Unleash Your Financial Freedom: 5 Strategies to Master Credit Card Balance Transfers

Related Articles: Unleash Your Financial Freedom: 5 Strategies to Master Credit Card Balance Transfers

- The Ultimate Guide To 5 Powerful Ways Secured Credit Cards Can Transform Your Financial Future

- 5 Amazing Credit Cards To Transform Your Finances In 2024

- 5 Crucial Steps To Unleash Your Credit Card Fraud Protection

- 5 Crucial Tips To Maximize Your Credit Card Application Success

- Conquer Credit Card Debt: A 5-Step Strategy For Financial Freedom

Introduction

With great pleasure, we will explore the intriguing topic related to Unleash Your Financial Freedom: 5 Strategies to Master Credit Card Balance Transfers. Let’s weave interesting information and offer fresh perspectives to the readers.

Unleash Your Financial Freedom: 5 Strategies to Master Credit Card Balance Transfers

Navigating the world of credit card debt can feel like a daunting task. High interest rates and mounting balances can create a sense of overwhelm, leaving you feeling trapped in a cycle of debt. But there is hope! One powerful tool at your disposal is the credit card balance transfer. This strategy, when implemented strategically, can offer a lifeline to financial freedom, allowing you to pay off debt faster and reclaim control of your finances.

This article will delve into the intricacies of credit card balance transfers, providing a comprehensive guide to understanding their benefits, potential pitfalls, and how to use them effectively. We’ll explore five key strategies to help you master the art of balance transfers, ultimately empowering you to break free from the shackles of debt and achieve financial peace of mind.

Understanding the Basics: What is a Credit Card Balance Transfer?

A credit card balance transfer is a process where you move the outstanding balance from one credit card to another, typically one with a lower interest rate. This can be a game-changer if you’re struggling with high-interest debt, as it allows you to save money on interest charges and accelerate your repayment journey.

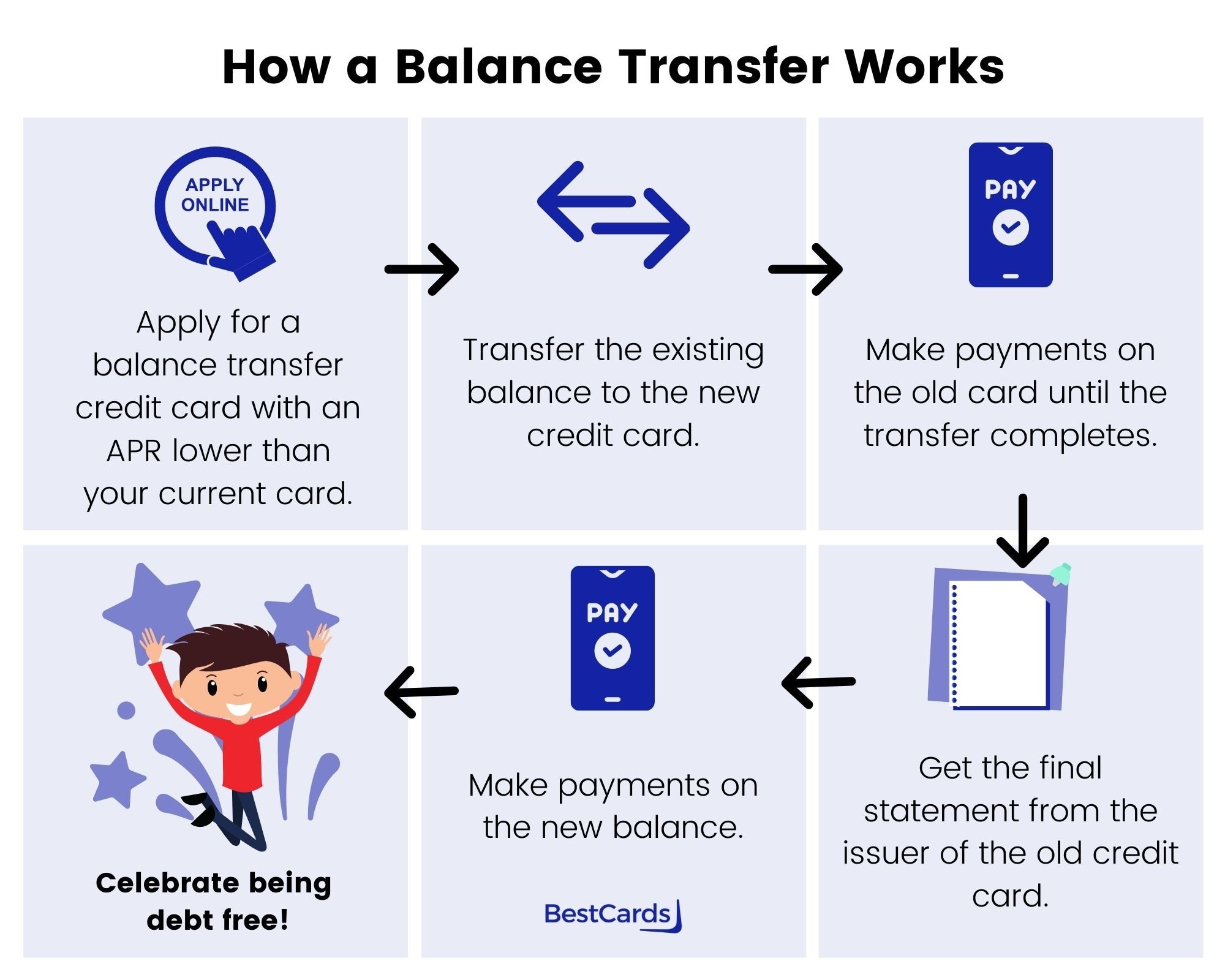

The Mechanics of Balance Transfers:

- Find a Transfer Offer: Many credit card issuers offer balance transfer promotions, often with introductory 0% APR periods. These offers can range from 6 to 18 months, allowing you to pay down your debt without accruing interest during that time.

