your strategy as needed.

Continual Education and Learning:

- Stay Updated on Market Trends: Follow financial news, economic data releases, and market analysis to stay informed about current events and potential market movements.

- Learn from Experienced Traders: Seek guidance from experienced forex traders, attend webinars, and read books and articles on forex trading.

- Practice and Refine Your Skills: Regularly practice your trading strategies on demo accounts before risking real capital.

Conclusion:

The right forex trading software can empower you to achieve your trading goals, but it’s only one piece of the puzzle. By combining powerful software with a well-defined trading strategy, effective risk management, and a commitment to continuous learning, you can navigate the dynamic world of forex trading with confidence and success. Remember, the journey to becoming a successful forex trader is an ongoing process of learning, adaptation, and refinement.

Closure

Thus, we hope this article has provided valuable insights into The 5 Unforgettable Forex Trading Software Tools That Will Transform Your Game. We appreciate your attention to our article. See you in our next article!

google.com