Unleashing Profitable Forex Strategies: 5 Essential Market Analysis Techniques

Related Articles: Unleashing Profitable Forex Strategies: 5 Essential Market Analysis Techniques

- 5 Powerful Forex Trading Strategies To Dominate The Market

- Benefit With Forex

- FOREX : Make Money with Currency Trading

- 5 Revolutionary Forex Brokers You Must Consider In 2024

Introduction

With great pleasure, we will explore the intriguing topic related to Unleashing Profitable Forex Strategies: 5 Essential Market Analysis Techniques. Let’s weave interesting information and offer fresh perspectives to the readers.

Unleashing Profitable Forex Strategies: 5 Essential Market Analysis Techniques

The foreign exchange market, or Forex, is the largest and most liquid financial market globally, with trillions of dollars changing hands every day. This vast liquidity and 24/5 trading hours attract a wide range of participants, from individual traders to large institutional investors. However, navigating the complexities of this market requires a comprehensive understanding of its dynamics and the ability to analyze market trends effectively. This article delves into five essential Forex market analysis techniques that can empower traders to make informed decisions and potentially maximize their profits.

1. Fundamental Analysis: Understanding the Big Picture

Fundamental analysis focuses on macroeconomic factors that influence currency values. These factors include:

- Economic Growth: Strong economic growth in a country typically leads to a stronger currency. Indicators like GDP growth, employment rates, and inflation provide insights into the overall health of the economy.

- Interest Rates: Higher interest rates attract foreign investment, leading to increased demand for the currency and appreciation. Central bank policies and interest rate announcements are closely monitored by traders.

- Government Policies: Fiscal and monetary policies can impact currency values. Government spending, tax policies, and trade agreements can influence investor confidence and currency demand.

- Political Stability: Political instability, conflicts, or uncertainty can negatively impact a currency. Stable political environments are generally associated with stronger currencies.

- Geopolitical Events: Global events like wars, natural disasters, or trade disputes can have significant short-term and long-term effects on currency values.

Example: If the US Federal Reserve announces an interest rate hike, it could strengthen the US dollar against other currencies. Investors might be drawn to higher returns in the US, leading to increased demand for the dollar.

Tools for Fundamental Analysis:

- Economic Calendars: These calendars provide a schedule of upcoming economic releases, allowing traders to anticipate potential market movements.

- News Sources: Staying updated on global news events, economic reports, and political developments is crucial for fundamental analysis.

- Economic Indicators: Analyzing economic indicators like inflation, unemployment, and GDP growth provides insights into the overall health of an economy.

2. Technical Analysis: Charting the Path to Profit

Technical analysis focuses on historical price data and trading patterns to identify trends and predict future price movements. This method assumes that market psychology and past price behavior can provide valuable insights into future price action.

Key Concepts in Technical Analysis:

