Unleash Your Financial Freedom: 5 Crucial Tips for Smart Credit Card Comparison

Related Articles: Unleash Your Financial Freedom: 5 Crucial Tips for Smart Credit Card Comparison

- 5 Amazing Credit Cards To Transform Your Finances In 2024

- 5 Powerful Strategies To Unlock A Stellar Credit Score

- Unleashing The Power Of 5: A Comprehensive Guide To Credit Card Rewards Programs

- “Bad Credit” Credit Cards: How You Can Avoid High Fees

- Credit card Examinations – Picking The Best Arrangement

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unleash Your Financial Freedom: 5 Crucial Tips for Smart Credit Card Comparison. Let’s weave interesting information and offer fresh perspectives to the readers.

Unleash Your Financial Freedom: 5 Crucial Tips for Smart Credit Card Comparison

Navigating the complex world of credit cards can be daunting, especially for those new to the financial game. With a dizzying array of offers, benefits, and fees, choosing the right card can feel like a gamble. But fear not! This comprehensive guide will equip you with the knowledge and tools to make informed decisions and unlock the potential of credit cards to enhance your financial well-being.

Understanding the Basics: Credit Cards and Their Purpose

Credit cards are a powerful financial tool, but like any tool, they can be misused. It’s crucial to understand their purpose and how to utilize them responsibly.

- Access to Credit: Credit cards allow you to make purchases without paying upfront, providing a short-term loan that you repay over time.

- Building Credit History: Responsible credit card use helps establish a positive credit history, which is essential for obtaining loans, mortgages, and other financial products in the future.

- Rewards and Benefits: Many credit cards offer rewards programs, such as cash back, travel points, or discounts, which can provide value for your spending.

- Convenience and Security: Credit cards offer convenience for online and in-store purchases, and they often come with fraud protection and other security features.

The Key to Smart Comparison: 5 Crucial Factors

Choosing the right credit card is a strategic decision that requires careful consideration. The following five factors are essential for making a wise choice:

1. Interest Rates: This is arguably the most critical factor. The interest rate is the cost of borrowing money from the credit card issuer. A lower interest rate means you’ll pay less in interest charges over time.

- APR (Annual Percentage Rate): This is the annual interest rate charged on your outstanding balance.

- Variable vs. Fixed APR: Variable APRs fluctuate with market interest rates, while fixed APRs remain constant for a specified period.

- Introductory APRs: Some cards offer lower introductory APRs for a limited time, which can be beneficial for balance transfers or large purchases.

2. Fees: Credit cards can come with various fees, which can significantly impact your overall cost.

- Annual Fee: This is a yearly charge for having the card.

- Balance Transfer Fee: Charged when transferring a balance from another card.

- Cash Advance Fee: Charged for withdrawing cash using your card.

- Late Payment Fee: Charged for missed payments.

- Foreign Transaction Fee: Charged for purchases made outside your home country.

3. Rewards Program: Credit card rewards can be a valuable perk, but it’s crucial to choose a program that aligns with your spending habits.

- Cash Back: Offers a percentage of your spending back in cash.

- Travel Points: Allows you to accumulate points that can be redeemed for flights, hotels, or other travel expenses.

- Other Rewards: Some cards offer rewards like gift cards, merchandise, or discounts on specific products or services.

4. Credit Limit: This is the maximum amount you can charge on your card. A higher credit limit provides more flexibility, but it’s important to use it responsibly and avoid overspending.

5. Customer Service and Other Features: Customer service quality, fraud protection, and additional benefits like travel insurance or extended warranties can influence your overall experience with a credit card.

Tools and Resources for Comparison

Several resources can help you compare credit cards effectively:

- Credit Card Comparison Websites: Websites like Credit Karma, NerdWallet, and Bankrate allow you to compare cards based on your criteria and preferences.

- Credit Card Issuer Websites: Check the websites of major credit card issuers like Visa, Mastercard, American Express, and Discover for their offerings.

- Financial Advisors: Consult with a financial advisor to get personalized recommendations based on your financial goals and risk tolerance.

