The Unleashing Power of Forex Leverage: A Dangerous 10x Multiplier for Your Trading

Related Articles: The Unleashing Power of Forex Leverage: A Dangerous 10x Multiplier for Your Trading

- Unleash The Power Of 5: Mastering Forex Risk Management For Explosive Growth

- 5 Powerful Forex Trading Strategies To Dominate The Market

- The Ultimate Guide To 24/7 Forex Trading: Unveiling The Secrets Of Global Market Hours

- 5 Revolutionary Forex Brokers You Must Consider In 2024

- 5 Unforgettable Forex Trading Platforms: Unlock Your Trading Potential

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Unleashing Power of Forex Leverage: A Dangerous 10x Multiplier for Your Trading. Let’s weave interesting information and offer fresh perspectives to the readers.

The Unleashing Power of Forex Leverage: A Dangerous 10x Multiplier for Your Trading

The allure of Forex trading lies in its accessibility and potential for high returns. But hidden within this world of global currency exchange is a powerful tool – leverage. Leverage, often described as a “double-edged sword,” can amplify both profits and losses, making it a subject of intense debate among traders. This article delves into the intricacies of Forex leverage, exploring its potential benefits and risks, and equipping you with the knowledge to navigate this powerful financial tool responsibly.

Understanding Forex Leverage

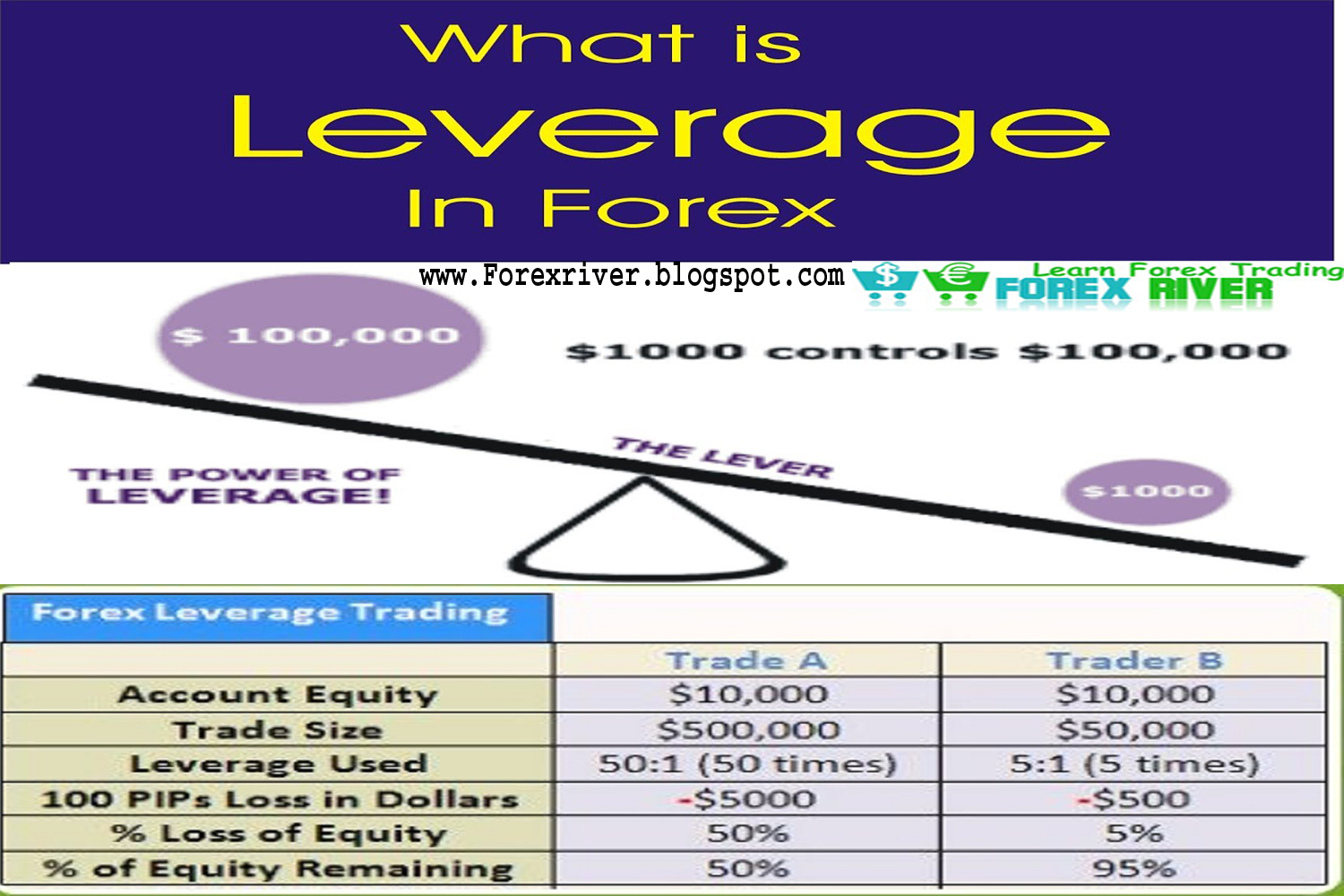

Imagine you have $1,000 to invest in the Forex market. Without leverage, your maximum potential profit or loss would be limited to that $1,000. However, with leverage, you can control a larger position in the market, effectively multiplying your potential gains (or losses).

