Unlocking 10X Growth: The Essential Guide to Business Cash Flow Statements

Introduction

With great pleasure, we will explore the intriguing topic related to Unlocking 10X Growth: The Essential Guide to Business Cash Flow Statements. Let’s weave interesting information and offer fresh perspectives to the readers.

Unlocking 10X Growth: The Essential Guide to Business Cash Flow Statements

In the fast-paced world of business, it’s easy to get caught up in the thrill of sales and revenue growth. However, the true measure of a company’s health lies not just in its top line, but in its cash flow. A robust cash flow statement is the lifeblood of any business, providing a clear picture of its financial health and its ability to meet short-term and long-term obligations.

This article delves deep into the world of cash flow statements, providing a comprehensive guide for business owners, entrepreneurs, and anyone seeking to understand this crucial financial document. We’ll explore the different components of a cash flow statement, its importance in financial planning and decision-making, and how to analyze it effectively to unlock significant growth potential.

Understanding the Basics: What is a Cash Flow Statement?

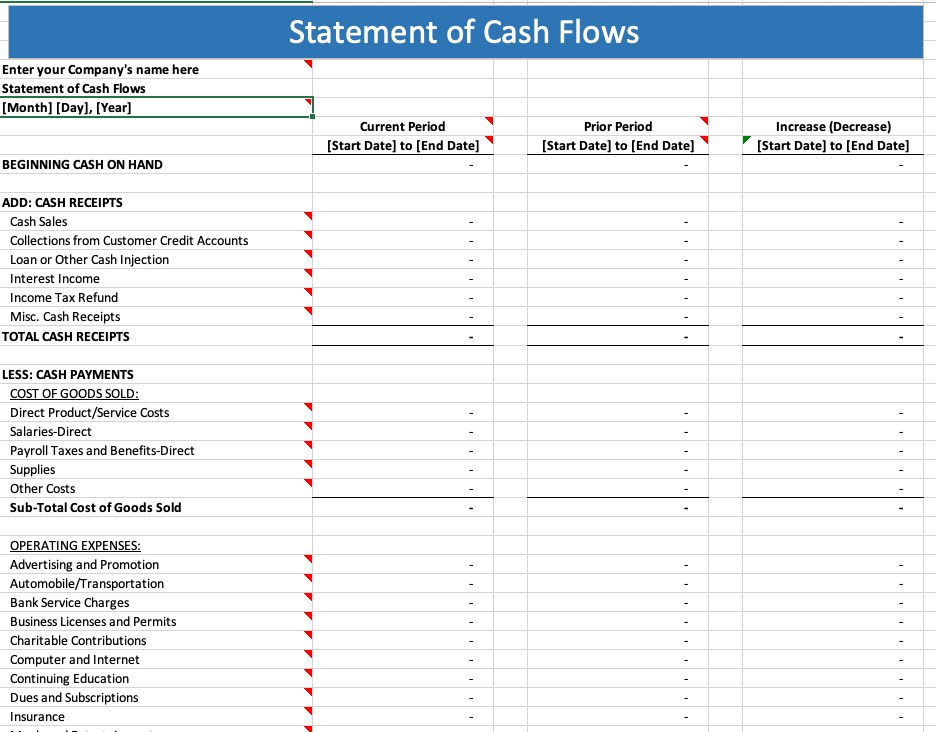

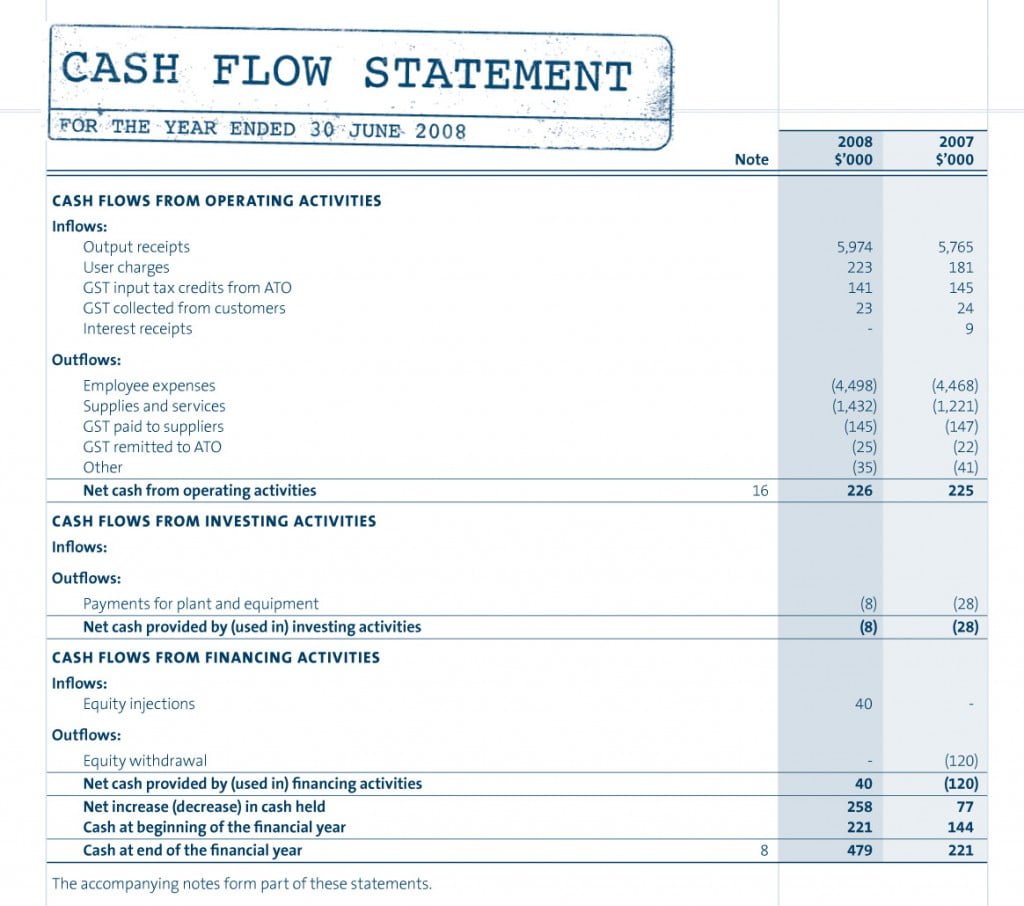

A cash flow statement is a financial report that tracks the movement of cash both into and out of a business over a specific period, typically a month, quarter, or year. It essentially provides a snapshot of the company’s cash inflows (money coming in) and cash outflows (money going out) during that period. Unlike the income statement, which focuses on revenue and expenses, the cash flow statement provides a more realistic picture of the company’s financial position by focusing on actual cash transactions.

The Three Key Sections of a Cash Flow Statement:

A standard cash flow statement is divided into three main sections:

- Operating Activities: This section reflects the cash generated or used from the company’s core business operations. It includes cash inflows from sales of goods or services, payments to suppliers, salaries, taxes, and other operating expenses.

- Investing Activities: This section tracks the cash used for investments in long-term assets, such as property, plant, and equipment (PP&E), as well as the cash generated from the sale of these assets.

- Financing Activities: This section focuses on cash flows related to the company’s financing activities, including debt financing, equity financing, and the repayment of debt. It also includes dividends paid to shareholders.

The Importance of Cash Flow Statements: A Beacon for Business Success

Cash flow statements are critical for various reasons, making them an indispensable tool for business owners and investors alike:

- Financial Health Assessment: By analyzing cash inflows and outflows, businesses can gain a clear understanding of their current financial health and identify potential areas of concern.

- Short-Term Liquidity Management: Cash flow statements help businesses manage their short-term liquidity, ensuring they have enough cash on hand to meet their immediate obligations, such as payroll, rent, and supplier payments.

- Long-Term Planning: Cash flow statements are essential for long-term financial planning, allowing businesses to project future cash flows and make informed decisions about investments, expansions, and acquisitions.

- Investor Confidence: Investors rely heavily on cash flow statements to assess a company’s financial strength and its ability to generate profits. A healthy cash flow statement can boost investor confidence and attract capital.

- Debt Management: Cash flow statements provide valuable insights into a company’s ability to service its debt obligations.

