The Ultimate Guide to 5 Powerful Ways Secured Credit Cards Can Transform Your Financial Future

Related Articles: The Ultimate Guide to 5 Powerful Ways Secured Credit Cards Can Transform Your Financial Future

- 5 Reasons Why Amazing Travel Credit Cards Can Be Dangerous

- Amazing! 5 Ways Low-Interest Credit Cards Can Transform Your Finances

- Unleash Your Financial Freedom: 5 Crucial Tips For Smart Credit Card Comparison

- Unlocking 5 Powerful Perks: The Ultimate Guide To Business Credit Cards

- Unleashing 5 Powerful Ways Credit Cards Can Transform Your Finances

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Ultimate Guide to 5 Powerful Ways Secured Credit Cards Can Transform Your Financial Future. Let’s weave interesting information and offer fresh perspectives to the readers.

The Ultimate Guide to 5 Powerful Ways Secured Credit Cards Can Transform Your Financial Future

For many individuals, building a strong credit history can feel like an insurmountable hurdle. It’s a vicious cycle: you need good credit to get approved for loans, but you need a loan to build good credit. This is where secured credit cards step in as a game-changer, offering a pathway to financial freedom for those who are just starting their credit journey or looking to rebuild after a setback.

This comprehensive guide will delve into the intricacies of secured credit cards, highlighting their key benefits, exploring their potential drawbacks, and providing you with 5 powerful strategies to maximize their impact on your financial future.

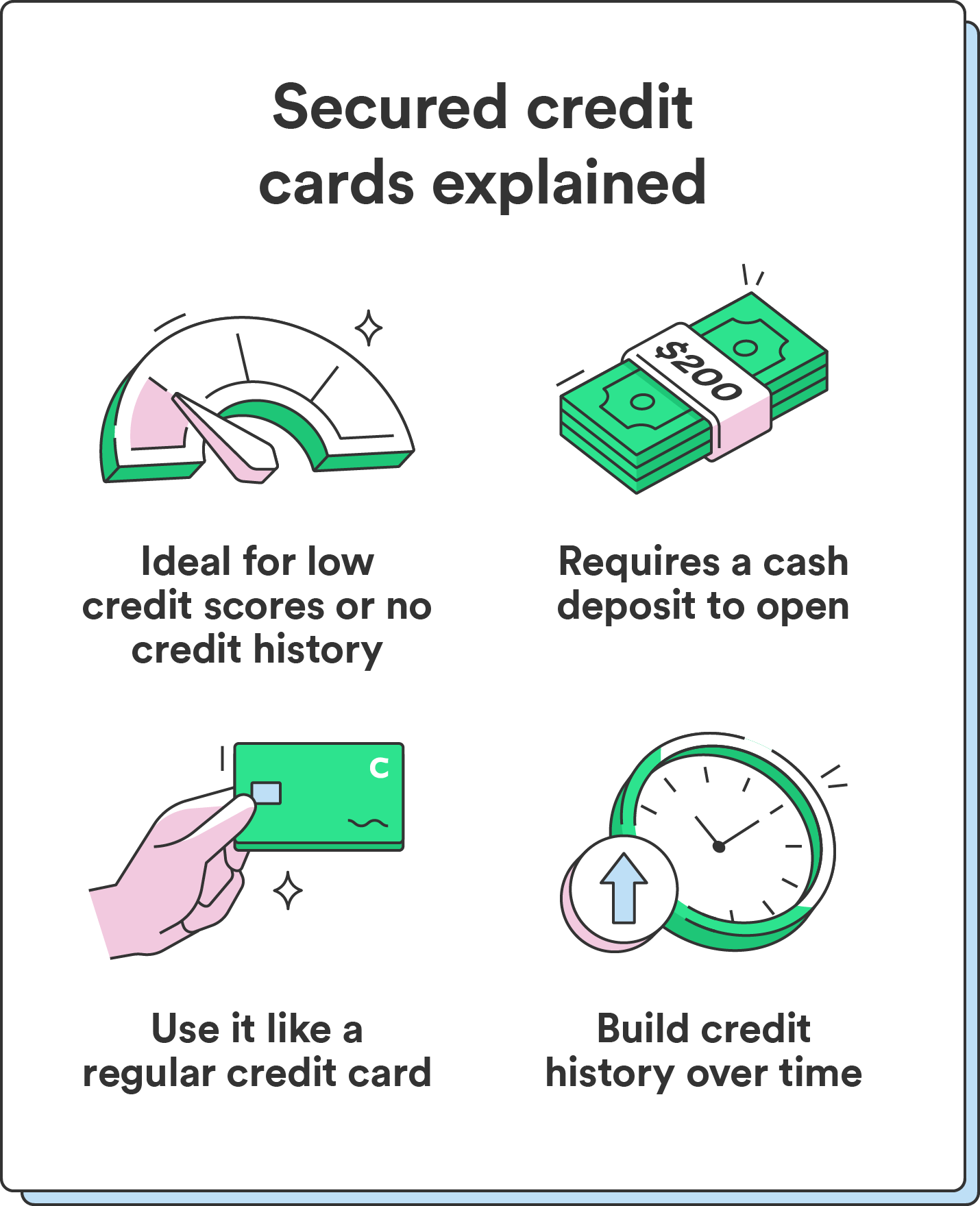

Understanding the Basics of Secured Credit Cards

A secured credit card operates differently from traditional unsecured credit cards. Instead of relying on your creditworthiness alone, a secured card requires you to deposit a sum of money as collateral, which serves as a safety net for the issuer. This deposit, often referred to as a security deposit, acts as a guarantee against potential losses in case you default on your payments.