For example, a 10x leverage allows you to control $10,000 worth of currency with your initial $1,000 investment. This means that a 1% move in the currency pair you’re trading will result in a 10% change in your account balance – both for profits and losses.

The Benefits of Forex Leverage

Leverage can be a powerful tool for Forex traders, offering several potential advantages:

- Increased Profit Potential: As mentioned above, leverage amplifies both profits and losses. This means that even small market movements can translate into significant gains, allowing traders to capitalize on short-term market fluctuations.

- Lower Entry Costs: Leverage allows traders to control larger positions with a smaller initial investment. This is particularly beneficial for new traders with limited capital, enabling them to participate in the Forex market without needing a large sum of money.

- Flexibility and Liquidity: The Forex market is highly liquid, meaning that traders can easily enter and exit positions with minimal impact on the market price. Leverage further enhances this liquidity, allowing traders to quickly capitalize on fleeting opportunities.

The Risks of Forex Leverage

While leverage can be a boon for traders, it also carries significant risks. Understanding these risks is crucial for responsible trading:

- Magnified Losses: The same leverage that amplifies profits also magnifies losses. A small market movement against your position can quickly erode your account balance, leading to substantial financial losses.

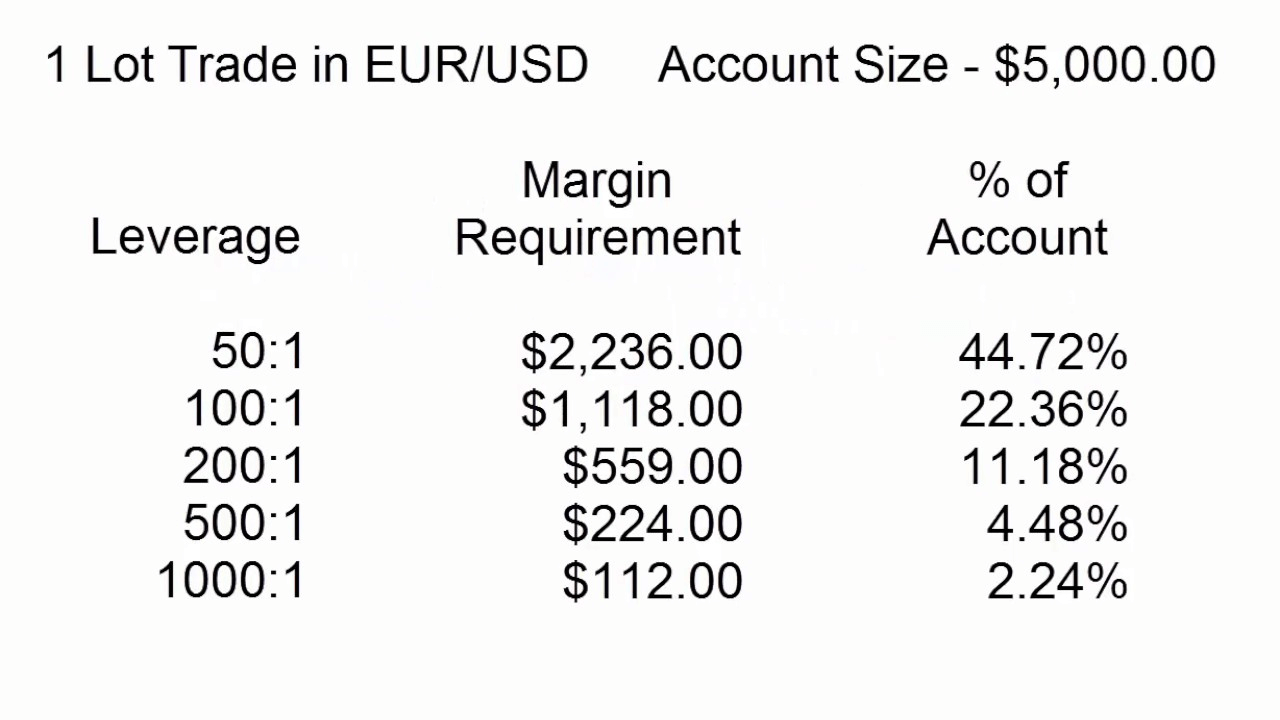

- Margin Calls: Leverage requires traders to maintain a certain level of funds in their account, known as margin. If your position moves against you and your account balance falls below the margin requirement, you’ll receive a margin call. This forces you to deposit additional funds to cover your losses, potentially leading to a cascade of further losses.