Apply and Get Approved: You’ll need to apply for a new credit card with a balance transfer offer. The approval process will involve a credit check, and your credit score will play a significant role in determining your eligibility.

Apply and Get Approved: You’ll need to apply for a new credit card with a balance transfer offer. The approval process will involve a credit check, and your credit score will play a significant role in determining your eligibility.- Transfer Your Balance: Once approved, you’ll need to transfer the balance from your old credit card to the new one. This typically involves providing the new credit card issuer with your old card details and the amount you wish to transfer.

- Start Paying Down the Balance: The new credit card issuer will usually require a minimum monthly payment, and you’ll need to make consistent payments to avoid accumulating interest once the introductory period ends.

The Potential Advantages of Credit Card Balance Transfers:

- Lower Interest Rates: The primary benefit of balance transfers is the potential to save money on interest charges. By transferring your balance to a card with a lower APR, you can significantly reduce the amount of interest you pay over time.

- Debt Consolidation: Balance transfers can simplify your debt management by consolidating multiple high-interest debts into a single account. This can make it easier to track your payments and stay organized.

- 0% APR Periods: Many balance transfer offers include introductory 0% APR periods, allowing you to pay down your debt without accruing interest for a set period. This can provide a valuable opportunity to make significant progress towards becoming debt-free.

- Flexibility and Convenience: Balance transfers can offer greater flexibility in repayment, as you may have a longer grace period and more payment options compared to other forms of debt.

Potential Drawbacks and Considerations:

While balance transfers can be a powerful tool, it’s crucial to be aware of the potential drawbacks:

- Transfer Fees: Many credit card issuers charge a fee for balance transfers, usually a percentage of the amount transferred. These fees can eat into your savings, so it’s essential to factor them into your calculations.

- Credit Score Impact: Applying for a new credit card can temporarily lower your credit score, especially if you have multiple recent applications. This is because inquiries from credit card applications can be reflected on your credit report.

- Limited Time Offers: Introductory 0% APR periods are often time-bound, and once they expire, the standard APR will apply. This can result in a significant increase in interest charges if you haven’t paid down your balance by then.

- Minimum Payment Traps: Make sure you understand the minimum payment requirements for your new credit card. If you only make minimum payments, it could take you longer to pay off your debt, and you could end up paying more in interest in the long run.

5 Strategies to Master Credit Card Balance Transfers:

Now that you understand the basics and potential advantages and disadvantages of balance transfers, let’s explore five key strategies to help you maximize their effectiveness:

- Shop Around for the Best Offers: Don’t settle for the first balance transfer offer you find. Compare offers from different credit card issuers to find the best rates, fees, and introductory periods. Consider factors such as the APR, transfer fee, and the length of the 0% APR period. Online comparison tools can make this process easier and more efficient.

- Check Your Credit Score: Before applying for a balance transfer, it’s wise to check your credit score. A higher credit score will generally improve your chances of approval and give you access to better offers. You can obtain your credit score for free from various sources, including credit reporting agencies and credit monitoring services.

- Plan Your Repayment Strategy: Once you have secured a balance transfer, develop a detailed repayment plan. Determine how much you can afford to pay each month, and factor in the transfer fee and the standard APR that will apply after the introductory period ends. A budget spreadsheet or financial planning app can be helpful in tracking your progress and staying on track.

- Avoid Making New Purchases: It’s essential to resist the temptation to make new purchases on your new credit card while you’re paying down your balance. This will help you avoid accumulating new debt and ensure that you’re making progress towards becoming debt-free.

- Don’t Forget the Expiration Date: Keep track of the expiration date for your introductory 0% APR period. Make sure you have a plan to pay off your balance before that date, or you could end up paying significantly more in interest. Consider setting reminders or using a calendar app to keep track of important dates.

The Power of Discipline and Planning:

Ultimately, the success of a credit card balance transfer depends on your commitment to paying down your debt. By following the strategies outlined above and exercising discipline in your spending habits, you can leverage the power of balance transfers to break free from the cycle of debt and achieve financial freedom.

Beyond Balance Transfers: Other Strategies for Debt Reduction:

While balance transfers can be a valuable tool, they are not a magic bullet. Here are some additional strategies to consider as part of a comprehensive debt reduction plan:

- Debt Consolidation Loans: A debt consolidation loan can help you consolidate multiple debts into a single loan with a lower interest rate. This can simplify your payments and make it easier to track your progress.

- Debt Management Plans: Debt management plans, offered by non-profit credit counseling agencies, can help you negotiate lower interest rates with your creditors and create a structured repayment plan.

- Negotiating with Creditors: You can try to negotiate with your creditors directly to lower your interest rates or reduce your monthly payments. Be prepared to explain your financial situation and demonstrate your willingness to make payments.

- Building a Budget: Creating a realistic budget can help you identify areas where you can cut spending and free up more money to pay down your debt. Consider using a budgeting app or spreadsheet to track your income and expenses.

The Path to Financial Freedom:

The journey to financial freedom is often challenging, but it’s a journey worth taking. By understanding the nuances of credit card balance transfers and employing effective strategies, you can reclaim control of your finances, reduce your debt burden, and build a more secure financial future. Remember, every step you take towards debt reduction is a step closer to a brighter financial tomorrow.

Closure

Thus, we hope this article has provided valuable insights into Unleash Your Financial Freedom: 5 Strategies to Master Credit Card Balance Transfers. We hope you find this article informative and beneficial. See you in our next article!

google.com