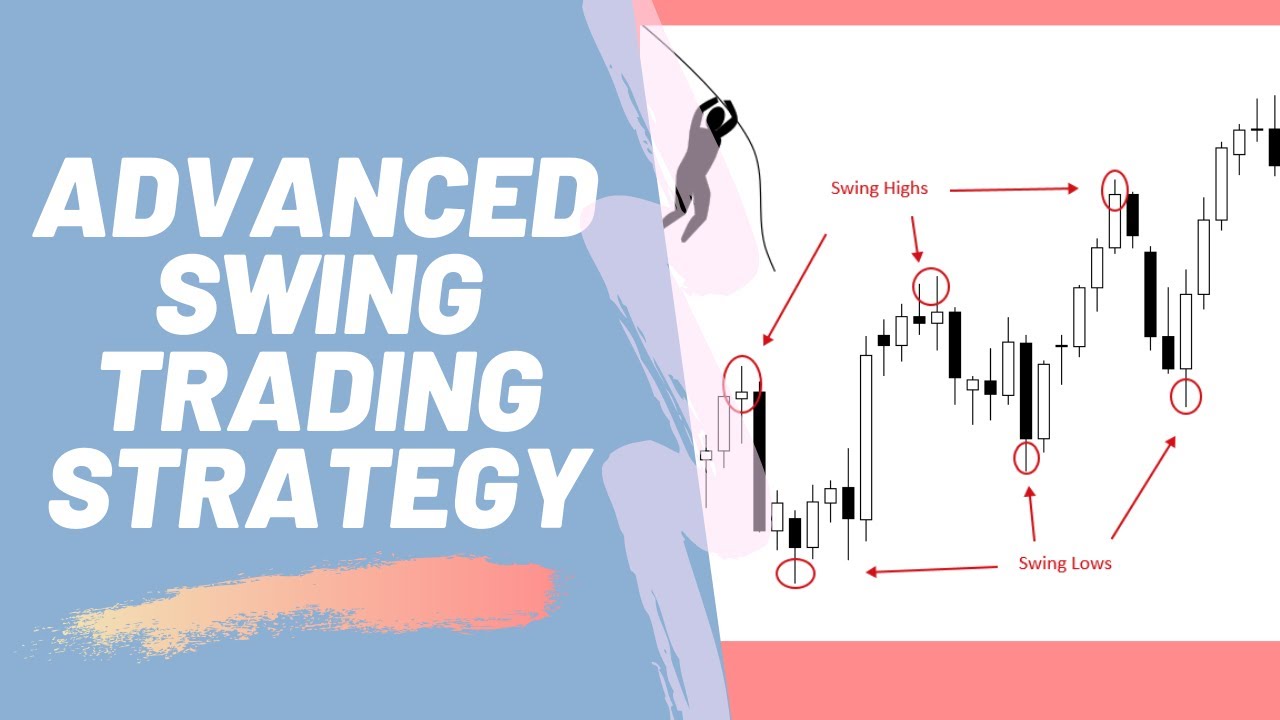

- Trendlines: Connecting price highs or lows to identify the direction of the market. Uptrends indicate rising prices, while downtrends suggest falling prices.

- Support and Resistance Levels: Price levels where buying or selling pressure is expected to be strong. Support levels act as a floor, while resistance levels act as a ceiling.

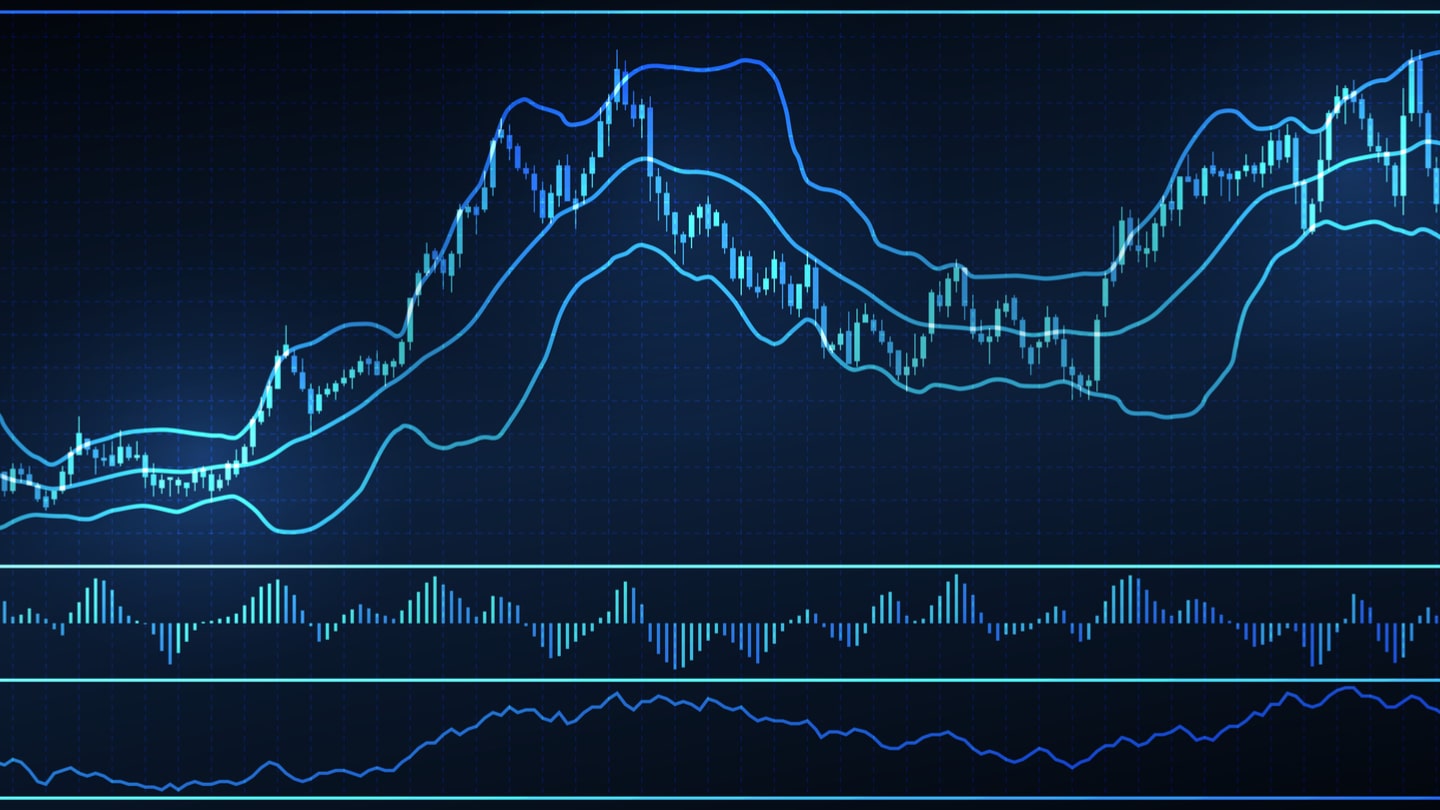

- Indicators: Mathematical calculations based on price data, such as moving averages, MACD, and RSI, to identify trends, momentum, and overbought/oversold conditions.