- Emotional Trading: The allure of high profits and the fear of significant losses can lead to emotional trading decisions. This often results in impulsive trades based on gut feelings rather than sound analysis, further increasing the risk of substantial losses.

- Overtrading: Leverage can encourage overtrading, where traders take on more positions than they can manage. This can lead to a lack of proper risk management and an inability to monitor and manage multiple positions effectively, increasing the probability of significant losses.

Choosing the Right Leverage Level

The key to utilizing leverage effectively lies in choosing the right level for your trading style and risk tolerance. Here are some key considerations:

- Trading Experience: New and inexperienced traders should start with lower leverage levels to minimize the risk of significant losses. As you gain experience and confidence, you can gradually increase your leverage levels.

- Risk Tolerance: Your personal risk tolerance determines how much risk you’re willing to take on. If you’re comfortable with a higher risk profile, you can consider higher leverage levels. However, it’s crucial to remember that higher leverage also increases the potential for substantial losses.

- Trading Strategy: Your trading strategy should dictate your leverage choice. Scalping strategies, which aim to profit from small market movements, often require higher leverage to generate meaningful gains. However, longer-term trading strategies may benefit from lower leverage levels.

Leverage Management Strategies

Effective leverage management is crucial for minimizing risk and maximizing your trading potential. Here are some strategies to consider:

- Start Small: Begin with a small leverage level and gradually increase it as you gain experience and confidence.

- Use Stop-Loss Orders: Stop-loss orders automatically close your position when the market price reaches a predefined level, limiting your potential losses.

- Set Profit Targets: Determine your desired profit level for each trade and close your position when you reach that target. This helps you secure your gains and avoid chasing further profits.

- Diversify Your Portfolio: Diversify your investments across different currency pairs and trading strategies to reduce the impact of any single position moving against you.

- Practice Risk Management: Implement strict risk management strategies, such as limiting your losses to a predetermined percentage of your account balance.

- Avoid Emotional Trading: Avoid impulsive trading decisions based on fear or greed. Stick to your trading plan and avoid chasing losses or getting carried away by market sentiment.

- Use a Demo Account: Practice trading with a demo account before using real money. This allows you to experiment with different leverage levels and trading strategies without risking your capital.

Leverage: A Tool for Growth, Not a Guarantee

Leverage can be a powerful tool for Forex traders, but it’s not a magic bullet for guaranteed success. It’s essential to understand the potential benefits and risks associated with leverage and to use it responsibly. Remember, leverage amplifies both profits and losses, so it’s crucial to manage your risk carefully and avoid overextending yourself.

By following these guidelines, you can harness the power of leverage to enhance your trading experience and potentially increase your profits. However, always remember that leverage is a double-edged sword – it can lead to significant gains, but it can also result in substantial losses if not managed properly.

Real-World Examples of Leverage in Action

- Example 1: The Leverage Advantage

Imagine you have $1,000 to invest in the EUR/USD currency pair. You believe the Euro will appreciate against the US Dollar.

Without leverage, you can only buy $1,000 worth of Euros. If the Euro rises by 1%, your profit would be $10.

However, with a 10x leverage, you can control $10,000 worth of Euros with your $1,000 investment. The same 1% rise in the Euro will now yield a $100 profit.

- Example 2: The Leverage Risk

Let’s say you use a 10x leverage to buy $10,000 worth of Euros. Unfortunately, the Euro depreciates by 1% against the US Dollar.

Without leverage, your loss would be $10. However, with a 10x leverage, your loss would be $100, significantly eroding your account balance.

Conclusion

Forex leverage can be a powerful tool for traders, offering the potential for amplified profits. However, it also carries significant risks, including magnified losses and margin calls. Responsible use of leverage requires a deep understanding of its benefits and drawbacks, coupled with a disciplined approach to risk management. By starting small, using stop-loss orders, diversifying your portfolio, and avoiding emotional trading, you can harness the power of leverage while minimizing its risks. Remember, leverage is a tool for growth, not a guarantee of success. It’s your responsibility to use it wisely and to protect your capital.

Closure

Thus, we hope this article has provided valuable insights into The Unleashing Power of Forex Leverage: A Dangerous 10x Multiplier for Your Trading. We thank you for taking the time to read this article. See you in our next article!

google.com