The Ultimate Guide to 5 Powerful Forex Scalping Techniques

Related Articles: The Ultimate Guide to 5 Powerful Forex Scalping Techniques

- 5 Unforgettable Forex Trading Platforms: Unlock Your Trading Potential

- The 5 Brutal Truths About Currency Trading You Need To Know

- 5 Powerful Forex Trading Strategies To Dominate The Market

- Unleash The Power Of 5: Mastering Forex Risk Management For Explosive Growth

- 5 Unstoppable Forex Trading Tools To Dominate The Market

Introduction

With great pleasure, we will explore the intriguing topic related to The Ultimate Guide to 5 Powerful Forex Scalping Techniques. Let’s weave interesting information and offer fresh perspectives to the readers.

The Ultimate Guide to 5 Powerful Forex Scalping Techniques

Forex scalping, a high-frequency trading strategy, involves profiting from small price movements in currency pairs. While considered risky, it can be incredibly lucrative for traders who master the art of quick and precise entries and exits. This guide will delve into five powerful Forex scalping techniques, providing you with the knowledge and tools to navigate this dynamic market.

Understanding Forex Scalping

At its core, Forex scalping relies on exploiting minute price fluctuations that occur constantly within the market. Unlike long-term traders who hold positions for days or weeks, scalpers aim to enter and exit trades within seconds or minutes, seeking to capitalize on even the slightest price discrepancies.

The Appeal of Forex Scalping

- High Profit Potential: With numerous trades executed throughout the day, scalpers can accumulate significant profits even from small price movements.

- Flexibility: Scalping allows for a flexible trading schedule, as opportunities arise constantly throughout the trading day.

- Lower Risk (Theoretically): By holding positions for shorter durations, scalpers theoretically minimize their exposure to market volatility.

The Challenges of Forex Scalping

- High Stress and Concentration: The fast-paced nature of scalping requires immense focus and quick decision-making.

- Tight Stop Losses: Scalpers rely on tight stop losses to manage risk, which can lead to frequent exits and missed opportunities.

- Transaction Costs: Frequent trading can result in substantial transaction costs, which can eat into profits.

- Slippage and Gaps: Rapid market movements can lead to slippage, where the actual execution price deviates from the intended price, or gaps, which can result in significant losses.

5 Powerful Forex Scalping Techniques

1. News-Based Scalping:

This technique involves leveraging the volatility that often accompanies major economic news releases. By anticipating the market’s reaction to news events, scalpers can identify potential entry and exit points.

- How it works:

- Identify key economic releases: Analyze economic calendars to pinpoint significant releases, such as employment data, inflation figures, and interest rate decisions.

- Analyze historical data: Study how the market reacted to similar news events in the past to predict potential price movements.

- Set up your trade: Based on your analysis, enter the market with a clear entry and exit strategy, utilizing tight stop losses to manage risk.

2. Range-Bound Scalping:

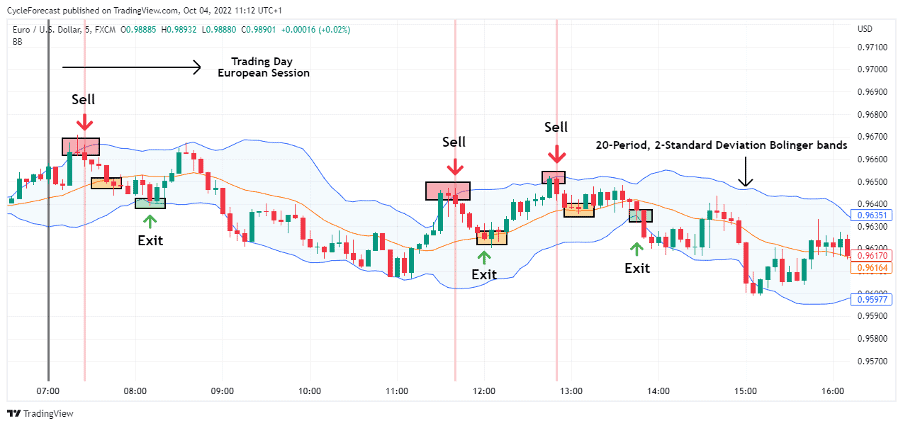

This technique focuses on identifying and exploiting price movements within a defined range. When a currency pair consolidates within a specific price band, scalpers can capitalize on its tendency to oscillate within that range.

- How it works:

- Identify consolidation patterns: Look for periods where the price fluctuates between defined support and resistance levels.

- Enter and exit within the range: Place buy orders near support levels and sell orders near resistance levels, aiming to capture the price swings within the range.

- Utilize technical indicators: Employ indicators like Bollinger Bands or moving averages to confirm range boundaries and identify potential entry points.

3. Trend Scalping:

This technique involves capitalizing on established price trends. Scalpers aim to identify and ride the momentum of a trending market, entering trades in the direction of the prevailing trend.

- How it works:

- Identify trending markets: Utilize technical analysis tools like moving averages, MACD, or ADX to confirm the presence of a strong trend.

- Enter with the trend: Place buy orders during uptrends and sell orders during downtrends, aiming to profit from the trend’s continuation.

- Use trailing stop losses: Implement trailing stop losses to manage risk and protect profits as the trend progresses.

4. Volatility Scalping:

This technique thrives on high market volatility, capitalizing on sharp price fluctuations that occur during periods of increased uncertainty.

- How it works:

- Identify volatile markets: Look for currency pairs known for their high volatility, often driven by geopolitical events, economic news releases, or major market shifts.

- Enter and exit quickly: Utilize tight stop losses and take profit targets to manage risk and capture quick gains during rapid price swings.

- Use momentum indicators: Employ indicators like RSI, Stochastic Oscillator, or MACD to identify overbought and oversold conditions and potential reversal points.

5. Breakout Scalping:

This technique aims to capitalize on price breakouts, where a currency pair breaks through a defined support or resistance level, signaling a potential continuation of the breakout move.

- How it works:

- Identify breakout points: Utilize technical analysis tools like Bollinger Bands or moving averages to identify potential breakout levels.

- Enter on confirmation: Confirm the breakout by waiting for a price candle to close above or below the breakout level, signifying a strong potential for continuation.

- Use stop losses: Place stop losses just below or above the breakout level to manage risk in case the breakout fails.

Key Considerations for Forex Scalping

- Trading Platform and Broker: Choose a reliable broker with low spreads and fast execution speeds.

- Leverage: Use leverage strategically, as it can amplify both profits and losses.

- Risk Management: Implement tight stop losses and manage your position size carefully.

- Emotional Control: Scalping requires discipline and emotional control. Avoid chasing losses and stick to your trading plan.

- Backtesting and Optimization: Thoroughly backtest your scalping strategies using historical data to assess their effectiveness and optimize parameters.

Conclusion

Forex scalping is a challenging but potentially rewarding trading strategy. By mastering the techniques outlined above and implementing sound risk management practices, traders can increase their chances of success in this fast-paced and dynamic market. Remember, scalping is not for the faint of heart. It requires a high level of skill, discipline, and risk tolerance. However, for those who possess the necessary traits and dedicate themselves to learning and refining their strategies, it can offer a path to consistent and profitable trading.

Closure

Thus, we hope this article has provided valuable insights into The Ultimate Guide to 5 Powerful Forex Scalping Techniques. We thank you for taking the time to read this article. See you in our next article!

google.com