The Advantages of Choosing a Secured Credit Card:

- Building Credit: The Foundation of Financial Success:

- Secured credit cards are the gateway to establishing a credit history. With responsible usage, your timely payments and responsible spending habits are reported to credit bureaus, helping you build a positive credit score.

- A good credit score unlocks a world of opportunities, from lower interest rates on loans and mortgages to easier access to rental properties and even better job prospects in certain industries.

- A Safe Haven for Those with Limited Credit:

- If you have a thin credit history, a poor credit score, or have been denied credit in the past, a secured credit card offers a chance to rebuild your financial standing.

- By demonstrating your ability to manage credit responsibly, you can gradually improve your creditworthiness and become eligible for unsecured credit cards in the future.

- Building Credit: The Foundation of Financial Success:

- Control Over Spending: A Financial Safety Net:

- The security deposit acts as a built-in spending limit, preventing you from overspending and accumulating debt.

- This feature offers a crucial layer of protection for those prone to impulsive spending or those who are just learning to manage their finances effectively.

- Access to Valuable Rewards and Perks:

- While some secured cards offer basic features, others come with attractive rewards programs, such as cashback, travel miles, or points that can be redeemed for merchandise or experiences.

- These perks can add value to your spending and help you maximize the benefits of using a secured credit card.

- A Stepping Stone to Unsecured Credit:

- With consistent responsible use, your secured credit card can serve as a stepping stone to obtaining unsecured credit cards.

- Once you have established a solid credit history, you can apply for unsecured cards with lower interest rates and higher credit limits.

Potential Drawbacks to Consider:

- Limited Credit Limits:

- Secured credit cards often have lower credit limits compared to unsecured cards. This is because the credit limit is tied to the amount of your security deposit.

- While this can limit your spending power, it also encourages responsible spending habits.

- Annual Fees and Interest Rates:

- Some secured credit cards may charge annual fees or higher interest rates compared to unsecured cards.

- Before choosing a card, compare fees and interest rates from different issuers to find the most favorable option.

- Security Deposit Loss:

- In the unfortunate event of defaulting on your payments, you could lose your security deposit.

- However, this scenario is unlikely if you manage your card responsibly and make timely payments.

5 Powerful Strategies to Maximize the Impact of Your Secured Credit Card:

- Choose the Right Card for Your Needs:

- Consider factors such as annual fees, interest rates, rewards programs, and credit limit options.

- Compare offers from different issuers to find the best fit for your financial goals and spending habits.

- Set a Budget and Track Your Spending:

- Create a realistic budget that outlines your income and expenses.

- Track your spending diligently to ensure you stay within your allocated limits and avoid unnecessary debt accumulation.

- Pay Your Bills on Time, Every Time:

- Punctual payments are crucial for building a positive credit history.

- Set reminders or automate payments to ensure you never miss a deadline.

- Keep Your Credit Utilization Low:

- Your credit utilization ratio is the percentage of your available credit that you are using.

- Aim to keep this ratio below 30% to demonstrate responsible credit management.

- Monitor Your Credit Score and Report Errors:

- Regularly check your credit score through credit bureaus or online services.

- Report any inaccuracies or errors to ensure your credit history is accurate and reflects your responsible financial behavior.

Navigating the Path to Financial Freedom:

Secured credit cards offer a valuable tool for individuals looking to build credit or rebuild their financial standing. By understanding their benefits, potential drawbacks, and implementing the strategies outlined above, you can leverage these cards to achieve your financial goals. Remember, responsible credit management is the key to unlocking a brighter financial future.

Beyond the Basics: Additional Considerations for Secured Credit Cards

- The Importance of Credit Reporting:

- It’s crucial to understand that not all secured credit cards report your activity to all three major credit bureaus (Equifax, Experian, and TransUnion).

- When choosing a card, look for one that reports to all three bureaus to maximize the impact on your credit score.

- Exploring Secured Credit Card Options:

- The market offers a diverse range of secured credit cards with varying features, benefits, and requirements.

- Research different options to find the card that best aligns with your individual needs and financial situation.

- Understanding the Security Deposit:

- While the security deposit is a safety net for the issuer, it also serves as a safeguard for you.

- Ensure you understand the terms and conditions surrounding the deposit, including its refund policy and any potential fees associated with it.

- Building a Strong Foundation for Future Financial Success:

- A secured credit card is not just a temporary solution; it’s an opportunity to build a strong foundation for your financial future.

- By using your secured card responsibly, you can gain access to unsecured credit options, lower interest rates, and ultimately achieve financial independence.

Conclusion: Embracing the Power of Secured Credit Cards

Secured credit cards are a powerful tool for individuals seeking to establish or rebuild their credit history. By understanding their benefits, potential drawbacks, and implementing the strategies discussed in this guide, you can effectively leverage these cards to transform your financial future. Remember, a strong credit score opens doors to numerous opportunities and empowers you to achieve your financial goals.

Closure

Thus, we hope this article has provided valuable insights into The Ultimate Guide to 5 Powerful Ways Secured Credit Cards Can Transform Your Financial Future. We hope you find this article informative and beneficial. See you in our next article!

google.com