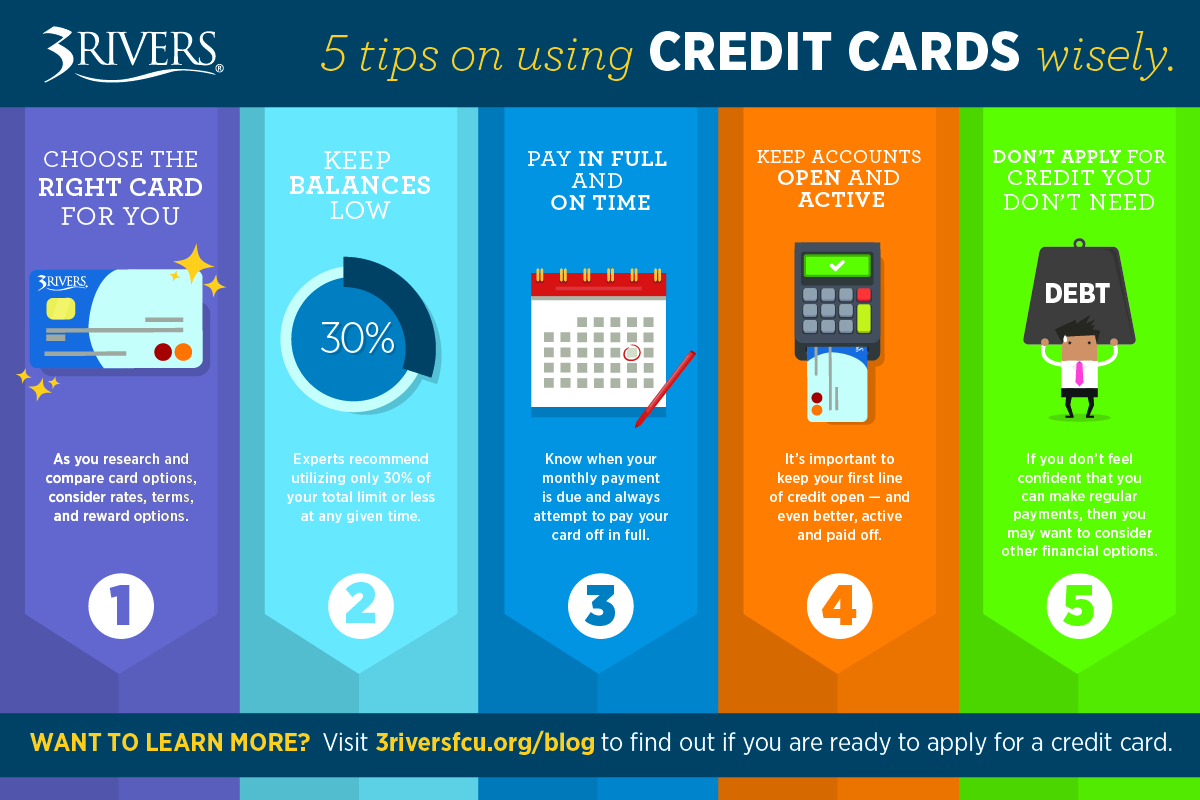

Tips for Responsible Credit Card Use

Once you’ve chosen the right credit card, it’s essential to use it responsibly to maximize its benefits and avoid financial pitfalls:

- Pay Your Bill on Time: Late payments can damage your credit score and incur penalties.

- Keep Your Balance Low: Aim to pay off your balance in full each month to avoid accruing interest charges.

- Monitor Your Spending: Track your spending regularly to stay within your budget and avoid overspending.

- Use Credit Cards for Purchases You Can Afford: Don’t use credit cards to finance purchases you can’t afford to pay back immediately.

- Don’t Overextend Yourself: Don’t apply for multiple credit cards simultaneously, as this can negatively impact your credit score.

The Bottom Line: Making Credit Cards Work for You

Credit cards can be a powerful tool for building credit, earning rewards, and enjoying financial convenience. By understanding the basics, comparing options carefully, and using them responsibly, you can unlock their potential and make them work for you. Remember, credit cards are not a free ride; they come with responsibilities that you must manage wisely. By approaching credit cards with a strategic mindset, you can harness their power to achieve your financial goals and secure a brighter future.

Closure

Thus, we hope this article has provided valuable insights into Unleash Your Financial Freedom: 5 Crucial Tips for Smart Credit Card Comparison. We thank you for taking the time to read this article. See you in our next article!

google.com