Analyzing Cash Flow Statements: Unlocking Growth Potential

Analyzing cash flow statements is crucial for understanding the financial health of a business and identifying areas for improvement. Here’s a breakdown of key metrics and strategies:

- Net Cash Flow: This is the difference between total cash inflows and total cash outflows. A positive net cash flow indicates a healthy financial position, while a negative net cash flow might signal potential financial distress.

- Cash Flow from Operations: This metric reveals the company’s ability to generate cash from its core business operations. A strong cash flow from operations indicates a sustainable business model and a healthy financial foundation.

- Cash Flow from Investing Activities: This metric provides insights into the company’s investment strategy and its ability to generate returns on its investments.

- Cash Flow from Financing Activities: This metric helps understand how the company is financing its operations and its ability to manage debt.

- Free Cash Flow: This metric represents the cash flow available to the company after accounting for operating expenses and capital expenditures. It is a key indicator of a company’s ability to pay dividends, invest in growth, and repay debt.

Key Strategies for Improving Cash Flow:

- Optimize Accounts Receivable: Implement strategies to reduce the time it takes to collect payments from customers, such as offering discounts for early payments or utilizing online payment platforms.

- Manage Accounts Payable: Negotiate favorable payment terms with suppliers to extend payment deadlines and improve cash flow.

- Control Inventory Levels: Optimize inventory management to reduce storage costs and minimize the risk of obsolescence.

- Reduce Operating Expenses: Identify areas where costs can be cut without compromising quality or customer satisfaction.

- Explore Alternative Financing Options: Explore alternative financing options, such as factoring or asset-based lending, to secure short-term financing needs.

- Invest in Growth: Allocate cash flow wisely to invest in strategic initiatives that drive growth and enhance profitability.

Case Study: The Power of Cash Flow Management

Imagine a small startup that’s experiencing rapid growth but is struggling to manage its cash flow. Despite strong sales, the company faces challenges with slow-paying customers, high inventory levels, and a lack of financial planning. This situation could lead to cash shortages, missed payments, and ultimately, a threat to the company’s survival.

By implementing effective cash flow management strategies, the startup can turn the tide. They can streamline their billing processes, negotiate better payment terms with suppliers, optimize their inventory levels, and develop a comprehensive financial plan. These actions will improve their cash flow, enhance their financial health, and pave the way for sustainable growth.

Conclusion: The Key to Sustainable Growth

Cash flow statements are not just financial reports; they are powerful tools that can unlock significant growth potential for any business. By understanding the intricacies of cash flow, businesses can proactively manage their financial health, make informed decisions, and drive sustainable growth.

Investing in a robust cash flow management system is an investment in the future of your business. By focusing on cash flow, you can navigate challenges, capitalize on opportunities, and achieve your business goals with confidence.

Closure

Thus, we hope this article has provided valuable insights into Unlocking 10X Growth: The Essential Guide to Business Cash Flow Statements. We hope you find this article informative and beneficial. See you in our next article!

google.com