Unleash Your Business’s Potential: 5 Ways Overdrafts Can Be Your Secret Weapon

Introduction

With great pleasure, we will explore the intriguing topic related to Unleash Your Business’s Potential: 5 Ways Overdrafts Can Be Your Secret Weapon. Let’s weave interesting information and offer fresh perspectives to the readers.

Unleash Your Business’s Potential: 5 Ways Overdrafts Can Be Your Secret Weapon

In the fast-paced world of business, unexpected expenses can throw even the most meticulously planned budgets off track. Sudden surges in demand, unexpected repairs, or unforeseen delays in payments can leave you scrambling for cash. This is where business overdrafts can act as a powerful lifeline, offering a flexible and accessible solution to bridge temporary cash flow gaps. While often perceived as a risky financial maneuver, overdrafts, when strategically utilized, can actually become a valuable tool for business growth and stability.

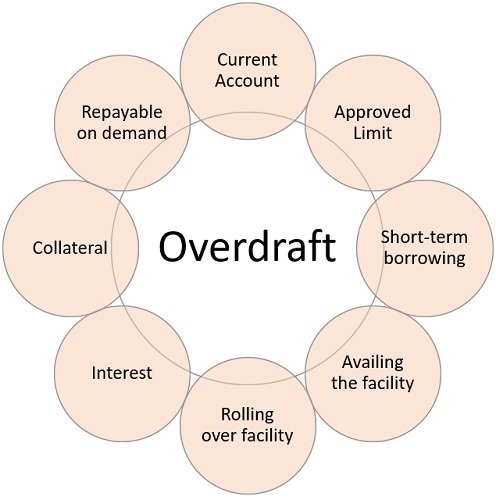

Understanding Business Overdrafts: A Safety Net for Your Finances

A business overdraft is a short-term loan provided by your bank that allows you to spend beyond your account balance. This facility acts as a safety net, ensuring that your business transactions are processed even if your account has insufficient funds. While overdrafts offer a crucial buffer against unexpected financial hurdles, it’s important to understand the associated costs and use them responsibly.

5 Ways Overdrafts Can Empower Your Business

1. Bridge Temporary Cash Flow Gaps: One of the most significant advantages of business overdrafts is their ability to bridge temporary cash flow gaps. Whether it’s a delay in payments from clients or a sudden surge in inventory costs, an overdraft facility can provide the necessary funds to keep your operations running smoothly.

2. Seize Opportunities: In the competitive business landscape, opportunities can arise unexpectedly. An overdraft facility allows you to seize these opportunities without waiting for funds to become available. This could mean purchasing a valuable piece of equipment, securing a lucrative contract, or taking advantage of a limited-time offer, ultimately driving your business forward.

3. Maintain a Positive Credit Score: Regularly utilizing an overdraft facility and paying it back promptly can actually contribute to a healthy credit score. This positive credit history can open doors to future financing options, such as loans or lines of credit, at more favorable terms.

4. Protect Your Business Reputation: Bounce checks can damage your business’s reputation and erode trust with suppliers and clients. Overdrafts prevent bounced checks, ensuring smooth and reliable transactions, thus preserving your professional image and fostering positive relationships.

5. Boost Efficiency and Productivity: By eliminating the stress of potential cash flow shortages, business overdrafts allow you to focus on core business activities, increasing productivity and efficiency. This translates to better decision-making, improved customer service, and ultimately, greater business success.

Navigating the Overdraft Landscape: Key Considerations

While overdrafts offer a valuable financial tool, it’s crucial to approach them with a clear understanding of their associated costs and limitations:

1. Interest Rates and Fees: Overdraft facilities come with interest charges and potential fees. It’s essential to compare different overdraft options from various banks and understand the associated costs to make an informed decision.

2. Overdraft Limits: Banks set specific overdraft limits based on your business’s financial history and creditworthiness. It’s crucial to operate within these limits to avoid exceeding your borrowing capacity and incurring additional fees.

3. Repayment Terms: Overdrafts are typically short-term loans with specific repayment terms. It’s vital to develop a repayment plan and stick to it to avoid accumulating debt and incurring further interest charges.

4. Credit Impact: While responsible use of overdrafts can enhance your credit score, excessive or prolonged reliance on them can negatively impact your creditworthiness. It’s crucial to use overdrafts strategically and maintain a healthy financial balance.

5. Alternative Funding Options: Overdrafts are not the only solution for bridging cash flow gaps. Explore other financing options, such as short-term loans, invoice financing, or lines of credit, to find the most suitable solution for your business needs.

Conclusion: Overdrafts – A Powerful Tool When Used Strategically

Business overdrafts can be a powerful tool for navigating unexpected financial challenges and seizing opportunities. When utilized responsibly and strategically, they can act as a safety net, allowing you to maintain business continuity, seize growth opportunities, and ultimately, drive your business forward. By understanding the associated costs and limitations and comparing different options, you can leverage overdrafts to empower your business and unlock its full potential.

Closure

Thus, we hope this article has provided valuable insights into Unleash Your Business’s Potential: 5 Ways Overdrafts Can Be Your Secret Weapon. We hope you find this article informative and beneficial. See you in our next article!

google.com