Unlocking the 5 Secrets to Explosive Cash Flow Growth for Your Business

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unlocking the 5 Secrets to Explosive Cash Flow Growth for Your Business. Let’s weave interesting information and offer fresh perspectives to the readers.

Unlocking the 5 Secrets to Explosive Cash Flow Growth for Your Business

Cash flow. The lifeblood of any business. It’s the oxygen that keeps your operations running smoothly, your employees paid, and your dreams alive. But for many entrepreneurs, cash flow can feel like a constant uphill battle, a nagging worry that threatens to derail their ambitions.

This article will delve into the 5 critical secrets to unlocking explosive cash flow growth for your business. These aren’t just theoretical concepts, but proven strategies that have helped countless companies navigate the turbulent waters of financial uncertainty and emerge stronger than ever.

1. Master the Art of Forecasting: Predicting the Future, One Number at a Time

Accurate forecasting is the cornerstone of effective cash flow management. It’s about looking ahead, anticipating potential challenges and opportunities, and making informed decisions that safeguard your financial well-being.

Here’s how to elevate your forecasting game:

- Embrace the Power of Data: Leverage historical data to identify patterns and trends. Analyze past sales figures, expenses, and cash flow statements to gain valuable insights into your business’s financial rhythm.

- Don’t Shy Away from Projections: Don’t let the fear of uncertainty paralyze you. Create realistic projections based on market research, industry trends, and your own strategic plans.

- Develop a Comprehensive Cash Flow Statement: This document acts as a roadmap, outlining your anticipated cash inflows and outflows over a specific period.

- Regularly Review and Adjust: The business landscape is constantly evolving. Regularly revisit your forecasts, factoring in new developments and market fluctuations.

2. Streamline Your Operations: Eliminate Leaks and Maximize Efficiency

Cash flow leaks are like slow, silent drains on your business’s financial health. They may seem insignificant at first, but over time, they can accumulate and significantly impact your bottom line.

Here’s how to plug those leaks and maximize efficiency:

- Identify and Eliminate Redundancies: Conduct a thorough audit of your processes, identifying any redundant tasks or overlapping responsibilities. Streamlining operations can free up valuable resources and reduce unnecessary costs.

- Automate Where Possible: Leverage technology to automate repetitive tasks, freeing up your team’s time and energy for more strategic initiatives.

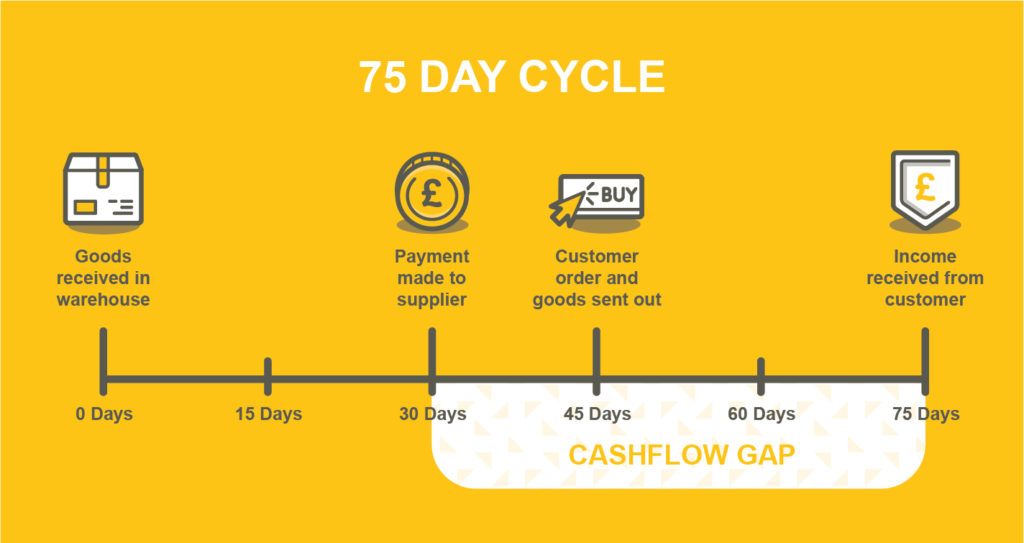

- Negotiate Better Payment Terms: Extend payment terms for your customers while simultaneously negotiating shorter payment terms with your suppliers. This can create a positive cash flow cycle.