- Candlestick Patterns: Visual representations of price movements that reveal buying and selling pressure. Specific candlestick patterns can indicate potential reversals or continuations of trends.

Example: A trader might identify a bullish trendline on a chart and use it as a signal to buy when the price breaks above the trendline.

Tools for Technical Analysis:

- Trading Platforms: Platforms like MetaTrader 4 (MT4) and TradingView provide charting tools, indicators, and real-time market data.

- Chart Patterns: Recognizing and understanding common chart patterns like head and shoulders, double tops/bottoms, and triangles can help predict price movements.

3. Sentiment Analysis: Gauging Market Mood

Sentiment analysis attempts to gauge the overall market mood towards a particular currency pair. This involves analyzing news articles, social media posts, and trader surveys to understand prevailing sentiment.

Factors Influencing Market Sentiment:

- News Headlines: Positive news stories can boost sentiment, leading to increased demand for the currency. Conversely, negative news can dampen sentiment and weaken the currency.

- Social Media Sentiment: Analyzing social media discussions, tweets, and forums can provide insights into public opinion and sentiment towards a particular currency.

- Trader Surveys: Surveys of traders and analysts can reveal their expectations and sentiment towards specific currency pairs.

Example: If there is a surge of positive sentiment about the Euro, traders might expect the Euro to strengthen against other currencies.

Tools for Sentiment Analysis:

- News Aggregators: Websites and apps that aggregate news from multiple sources can provide a comprehensive overview of market sentiment.

- Social Media Monitoring Tools: Tools that track social media discussions and sentiment can be used to identify emerging trends and market sentiment.

4. Volatility Analysis: Riding the Waves of Change

Volatility refers to the rate at which prices fluctuate. High volatility implies rapid and significant price swings, while low volatility suggests relatively stable prices. Understanding volatility is crucial for traders to manage risk and adjust their trading strategies.

Factors Affecting Volatility:

- Economic Releases: Major economic data releases can trigger significant price movements, increasing volatility.

- Geopolitical Events: Unexpected events like wars, political crises, or natural disasters can cause dramatic shifts in currency values.

- Market Sentiment: Changes in market sentiment can also lead to increased volatility, as traders react to news and events.

Example: During periods of high volatility, traders might choose to use smaller position sizes and tighter stop-loss orders to manage risk.

Tools for Volatility Analysis:

- Volatility Indicators: Technical indicators like the Average True Range (ATR) and Bollinger Bands can help identify periods of high or low volatility.

- News Calendars: Monitoring economic data releases and geopolitical events can help anticipate potential periods of increased volatility.

5. Risk Management: Safeguarding Your Profits

Risk management is an essential aspect of trading Forex. It involves identifying and mitigating potential losses while maximizing profit opportunities.

Key Risk Management Techniques:

- Stop-Loss Orders: Pre-set orders to automatically exit a trade when the price reaches a predetermined level, limiting potential losses.

- Position Sizing: Determining the appropriate size of a trade based on risk tolerance and account balance.

- Diversification: Spreading investments across different currency pairs to reduce exposure to individual risks.

- Trading Plan: Establishing a clear trading plan that outlines entry and exit points, risk management strategies, and trading goals.

Example: A trader might set a stop-loss order at a specific price level to limit potential losses if the market moves against their position.

Tools for Risk Management:

- Trading Platforms: Most trading platforms offer stop-loss orders, position sizing tools, and other risk management features.

- Risk Management Calculators: Online calculators can help traders determine appropriate position sizes and stop-loss levels based on their risk tolerance.

Conclusion: Mastering Forex Market Analysis for Success

Successful Forex trading relies on a combination of fundamental, technical, and sentiment analysis. By understanding the factors that drive currency values and using the right tools and strategies, traders can increase their chances of making informed decisions and potentially maximizing their profits. Remember, Forex trading involves inherent risks, and it’s crucial to manage risk effectively to protect your capital.

Key Takeaways:

- Fundamental analysis focuses on macroeconomic factors that influence currency values.

- Technical analysis uses historical price data and patterns to predict future price movements.

- Sentiment analysis gauges market mood towards a particular currency pair.

- Volatility analysis helps traders understand and manage the risk associated with price fluctuations.

- Risk management techniques are crucial for protecting capital and limiting potential losses.

By mastering these essential Forex market analysis techniques, traders can equip themselves with the knowledge and skills necessary to navigate the complexities of this dynamic market and potentially unlock profitable trading opportunities.

Closure

Thus, we hope this article has provided valuable insights into Unleashing Profitable Forex Strategies: 5 Essential Market Analysis Techniques. We hope you find this article informative and beneficial. See you in our next article!

google.com