- Optimize Inventory Management: Avoid overstocking, which ties up valuable capital. Implement an inventory management system that ensures just-in-time delivery, minimizing storage costs and maximizing efficiency.

3. Embrace the Power of Strategic Pricing: Finding the Sweet Spot Between Value and Profitability

Pricing is a delicate dance, a balancing act between attracting customers and maximizing profits. Get it wrong, and your cash flow can suffer. Get it right, and you’ll be on the path to explosive growth.

Here’s how to find the sweet spot:

- Value-Based Pricing: Don’t just focus on costs; understand the value you deliver to your customers. Price your products and services accordingly, reflecting the unique benefits you offer.

- Consider Bundling and Packages: Offer tiered pricing options or bundle related products and services to attract a wider range of customers and increase your average transaction value.

- Implement Dynamic Pricing Strategies: Adjust prices based on demand, seasonality, and competitor activity. This can help you optimize revenue and maximize cash flow.

- Monitor and Analyze Pricing Performance: Track your sales, profit margins, and customer feedback to identify areas for improvement. Continuously refine your pricing strategies based on real-world data.

4. Unlock the Potential of Customer Relationships: Building Loyalty for Long-Term Growth

Loyal customers are the lifeblood of sustainable cash flow. They’re more likely to repeat purchases, recommend your business to others, and remain committed even during challenging times.

Here’s how to cultivate loyal customer relationships:

- Deliver Exceptional Customer Service: Go above and beyond to exceed expectations. Respond promptly to inquiries, resolve issues efficiently, and create a positive and memorable experience for your customers.

- Foster a Sense of Community: Engage with your customers on social media, host events, and create opportunities for them to connect with each other. Building a strong community around your brand can lead to increased loyalty and advocacy.

- Implement Customer Loyalty Programs: Reward repeat customers with discounts, exclusive offers, and personalized experiences. These programs can incentivize continued engagement and boost your cash flow.

- Seek Feedback and Act on It: Actively solicit customer feedback through surveys, reviews, and social media interactions. Use this feedback to improve your products, services, and customer experience.

5. Embrace the Power of Technology: Automating, Optimizing, and Empowering

Technology is a powerful tool for unlocking explosive cash flow growth. From automating processes to streamlining operations and enhancing customer experiences, the right technology can transform your business’s financial landscape.

Here’s how to leverage technology for cash flow success:

- Invest in Accounting Software: Automated accounting software can streamline your financial processes, improve accuracy, and provide real-time insights into your cash flow.

- Utilize Customer Relationship Management (CRM) Systems: CRMs help you manage customer interactions, track sales opportunities, and personalize communication, ultimately leading to increased customer loyalty and repeat business.

- Embrace E-commerce Platforms: Expand your reach and generate new revenue streams by establishing an online presence. E-commerce platforms can simplify online sales, manage inventory, and process payments efficiently.

- Explore Payment Processing Solutions: Offer a variety of secure and convenient payment options to your customers, including online payments, mobile wallets, and contactless payment methods.

Conclusion: Unlocking Explosive Cash Flow Growth: A Journey of Continuous Improvement

Cash flow management isn’t a one-time event, but an ongoing journey of continuous improvement. By embracing the 5 secrets outlined above, you can transform your business’s financial performance, unlocking explosive cash flow growth and achieving your entrepreneurial dreams.

Remember, success is not a destination, but a journey. Stay committed to optimizing your processes, nurturing your customer relationships, and leveraging technology to its full potential. With dedication, innovation, and a proactive approach to cash flow management, you can propel your business to new heights of financial success.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the 5 Secrets to Explosive Cash Flow Growth for Your Business. We thank you for taking the time to read this article. See you in our next article!

google.com